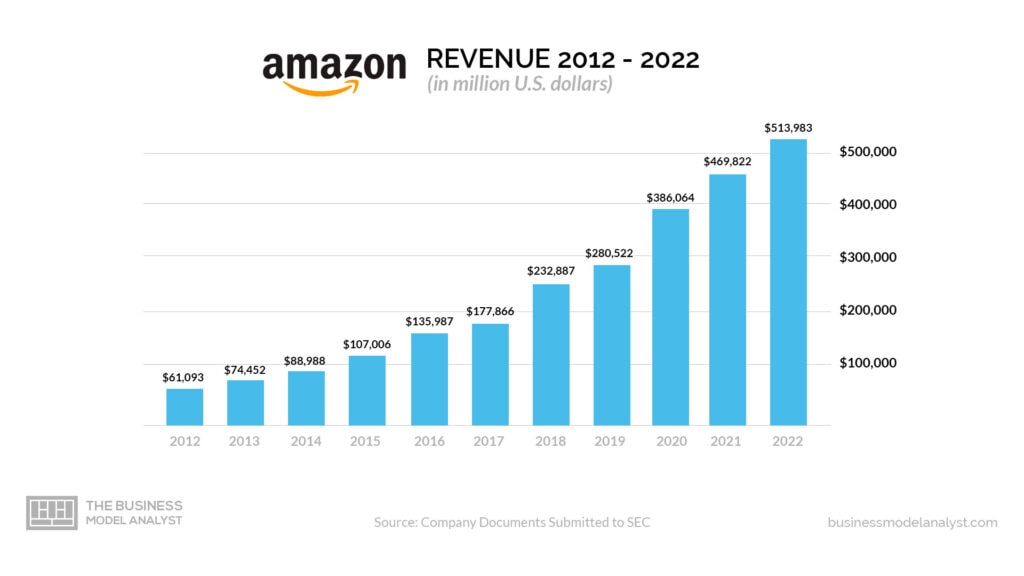

Defining the Amazon business model can be kind of a curious task, as we observe that this global trade giant increases its reach year by year, both geographically and in terms of products and services offered. To give you an idea of the size of the business we’re talking about, in the time it takes you to read this simple article, Amazon may have added about a million dollars more to its revenue.

Contents

A brief history of Amazon

Back in 1994, Jeff Bezos, a former Wall Street hedge fund executive and a visionary who was already aware of the potential of the internet and the e-commerce platforms, took the decision to give the first step in creating an “online everything store” — yes, he knew steroide zu verkaufen from the beginning that this was Amazon’s objective. At first, he thought about naming the company “Cadabra” (from abracadabra). However, his lawyer, Todd Tarbert, advised him that the name could be seen as kind of obscure. Besides, it sounded like “cadaver”, especially over the phone.

After the new name was decided, the next decision would be about the product to be sold on the e-commerce platform. Bezos found that the most logical option would be to sell books. Going against financial journalists and analysts, that just couldn’t see the growth of the internet as Bezos did, Amazon.com reached 180,000 accounts in its first year. In May 1997, Amazon.com became a public company, with $54 million on NASDAQ.

At the end of the same year, there were 1 million accounts and $148 million in revenues (what would become $610 million the following year). The company expanded rapidly and began selling music, videos, electronics, video games, software, houseware, toys, games, and more. Moreover, what attracted customers were its personalized recommendation tools and customers reviews, thus developing a community of consumers. In 2000, Amazon opened room for small companies and individuals to sell their goods through the platform.

Two years later, Amazon Web Services (AWS) was launched, confirming what Bezos claimed from the start: Amazon was not a retailer, but a technology company. From that year on, AWS has encompassed statistics on the internet for developers and marketers, its Elastic Compute Cloud that rents out computer processing power, and its Simple Storage Service, for renting data storage. Kindle e-readers appeared in 2007, fostering the e-book market.

In 2009, the company launched Amazon Encore, its first publishing line, which would also allow individuals to publish their own e-books. Two years later, it would become Amazon Publishing, aiming to develop its own titles. Well, Amazon went from a bookstore to an “everything store” and then to a worldwide e-commerce giant. But the brand definitely didn’t stop there — and its potential never seems to end. Perhaps what keeps its audience so close is its profit margin, which remains low on any product/service offered by the company.

For the buyer, it is comfortable to know that Amazon will always bring a reasonable and competitive price in all fields and products. And for sellers who use the multisided platform, it’s convenient to be sure they can easily display their products on the website and make sales on all continents on Earth. Nowadays, Amazon is recognized as the largest retailer on the planet, a brand for which not even the sky seems to be the limit.

Who Owns Amazon

Since Amazon is a publicly traded company, it is owned by a number of institutional and individual shareholders. However, Jeff Bezos, its founder, still holds a major part of the company (about 10%), making him one of the most influential shareholders in the company. However, in July 2021, Bezos stepped down as CEO to become Executive Chairman, leaving Andy Jassy for the president and CEO positions nowadays. Differently from Google x Alphabet and Facebook x Meta relations, Amazon is actually the official name of the holding group, which includes all of its arising services, such as Amazon Music, Amazon Prime Video, Kindle and Alexa devices, Amazon Web Services (AWS), among many others.

Amazon’s Mission Statement

How Amazon makes money

To understand how Amazon makes money, we need to take a look at each of the different operations that are under this big corporate umbrella. These operations have successfully helped the company achieve year-on-year profitability, which has fueled its growth. They are:

- Amazon Marketplace: The company’s first revenue stream, Amazon.com, accounts for more than 42% ($220 billion of $513.98 billion revenue in 2022 from its online stores) of the income. Third-party sellers accounted for an additional $117.71 billion of revenue. Basically, Amazon asks for a fee from its sellers to promote and advertise their products;

- Amazon Prime: It is Amazon’s subscription business model and has been vital to the brand’s growth. In exchange for a monthly fee, subscribers have access to the platform’s video and music streaming catalog, free two-day shipping, unlimited photo storage, etc. Prime currently has more than 150 million members;

- Amazon Web Services: It is a low-cost complete IT structure platform, whose services are contracted by companies, organizations, and institutions around the world. It’s not the main source of revenue, but it is certainly the most profitable one;

- Amazon Kindle: It is Amazon’s e-reading service, where users can buy, browse and download books, magazines, and newspapers, that are available at Kindle Store. Amazon doesn’t make much money from Kindle itself, but by attracting traffic to the Prime membership plan. Besides, the platform allows independent authors to publish their info-products and e-books, charging something between 30 to 70% of royalty fees from the sales;

- Amazon Patents: The company has more than 17,600 patents, several of which are licensed by other companies. Just in 2022, the U.S. Patent & Trademark Office granted them about 2,051 patents;

- Amazon Advertising: Amazon Ad platform offers sponsored ads and videos. It is a very efficient marketing channel, since the audience that accesses the platform already intends to buy something.

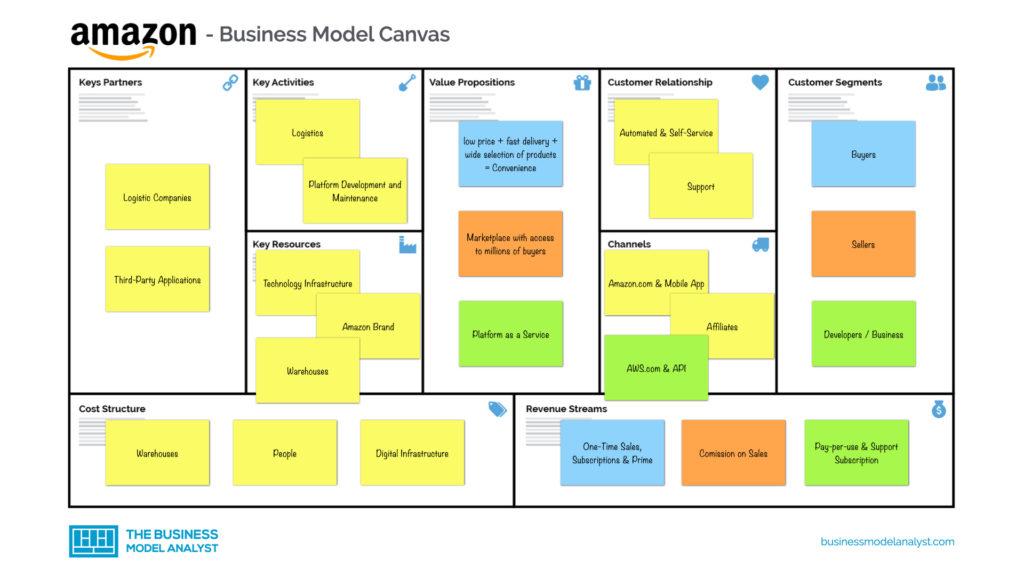

Amazon’s Business Model Canvas

The Amazon Business Model can be seen in the business model canvas below:

Amazon’s Customer Segments

The customer segments of Amazon can be divided into basically three groups: sellers, buyers, and developers.

- Sellers are all the companies that use Amazon’s e-commerce platform to sell their products to its wide audience.

- Developers are all the community involved with Amazon Web Services (AWS) — Amazon’s cloud computing platform. As its own website states, they are customers and partners “across virtually every industry and of every size, including startups, enterprises, and public sector organizations”.

- And the buyers are the millions of people across the world who acquire products and services through Amazon’s channels. Amazon tracks its customers based on some characteristics, such as interest, engagement, and personal information (age, gender, geographical space, language, among others).

Amazon’s Value Propositions

Jeff Bezos defines that Amazon’s business model is based on three value propositions: low price, fast delivery, and a wide selection of products. However, looking at these three consumer benefits, we can say that Amazon’s greatest value proposition is convenience because the audience understands that, with just the help of a device connected to the internet, they have access to the product catalog of the largest retailer in the world, with a reasonable price and an agile, safe and reliable delivery service.

Amazon’s Channels

Certainly, the Amazon website is its largest and most important channel. But important channels also include the brand’s app, Amazon Prime (its streaming, entertainment, and subscription platform), and its affiliate program. As an internet-based company, its marketing is basically digital, including advertisements, sponsored publications, and e-mail marketing. Overall, the company invested over $20 billion in media in 2022.

Amazon’s Customer Relationships

Amazon’s focus, no doubt, is to have a healthy and long-lasting relationship with its customers. For this reason, they maintain several communication channels open with their consumers — such as reviews and comments on the platform, telephone, online chat, and e-mail contact. Plus, they don’t usually take a lot of days to give feedback.

Amazon’s Revenue Streams

Amazon’s revenue streams consist of:

- One-Time Sales

- Commission on Sales

- Advertising

- Subscriptions (Amazon Prime)

- Web Services (AWS)

- Licenses

- Delivery Services

- Patents

- Pay-Per-Use & Support Subscription

Amazon’s Key Resources

Hands down, “the one” Key Resource of Amazon is its technological infrastructure, which needs to be broad and very secure, in order to keep the whole chain running without interruption or losses (back in 2013, Amazon was down for about 40 minutes, which resulted in a loss of more than US$ 5 million in sales). Aside from that, other key resources include physical spaces of the company, such as offices, warehouses, supply chain structure, and automation, among others. And, of course, human resources are essential for Amazon, which needs to guarantee A-players among its designers, engineers, developers, etc.

Amazon’s Key Activities

Amazon’s key activities are all about the development, maintenance, and expansion of its gigantic platform. Therefore, the brand invests in website and app development and management, management of the entire supply chain, storage and logistics, information security on all platforms (including e-commerce, streaming, cloud computing, etc.), production of films, series, and other products for its video platform, as well as marketing for all of its products and services.

Amazon’s Key Partners

Amazon’s key partners consist of:

- Sellers: Certainly the most important partners of the brand, since they are the generators of Amazon’s first source of revenue. There are approximately 8 million worldwide, which guarantees more than half of the company’s revenue;

- Affiliates: Bloggers who earn a commission for any referrals that lead to a sale. In addition to helping with sales, they promote traffic to the platform;

- Developers: They are the partners of the AWS segment, or, as Amazon itself defines, “thousands of systems integrators who specialize in AWS services and tens of thousands of independent software vendors (ISVs) who adapt their technology to work on AWS”;

- Content creators: Independent authors who can publish their works through Kindle Direct Publishing;

- Subsidiaries: They include companies that provide storage spaces, stores, and systems, in addition to brands and products developed by Amazon itself, such as Amazon Essentials, Amazon Elements, Amazon Elements, Kindle, Alexa, etc.

Amazon’s Cost Structure

The cost structure of Amazon includes its complete IT structure, customer service center, software development and maintenance, information security, and marketing, as well as all expenses involved in maintaining its physical spaces, such as fulfillment centers, sortation centers, and delivery stations.

Amazon’s Competitors

- Online stores: It’s estimated that there are over 24 million online stores nowadays. Especially regarding knowledge and quality, smaller niche shops can be “stronger” than Amazon in their fields;

- Walmart: Although a large percentage of Walmart sales comes from brick-and-mortar stores, this is another global giant with a significant presence online, being the second most popular online store in the U.S.;

- Alibaba: A China-based online retailer, specialized in wholesale selling online. It splits into separate businesses. Alibaba is focused on B2B, Taobao on B2C, and Tmall on multinational brands;

- Otto: A European online retailer, that sells products from other brands on its platform. With a user-friendly interface, some top categories include fashion, electronics, housewares, and sports;

- Jingdong (JD): Another Chinese e-commerce, and a direct competitor of Tmall (from Alibaba). It also has an English language version, Joybuy.com, which ships to more than 200 countries;

- eBay: eBay is the pioneer in C2C online selling and has evolved to offer B2C sales. Regarding visits, it only loses to Amazon and stands for about 20% of the market share;

- Flipkart: The largest online retailer in India, founded in 2007. In 2018, Walmart acquired 77% of Flipkart’s shares. Nowadays, there are more than 100 million accounts registered on the platform;

- Rakuten: Japanese e-commerce company, controlling over 14% of the total global e-commerce market. It has bought some other companies around the globe to expand its online presence;

- Newegg: The global leader in selling electronics (computers, TVs, cameras, phones, etc.) — consider that electronics is Amazon’s most popular category.

- Microsoft: With a 21% market share in the cloud services industry, Microsoft Azure is hot on the heels of Amazon’s 34% market share (2022 Q3). Since its launch in 2010, Azure has been steadily gaining market share and has proven to be a force to be reckoned with in the cloud business.

- Google: While Google still maintains a modest market share compared to the other cloud behemoths, its 11% market share in the industry serves as a foot in the door toward becoming a fierce industry competitor.

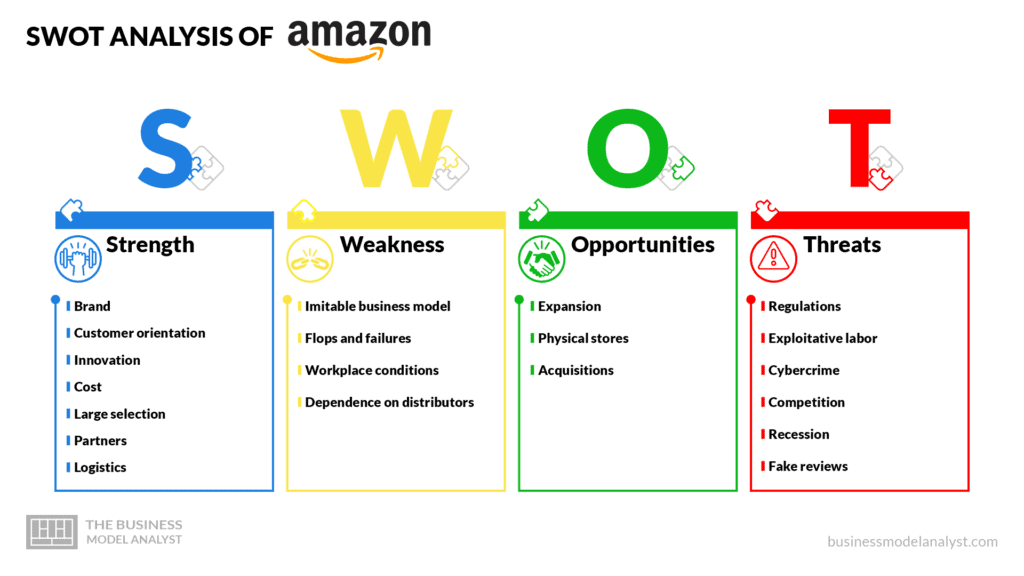

Amazon’s SWOT Analysis

Below, there is a detailed SWOT Analysis of Amazon:

Amazon’s Strengths

- Brand: Being an e-commerce giant, Amazon has a strong brand image in the market, and it’s ranked second in brand valuation, only behind Apple;

- Customer orientation: Reasonable prices, personalized suggestions, and reviews make a loyal consumer community;

- Innovation: Amazon is always developing new products and services while improving its regular business;

- Cost: As Amazon does not maintain physical stores and has little inventory, it is able to keep a low-cost structure, which enables low margins;

- Large selection: The company owns an extensive product mix, allowing customers to buy everything on the same platform;

- Partners: There are more than 2 billion items available from third-party sellers. Besides, Amazon makes partnerships with local supply chain companies, to understand and meet local needs per country;

- Logistics: Amazon uses a highly efficient distribution system, and it is known for its short and reliable delivery time periods.

Amazon’s Weaknesses

- Imitable business model: Online retail businesses have become more and more common, and Amazon has been facing some strong competitors;

- Flops and failures: The Fire Phone was a big failure and Kindle Fire didn’t grow as expected;

- Workplace conditions: There have been some negative reports regarding employees’ treatment, which have affected its reputation;

- Dependence on distributors: It exposes Amazon to a wide range of issues, especially considering the renegotiation of terms.

Amazon’s Opportunities

- Expansion: Amazon can expand its operations in developing countries;

- Physical stores: More brick-and-mortar operations may engage customers and compete more strongly against box retailers;

- Acquisitions: Amazon has made some big purchases, such as Zappos, and that can increase market share and reduce competition.

Amazon’s Threats

- Regulations: Some government regulations can threaten Amazon distribution inside some countries;

- Exploitative labor: Amazon faced scrutiny from the U.S. for allegedly maintaining partnerships with sources associated with human rights abuses;

- Cybercrime: It can threaten the security of the platform and its users;

- Competition: In addition to big retail companies, Amazon also faces strong competitors in video streaming services, such as Netflix, Apple TV+, HBO Max, Hulu, Disney+, etc.;

- Recession: Online stores are not immune to economic recession, and uncertainty can impact Amazon’s sales;

- Fake reviews: Customers rely on reviews to make purchases, and the company has already deleted thousands of fake reviews from its platform.

-> Read More About Amazon’s SWOT Analysis.

Conclusion

Think about it: Amazon isn’t just a part of today’s business landscape, it’s shaping it. Everywhere you look—whether it’s globally or in the digital space—Amazon’s footprint is undeniable. Its rapid adaptation to market changes is impressive, but what really sets it apart? It’s their rock-solid multisided platform business model. This isn’t just a lucky break; it’s strategic genius. Now, if you’ve ever found yourself wondering just how Amazon ticks, or what’s under the hood of their roaring engine of success, I’ve got some great news for you. We’ve rolled up our sleeves and put together an in-depth guide all about Amazon’s business model. Curious? Dive in and check it out here.