In the Business Model Canvas, the Revenue Streams component encompasses the money that the company generates with each previously defined Customer Segment. But that does not mean the “profit” earned, but the revenue flow involved.

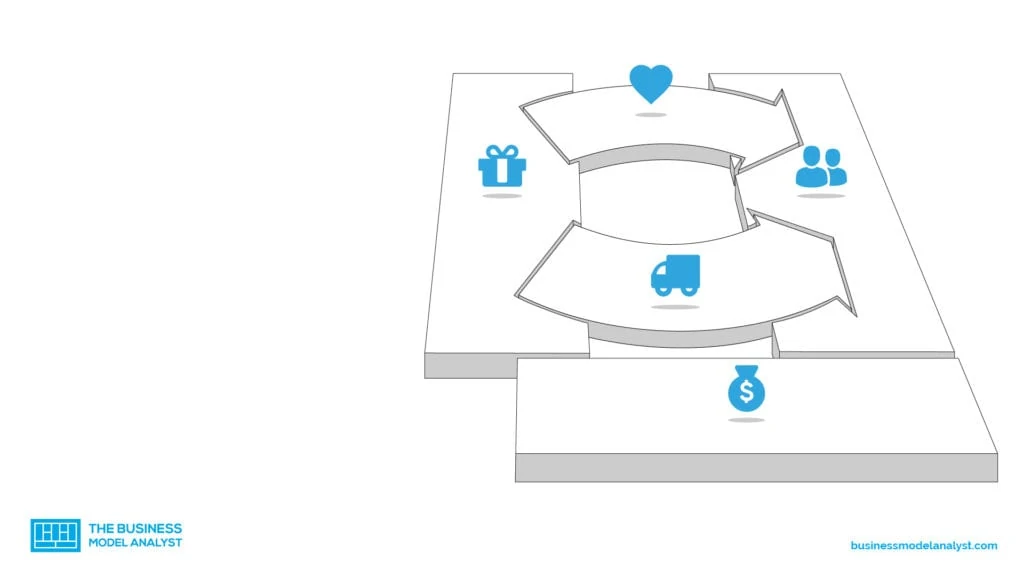

As you may have guessed, the heart of the Business Model is the Customer. Therefore, the first block of everything is the definition of Customer Segments.

From there, the appropriate Value Propositions are developed for each segment, the Distribution Channels are chosen to reach them, in addition to the strategies that will be used for the Customers Relationships.

Now your organization needs to find out how much your target audience is willing to pay for your product or service. Thus, you can define what the Revenue Streams will be for each customer segment.

Each stream will have its pricing mechanisms and its life cycles. The purpose will be to check whether these streams will be profitable or not. There is no reason, for example, to develop a new product whose design and production will cost more than the amount the public is willing to pay.

Let’s find out, therefore, how to assess whether a product or service deserves the attention of your brand or not.

How to choose your Revenue Streams

The best way to understand the flow of revenue streams in your business is to do it through forecasts. But this is an exercise that must be accomplished throughout the life of your enterprise.

That’s because, as the market and industry evolve, your revenue streams may change. Note the most important factors to consider when deciding what revenue streams your organization will follow:

- Choose the most realistic stream: first of all, choose the most appropriate source for your company, because your decision will be closely linked to the direction of your production efforts.

- Extend your value: your revenue stream should also increase the value of your organization. That is, highlight what differentiates your brand and what is unique about the others.

- Attract the right investors: your revenue stream will also determine the profile of investors who will be interested in your business. So look at market trends to attract long-term investors who match your venture, not just immediate opportunists who want to make quick money.

- Be flexible: this does not mean that you need to change the entire structure of your business. But you need to constantly check if your chosen revenue stream is working and adjust it if necessary.

Different Ways to Generate Revenue Streams

A business model essentially includes two types of revenue streams: single-payment and recurring-income transactions resulting from the constant payment due to repeat service or after-sales support. Some options for generating Revenue Streams involve:

- Asset sale: it is the most common source of income, the result of the sale of a physical product, which belongs to the customer.

- Usage fee: this revenue stream contemplates the frequency of use of a particular service. The higher the use, the greater the amount paid by the customer. This is what happens with the minutes of a telephone company or with the fees of a hotel, for example.

- Subscription fee: This revenue stream corresponds to the sale of continuous access to a particular service. It is the model of the monthly payment of a gym or of the license of access to a news site, for example.

- Lending, renting, or leasing: for this revenue stream, the client has the right to temporary access to a particular resource, for a certain period of time.

- Licensing: Customers here are allowed to use a protected, for-profit intellectual property by paying a fee. It is quite common in the areas of media and technology.

- Brokerage fee: this revenue stream provides a percentage of the value of a service executed, through intermediation between the parties. This is the case with insurance brokers or real estate brokers, as well as credit card operators, who receive a commission on the transactions they intermediate.

- Advertising: As the name says, the revenue stream involves advertising a brand, product, or service. Fairly common in media, events, and in software and apps.

Pricing mechanisms

Each Revenue Stream may have different pricing mechanisms. It is a tool with the aim of combining buyers and sellers. The mechanism chosen will have a direct impact on the income generated by the Revenue Stream used. There are two types of pricing mechanisms, fixed and dynamic prices:

In the fixed-price system, the price remains uniform because the raw material value and the processes vary little:

- List pricing: is the price reported by the product manufacturer or the service provider.

- Product feature dependent: the price depends on the quantity or quality of the value propositions presented.

- Customer segment dependent: the price considers the characteristics of each customer segment.

- Volume dependent: the price varies with the purchased volume. The higher the quantity purchased, the lower the unit price.

In the system of dynamic price, the price varies according to market conditions:

- Negotiation (bargaining): the price is negotiated between the parties, and the result depends very much on who has more negotiating power (or greater ability to do so).

- Yield management: the price depends on the inventory and the moment of purchase. The product or service has time or exhaustible resources.

- Real-time market: known as the laws of supply and demand. The price fluctuates based on how many customers they want to acquire and how much is available for sale.

- Auctioning: the final price depends on the perception of value that customers have for the product. It usually involves initial bidding and competition among buyers.

To build the Revenue Streams block, it is important for the company to ask itself what benefits encourage customers to pay more, at what prices they are acquiring similar benefits these days, what mode of payment they prefer, and also what share of the organization’s total revenue each stream represents.

After defining the Revenue Streams, the company will be able to define what will be the Key Resources for its business, thus continuing the development of its business model canvas.

TAKE ME TO THE NEXT BLOCK -> KEY RESOURCES