The Uber business model is also known as a multisided platform business model, as it connects drivers (offer) and passengers (demand), in order to offer cheaper transportation and an additional source of income. According to Dara Khosrowshahi, current CEO of Uber, “Uber accounts for less than 1% of all miles driven globally. Just a small percentage of people in countries where Uber is available have ever used our services”. Still, I am sure that you know very well what this company is, you have probably already used its services and, most likely, you have the app installed on your smartphone.

Uber is a technological platform that has revolutionized urban transportation — and has given taxi drivers and cab companies a lot of headaches. In short, it is an app that connects drivers to users who need a ride, using a smartphone as a tool.

Contents

A brief history of Uber

Uber’s history starts back in 2008, in Paris. Travis Kalanick and Garrett Camp were attending an annual tech conference (LeWeb) in the city and, one night during the conference, they simply could not get a cab, and they got thinking about how it would be if people could just ask for a cab via smartphone.

Camp kept thinking about it and, back to San Francisco, he bought the domain UberCab.com. In 2009, Camp was CEO of StumbleUpon, a startup he had sold two years earlier to eBay for $75 million — by the way, Kalanick also had sold his startup, Red Swoosh, to Akamai Technologies for $19 million, in the same year, but he began working on UberCab as a side project.

By summer, Camp persuaded Kalanick to join turinabol_10 UberCab, and the official launch took place in 2010. The company grew quickly. One year later, it would be launched internationally — in Paris, of course. From 2009 on, Uber raised a lot of funding and, in 2015, it was the most valuable startup in the world ($51 billion).

Currently, with more than a decade of existence, Uber operates in more than 900 cities worldwide and has a valuation of more than $70 billion. Let’s understand the business model of this innovative urban transportation giant, which allows us to get a vehicle within reach of a click.

Who Owns Uber

It was June 2017 when Travis Kalanick was on an UberBlack ride and got into a discussion with the driver. After that incident, Travis stepped down from his position as Uber’s CEO. Later, he launched two new enterprises, the venture firm 10100 and the real state company City Storage Systems.

As for Uber’s CEO, Expedia’s former CEO, Dara Khosrowshahi, was the chosen one after Kalanick stepped down, and has been occupying this position until today.

Uber’s Mission Statement

“We ignite opportunity by setting the world in motion.”

How does Uber operate?

To get an Uber, you need a smartphone with a GPS system, internet, and the Uber app installed. Then, in the app, you will enter your destination and the platform will locate an available driver, based on the location of both. As soon as you get in the car, the driver will take you to your chosen destination, using the navigation system of the app itself.

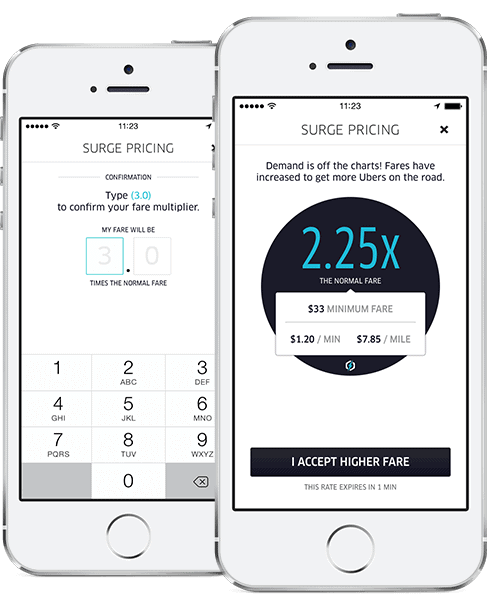

There are different categories of vehicles in the app, depending on the city in which you are going to use it. There are some differences in the rates for each category, accordingly. The value of the race is calculated by an Uber algorithm, considering the distance traveled, elapsed time, and the fuel used.

There are also different payment methods, depending on the location where you use the app. Besides, there is a rating system, which is an important feature of Uber. The rider evaluates the driver, and the driver also evaluates the passenger. Thus, everyone can check each other’s degree of confidence before accepting a ride.

Uber’s Pros and Cons

Uber’s biggest advantage for users is convenience. To begin with, the app is user-friendly and is rarely down. Today, practically everyone in urban areas has a cell phone, mostly with an internet connection, so the majority of the population can ask for a car without having to walk even a step from wherever they are.

When making the request, users receive plenty of information about the driver and the car, such as license plate, name, photo, time of service, and grade within the ranking system. This offers more security to the user. In fact, they can also send their ride information in real-time to someone else, which also guarantees them more security and peace of mind.

For drivers, the big benefit is being able to get a job, by just having access to a car and a cell phone, being able to choose their working hours, and having their income coming in regularly. In addition, due to the ranking system, the driver also has greater security by being able to check the user’s profile and their score on the app, to decide whether to stay with the ride or not.

Regarding Uber itself, its great advantage is that it was the first entrant in this market. Although it can be said that taxis are competitors of Uber, the customer segment is different, since we are talking about an audience that will ask for a ride via the app and not wave at an identified car that is in their way.

In addition, Uber has established itself in the market not only because it is the first in its business model, but because it has set up a functional structure, which really works and which has guaranteed the confidence of both drivers and riders.

As negative points, we can mention the liability questions and insurance issues, which the company continues to face both in the cities in which Uber enters and in those in which it has already been operating. This includes battles against taxi drivers’ unions, as well as against some municipalities around the world.

As for customers, both users and drivers, the disadvantage is precisely the lack of strong competition. Although in some locations there is already competition, competitors are unable to force a fight over price, for example, making Uber practically choose how much to charge the user and, mainly, how much to pass on to the driver.

How Uber makes money

Uber’s business model is based on commissioning and this is, therefore, its revenue stream. The total value of each ride includes the driver’s payment, fees, taxes, and company commission. In general, the driver gets about 75% to 80% of the value and the rest keeps with Uber.

But the commission can reach around 50% when it comes in the short run, due to the fees and minimum fare. But this is not the company’s only source of income. Uber also makes money with promotional partnerships. These are marketing campaigns run through the app and several times through the ride itself (for example, the BMW 7 Series offered free trips in their new car to promote it). In addition, it is worth remembering that Uber has been expanding its service offering.

Probably the most famous one, especially during the period of social isolation on the Covid-19 pandemic, is Uber Eats. It is a food service delivery, with the same characteristic as the transportation app — connecting restaurants to costumers through an online platform, providing the delivery service through partner deliverers. The revenue streams, in this case, are three: advertising, the delivery fee, and the shares in revenue with the restaurants. All of these values and percentages vary depending on the location where the operation takes place.

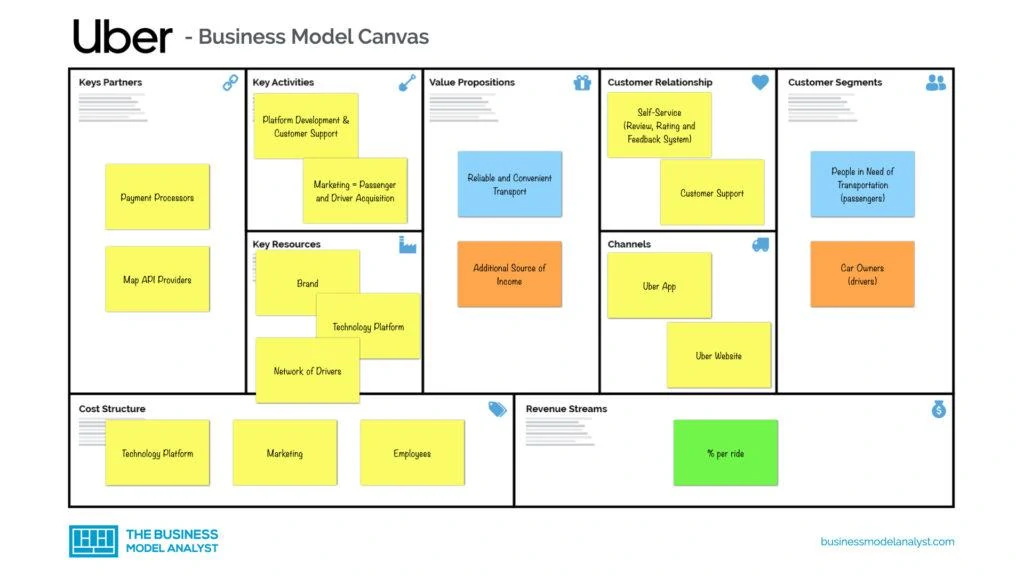

Uber’s Business Model Canvas

Let’s see how the Uber Business Model Canvas can be designed below:

Uber’s Customer Segments

In general, Uber has two customer segments riders and drivers. The side of riders is people who either do not have their own car, need to travel outside their city of residence, or don’t want to drive at a certain time — for example, when they know they will consume alcohol at a party, concert or celebration. And the side of drivers are those people mentioned above, who are probably out of the market or need some extra money, and may start a new job just by driving and using an app.

Uber’s Value Propositions

For customers, the greatest value proposition is the convenience of not having to look for a taxi — the car comes to you. Cars are available 24/7 and their route can be tracked. In addition, fares are generally lower than those charged by taxi drivers, and the rider can estimate how much the ride will cost before calling the driver. For drivers, it is a source of income (main or additional), a job that doesn’t require experience, with flexible working schedules and easy access to passengers. Plus, let’s not forget that the passenger informs the destination on the app, which avoids misunderstandings when we are talking about people who do not speak the same language, which is a positive point for both sides.

Uber’s Channels

Historically, in those ten years, the biggest channel for accessing customers was word of mouth. In addition, the other widely used distribution channel has been social media. And, of course, the app stores, where riders and drivers download their Uber apps.

Uber’s Customer Relationships

The customer relationship involves three sides: customer, driver, and regulators. Uber’s focus is predominantly on the customer. If the company has no credibility with the end-user, then it has no reason to create a relationship with the other two. Transparency regarding time and prices, as well as confidence in security and privacy, are essential here. Uber’s second-largest customer is its own driver. Since the driver is not an Uber employee and their vehicle is not Uber’s property — even though there are several lawsuits around the world in this regard —, the company needs to offer them attractive working and payment conditions to keep its business running. As for regulators, Uber seeks compliance and responsibility within the law, within a threshold that also allows it to obey the laws of the market itself.

Uber’s Revenue Stream

- Share (%) per ride

- Uber Eats

Uber’s Key Resources

Uber has two key resources: 1) The platform that connects drivers and riders, with a focus on continuous improvement of its resources and algorithms, and 2) The Uber brand itself, which is used in all cities where the company operates.

Uber’s Key Activities

Uber’s two key activities are: 1) Developing and maintaining the app (and its algorithms), and 2) Maintaining and improving engagement between riders and drivers. In order for these activities to work, its key activities also include marketing, communication between the parties, customer service, and more.

Uber’s Key Partners

Uber’s most important key partner is its driver, without whom the company doesn’t reach the final customer, doesn’t deliver its value propositions, and therefore doesn’t produce revenue. They are the supply side of the chain. Other important key partners are the investors, that allow the company to develop and reach other levels of performance. They bring the initial rounds of funding to develop the app, algorithms, and new proposals, such as driverless cars. Of course, this revenue is also used for other expenditures. And, last but not least, technology providers, with GPS, payment, communication, cloud storage, and data analytics systems, among others.

Uber’s Cost Structure

The cost structure of Uber is all about maintaining the platform and marketing to acquire new customers (Customer Acquisition Costs — CAC). In addition, there are legal costs, credit card fees, insurance, research and development investments, customer support, and more.

Uber’s Competitors

- Lyft: This is the major competitor. Founded in 2012, the company provides services throughout the U.S. and in more than 220 cities, providing 18.5 billion rides per month. It went public at a $24 billion valuation;

- Curb: Owned by VeriFoneSystems, the company uses its systems and credit card machines for operation. Launched in 2015, Curb operates most of New York’s green and yellow taxis and aims to reach all the major cities in the U.S.;

- DidiChuxing: Launched in 2009 and already one of the largest companies in China, it offers services such as DiDi Chauffeur, Didi Test Drive, taxi-hailing, DiDi Minibus, and DiDi private car rental through its app. In 2015, the company reached 1.4 billion rides and its valuation was $28 billion in 2016;

- OlaCabs: It began in Mumbai, in 2010, as an online taxi aggregator. Now, the network reaches Australia, New Zealand, and the UK, and its valuation surpassed $5 billion in 2015. Currently, Ola has a more than 60 percent market share in India;

- Grab: Founded in 2011, in Singapore, the company also offers services in the Philippines, Indonesia, Vietnam, Thailand, Myanmar, and Malaysia. At the end of 2016, Grab introduced a messaging service on its app that allowed language translations, helping break this barrier in Asia;

- Cabify: Launched in 2011 in Spain, it is considered the most secure in the industry, with modern vehicles, expert drivers, and geo-tracking. The company operates in Spain, Mexico, Chile, Brazil, Peru, Argentina, and Portugal, among other places;

- Yandex Taxi: This Russian company offers ride-sharing and food delivery services in the Middle East, Russia, Eastern Europe, and Africa, and is also one of the world’s leading companies developing self-driving vehicles. The company completed 1 billion rides by the end of 2018, performed by more than 700,000 drivers;

- Local taxis: Every major city in the world has taxi spots, generally near stations, terminals, airports, and hotels. The advantage of taxis is the possibility of negotiating prices directly with the clients.

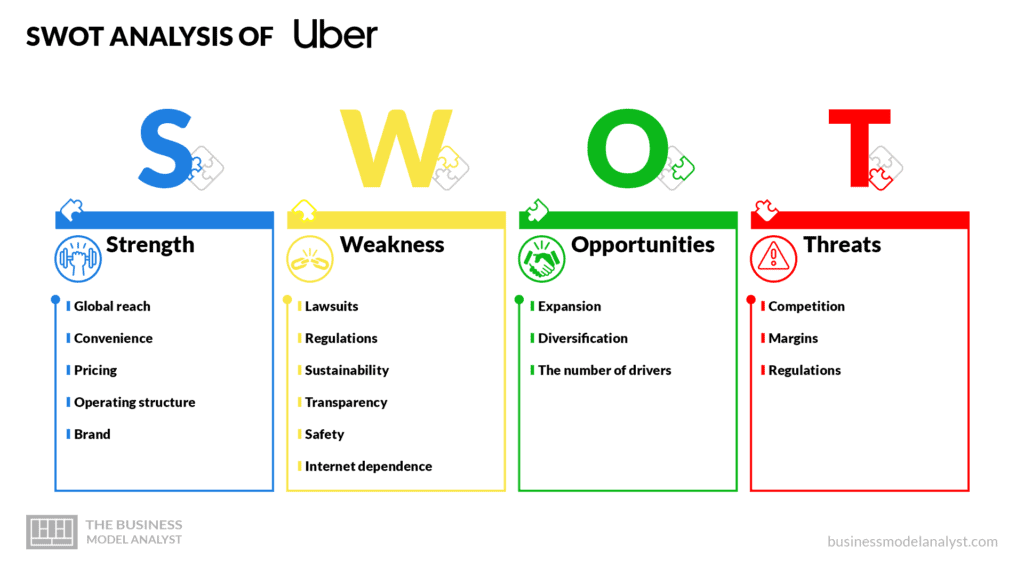

Uber’s SWOT Analysis

Below, there is a detailed SWOT Analysis of Uber:

Uber’s Strengths

- Global reach: Uber is a worldwide company, making it the most recognizable brand in the industry, since it operates in 85 countries;

- Convenience: Uber is accessible to anybody with an internet connection and a smartphone. The app is easy to use, offers interaction with the drivers, provides several payment methods, and is usually cheaper than regular taxis;

- Pricing: The company uses multiple variables to determine the price of a trip, also bringing more advantages for the drivers;

- Operating structure: Uber doesn’t have employees, which allows the company to invest much more back in the business and R&D;

- Brand: Uber has the widest coverage in the industry, was the first one to be launched, and also had a lot of attention from the media.

Uber’s Weaknesses

- Lawsuits: Uber has been involved in many lawsuits which have been affecting its image and reputation;

- Regulations: The company has a history of problems with governments regarding regulations and laws of the taxi industry;

- Sustainability: Uber does not have internal policies to minimize the impact on the environment;

- Transparency: As it is a private company, Uber does not need to open up its finances, but this lack of transparency puts in check whether they are investing in R&D or others;

- Safety: Like any other transportation, Uber riders are subject to robbery, abuse, and other safety issues;

- Internet dependence: It relies on the internet and smartphones to run, but the majority of emerging countries still face difficulties in those matters.

Uber’s Opportunities

- Expansion: Uber has a huge opportunity to expand into new markets around the planet;

- Diversification: The company has already added food delivery to its services, but it can still diversity its business and offers, especially niching down to categories of transportation, for example;

- The number of drivers: Whether it is a result of an economic crisis or not, the company has been able to attract many drivers. This increases the offer for cars, which pleases the consumers, thus raising the number of regular users.

Uber’s Threats

- Competition: The high level and rising number of rivals may jeopardize Uber’s expansion, thus making it difficult to grow as planned;

- Margins: Uber keeps low rates that result in low margins. For example, it has an 80% market share in Brazil, but it is still unprofitable there;

- Regulations: Governments may impose strict rules that can endanger Uber businesses in many countries.

-> Read more about Uber’s SWOT Analysis.

Conclusion

The success of Uber’s business model is very clear from the fact that you will rarely see a user comparing prices on their mobile before ordering a ride. They will simply open the Uber app and enter their destination. In addition, the company has had a very positive response from the population, especially in locations with employment problems, as it offers a new possibility to several people who are not working.

Any entrepreneur can draw several “lessons” from Uber’s business model. For example, you don’t need large equity to start a business. Uber doesn’t even own a car and, still, provides over 1 million rides a day. More than that, its founders saw a problem in an industry and simply sought a solution for it. And in doing so, they were able to transform the cab industry.

Finally, two of the biggest entrepreneurship classes you can take: 1) Treat your workforce as partners, and 2) Expand one step at a time. Uber started with cars and is already operating with bikes, boats, and even helicopters!