Ripple Business Model

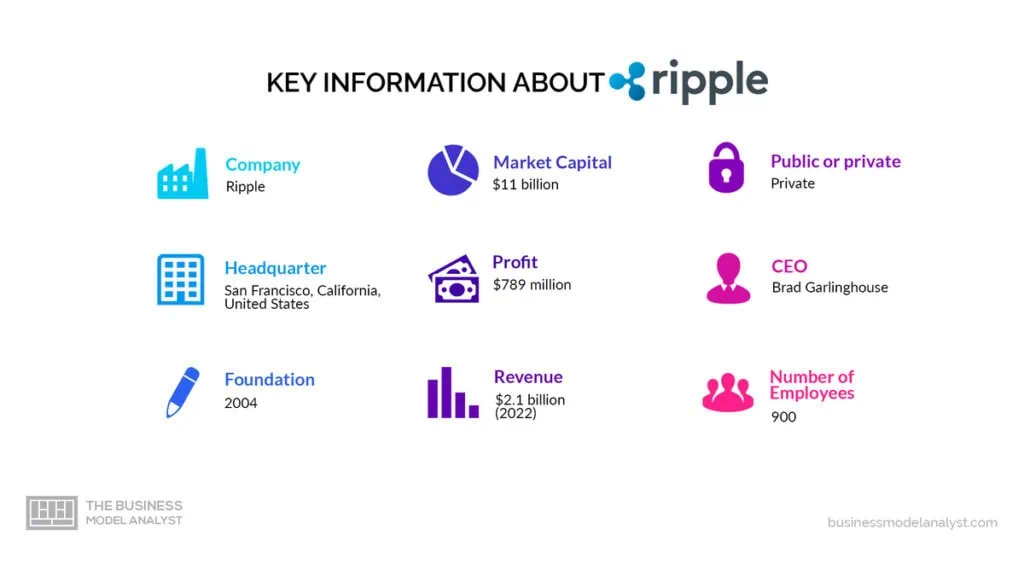

The Ripple Business Model revolves around a decentralized digital payment protocol and a cryptocurrency known as XRP. The idea for Ripple was conceived in 2004, but its current iteration was established in 2012. It aims to revolutionize the global payment system by providing fast, low-cost, secure transactions. Like other cryptocurrencies, Ripple operates on blockchain technology with a unique twist.

Ripple primarily provides financial institutions and banks solutions to facilitate cross-border transactions. Unlike traditional payment networks that rely on correspondent banking relationships, Ripple utilizes its proprietary technology, the XRP Ledger, to enable instantaneous and cost-effective money transfers. This decentralized system eliminates the need for intermediaries and reduces settlement times from days to seconds.

The Ripple Business Model offers three main products: xCurrent, xRapid, and xVia. xCurrent enables financial institutions to communicate and settle real-time transactions using Ripple’s blockchain infrastructure. xRapid utilizes XRP as a bridge currency to minimize the liquidity requirements for cross-border payments. Finally, xVia is a standardized interface allowing businesses to access Ripple’s network to send and receive payments globally.

With a growing network of over 100 financial institutions and partnerships with central global banks, Ripple has gained traction in the financial industry. The company continues to innovate and expand its reach, aiming to disrupt the traditional banking system and make global transactions more efficient.

Contents

A brief history of Ripple

The concept of Ripple was born out of the need to address inefficiencies in the traditional banking system and enable fast, low-cost international money transfers.

The idea behind Ripple was first introduced by Ryan Fugger, a Canadian entrepreneur, who developed a peer-to-peer electronic cash system called RipplePay in 2004. RipplePay aimed to create a decentralized payment network where individuals could trust each other for transactions without relying on intermediaries.

In 2012, Fugger met Jed McCaleb, a well-known programmer and entrepreneur who shared his vision for a decentralized digital currency system. McCaleb saw Ripple’s potential and joined forces with Fugger to bring their ideas to life.

Fugger and McCaleb founded Opencoin, which would later become Ripple Labs. They enlisted the help of Chris Larsen, a successful entrepreneur and executive, to serve as the CEO of the new venture. Larsen brought a wealth of experience in the financial services industry, making him an invaluable asset to the team.

Under Larsen’s leadership, Opencoin set out to revolutionize cross-border payments. They envisioned a system allowing anyone to send and receive money instantly, securely, and at a fraction of the cost of traditional methods. This vision led to the development of the Ripple protocol, which would serve as the foundation for the Ripple network.

The Ripple network, launched in 2012, enabled financial institutions to make real-time, low-cost international payments using the XRP cryptocurrency. XRP, the native digital asset of the Ripple network, served as a bridge currency, facilitating the transfer of value between different fiat currencies.

As Ripple gained traction in the financial industry, it attracted the attention of significant banks and payment providers. In 2015, Ripple secured its first major partnership with the Spanish bank Santander. This partnership marked an important milestone for Ripple, as it demonstrated the potential for its technology to streamline cross-border payments on a large scale.

Since then, Ripple has continued expanding its partner network, with over 100 financial institutions now using its technology. This includes prominent names such as American Express, Standard Chartered, and PNC Bank. These partnerships have helped to solidify Ripple’s position as a leading provider of blockchain-based solutions for the financial industry.

In recent years, Ripple has also faced challenges and regulatory scrutiny, particularly regarding the classification of XRP as a security. However, Ripple has remained committed to working with regulators to ensure compliance and address concerns.

Looking to the future, Ripple continues to innovate and evolve its business model. The company is focused on driving the adoption of its technology to enable faster, more cost-effective cross-border payments. With its experienced team, strong industry partnerships, and innovative solutions, Ripple is well-positioned to shape the future of global payments.

Who Owns Ripple

Ripple is not a publicly traded company. It is owned by a combination of private individuals, venture capital firms, and strategic partners. However, Ripple’s specific ownership details are not publicly disclosed.

Some notable investors in Ripple include Andreessen Horowitz, IDG Capital Partners, and Google Ventures (now GV). These investors have made significant financial investments in Ripple’s growth and development.

In addition, Ripple co-founders Chris Larsen and Jed McCaleb are known to have significant stakes in the company. Chris Larsen, in particular, has been a leading figure in Ripple’s success and has actively contributed to its growth.

As a private company, Ripple’s shareholders and ownership holdings are not publicly available. It is common for private companies to maintain confidentiality regarding ownership information. Nevertheless, Ripple’s ownership structure reflects a combination of critical investors, co-founders, and strategic partnerships that have played a vital role in its journey as a blockchain technology provider.

Ripple Mission Statement

Ripple’s mission statement is “to build breakthrough crypto solutions for a world without economic borders.”

How Ripple works

Ripple’s business model centers around its digital payment protocol, XRP Ledger. This decentralized ledger allows financial institutions to conduct transactions directly, bypassing intermediaries and reducing transaction costs. Ripple’s technology has gained significant adoption from banks and financial institutions worldwide.

Financial institutions must integrate their systems with the XRP Ledger to utilize Ripple’s services. This integration enables them to send and receive payments seamlessly using Ripple’s native digital currency, XRP. The XRP Ledger’s consensus mechanism, known as the Ripple Protocol Consensus Algorithm (RPCA), ensures the integrity and security of transactions by validating them through a network of trusted nodes.

Once integrated, financial institutions access RippleNet, Ripple’s global payments network. RippleNet provides a seamless and standardized infrastructure for financial institutions to connect, enabling them to transact with each other efficiently. This network includes many banks, payment providers, and other financial institutions worldwide, creating a vast network effect.

Ripple’s solutions offer several benefits to financial institutions, including:

- Fast and efficient cross-border transactions: Ripple’s technology enables near-instant global payments, reducing settlement times from days to seconds. This speed enhances liquidity management and provides financial institutions with better customer service;

- Low transaction costs: By eliminating the need for intermediaries, Ripple significantly reduces transaction costs associated with cross-border payments. This cost savings benefits financial institutions and their customers, making transactions more affordable;

- Enhanced liquidity management: Ripple’s technology provides real-time visibility into currency exchange rates and fees, enabling financial institutions to optimize their liquidity management. This feature minimizes the risk of volatility and enhances overall efficiency;

- Improved transparency and traceability: All transactions conducted on the XRP Ledger are publicly recorded, providing an immutable transaction history. This transparency ensures accountability and helps prevent fraudulent activities.

Ripple offers additional solutions to enhance its offering, such as:

- RippleNet Cloud: This cloud-based platform enables financial institutions to connect to RippleNet and leverage its benefits without requiring extensive IT infrastructure investments;

- On-Demand Liquidity (ODL): ODL utilizes XRP as a bridge currency to facilitate instant cross-border transactions. By converting one currency into XRP and immediately settling it in the destination currency, ODL eliminates the need for pre-funded accounts and minimizes liquidity constraints.

How Ripple makes money

Ripple operates a diversified business model to generate revenue. The company’s sources of income include selling XRP, payment fees, profits from investments, and interest fees on loans. Below are the key ways in which Ripple makes money:

Sale of XRP

Ripple is the issuer of XRP, a digital asset that serves as the native cryptocurrency for its decentralized payment protocol. The company periodically sells some of its XRP holdings to institutional investors and market participants. These sales generate revenue for Ripple and help fund its operations.

Payment Fees

Ripple offers various payment solutions that enable fast and low-cost cross-border transactions. Financial institutions and businesses using Ripple’s payment network pay fees for each transaction. The costs are typically based on the volume and value of the transactions, providing a steady revenue stream for Ripple.

Profits from Investments

Ripple actively manages its investment portfolio, which includes holdings in other digital assets and companies in the blockchain and fintech space. The company aims to generate returns from these investments through capital appreciation and dividends. Profits obtained from successful investments contribute to Ripple’s overall revenue.

Interest Fees on Loans

Ripple provides its customers with financial services through various products and partnerships, such as lending and borrowing. Customers who borrow funds from Ripple or utilize its lending platform pay interest fees on the loans, which represent another source of revenue for the company.

Ripple’s loan product, Line of Credit, was launched in August 2020. This service allows customers to access On-Demand Liquidity (ODL), a feature that leverages Ripple’s core technology to facilitate quick and secure cross-border transactions using digital assets.

Line of Credit, a loan facility, enables customers to borrow funds against their digital asset holdings. By utilizing ODL, borrowers can effectively collateralize their digital assets and secure a loan without the need for traditional banking intermediaries.

By leveraging its core technologies and ecosystem, Ripple generates revenue from multiple streams, ensuring a diverse income base.

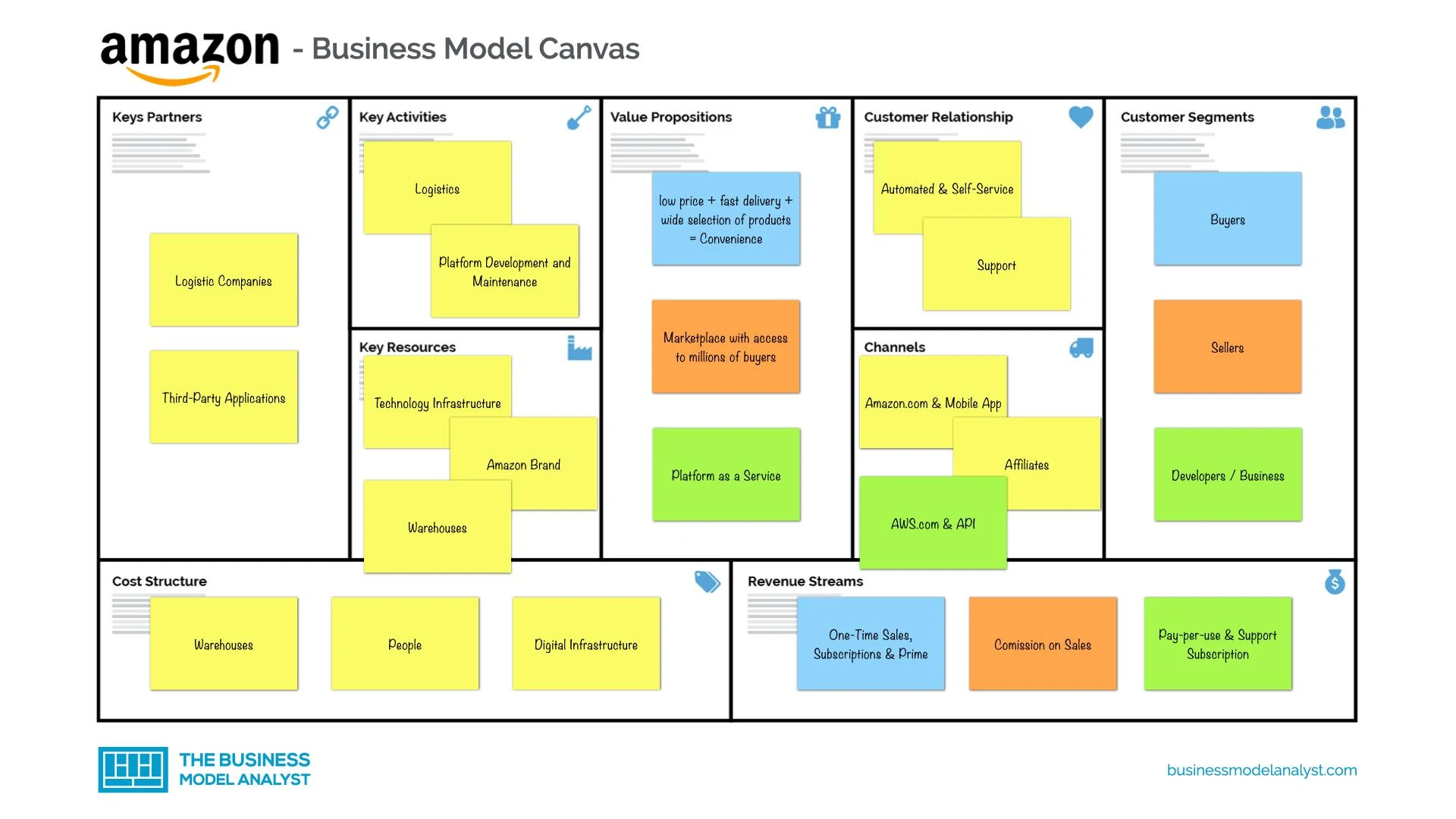

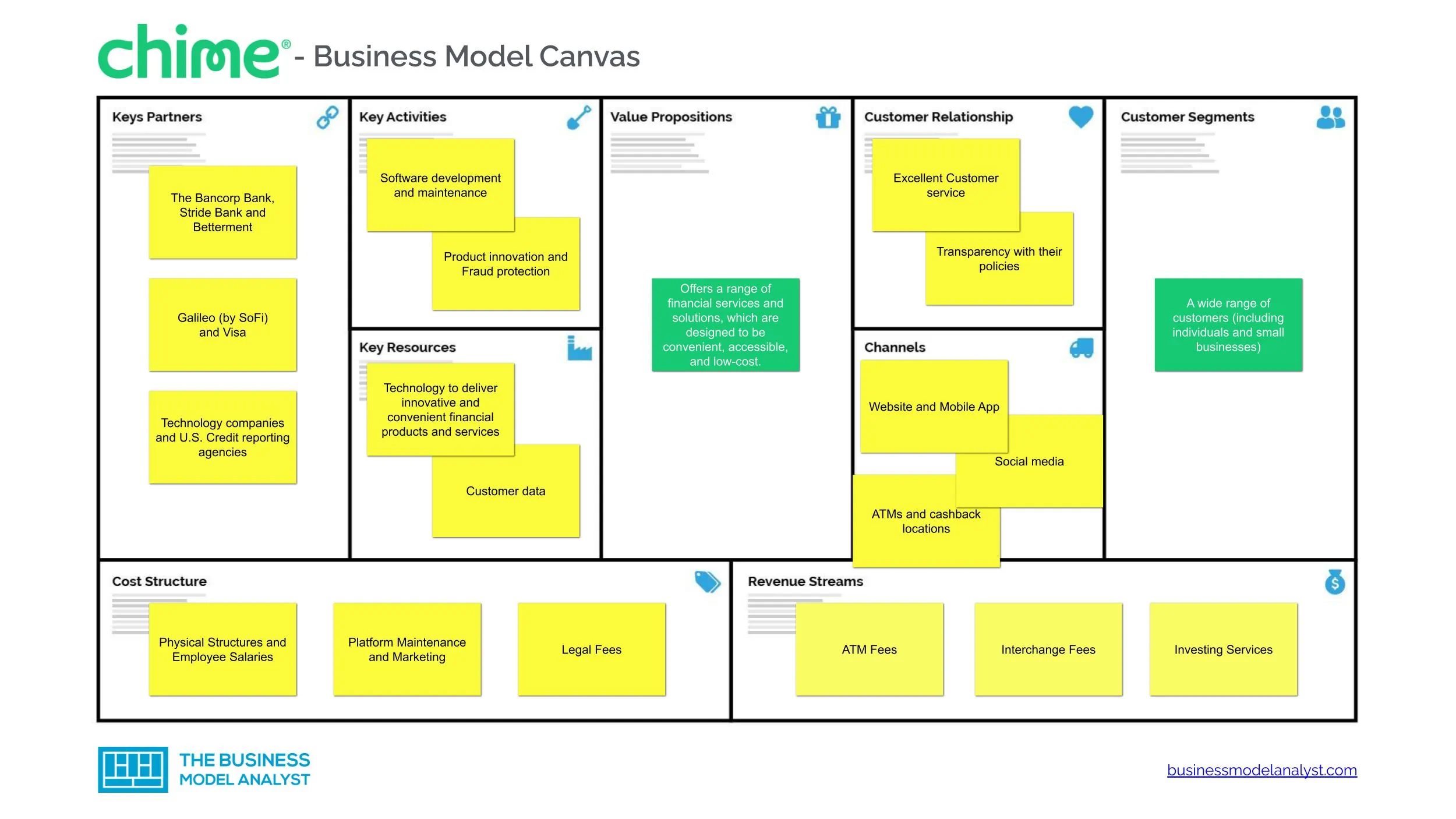

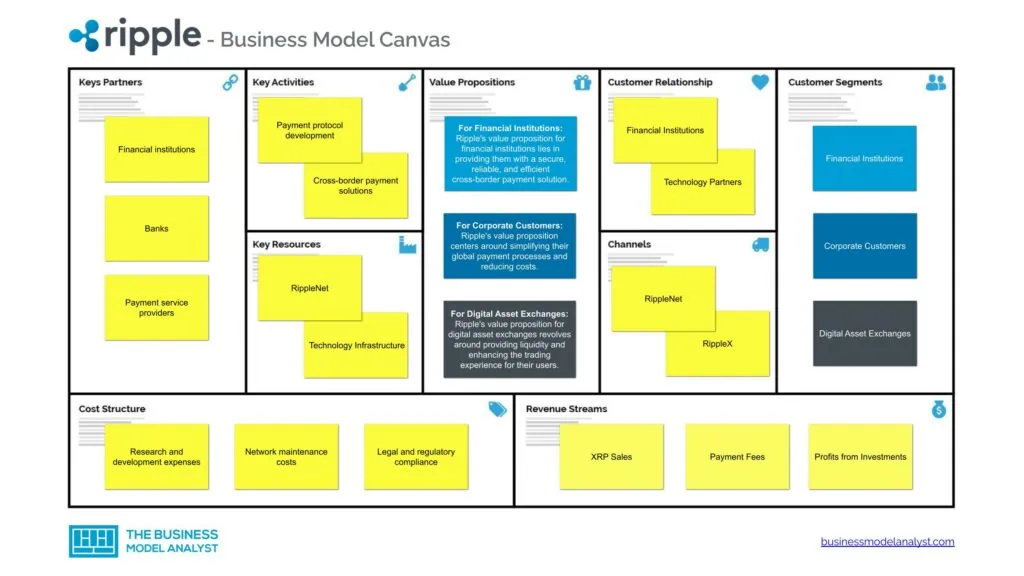

Ripple Business Model Canvas

The Ripple Business Model can be explained in the following business model canvas:

Ripple Customer Segments

The following are the key customer segments that Ripple caters to:

- Financial Institutions: Ripple primarily targets financial institutions, including banks, payment processors, and remittance service providers. These institutions utilize Ripple’s technology and network to facilitate faster, more secure, cost-effective cross-border payments and remittances;

- Corporate Customers: Ripple also caters to corporate customers, including multinational corporations and enterprises that require efficient and scalable cross-border payment solutions. These customers benefit from Ripple’s technology by simplifying their global payments, reducing reliance on intermediaries, and improving liquidity management;

- Digital Asset Exchanges: Ripple’s customer segment also includes digital asset exchanges that facilitate the trading of cryptocurrencies, including Ripple’s native cryptocurrency, XRP. These exchanges utilize Ripple’s technology to provide liquidity and facilitate transactions involving XRP;

- Remittance Service Providers: Another customer segment for Ripple consists of remittance service providers, which specialize in facilitating cross-border money transfers, particularly by migrant workers who send money back to their home countries. Ripple’s solutions enable these providers to offer faster and more affordable remittance services, bypassing traditional correspondent banking networks;

- Central Banks: Ripple has also targeted central banks, particularly those exploring the adoption of central bank digital currencies (CBDCs). Ripple’s technology offers potential solutions for central banks to digitize their fiat currencies and improve their domestic and international payment systems;

- Blockchain Developers and Innovators: As Ripple’s technology is built on blockchain, the company also caters to blockchain developers and innovators. These customers utilize Ripple’s platform, tools, and resources to create new applications and solutions, leveraging the advantages of blockchain technology in various industries beyond finance.

Ripple Value Propositions

Ripple’s value propositions consist of:

- For Financial Institutions: Ripple’s value proposition for financial institutions lies in providing them with a secure, reliable, and efficient cross-border payment solution. They offer a scalable blockchain-based network and technology that enables institutions to settle transactions instantly, with complete transparency and at a lower cost than traditional methods. By leveraging Ripple’s solutions, financial institutions can eliminate costly intermediaries, reduce settlement times, and enhance customer experience. They benefit from increased operational efficiency, improved liquidity management, and the ability to expand their global reach;

- For Corporate Customers: Ripple’s value proposition centers around simplifying their global payment processes and reducing costs. Using Ripple’s technology and network, corporate customers can facilitate fast and reliable cross-border payments, reducing dependency on traditional banking intermediaries. They gain access to a seamless and transparent payment ecosystem that eliminates delays, increases payment speed, and ensures funds reach their intended recipients promptly. This enables them to optimize their supply chain, manage cash flows effectively, and improve overall financial management;

- For Digital Asset Exchanges: Ripple’s value proposition for digital asset exchanges revolves around providing liquidity and enhancing the trading experience for their users. By integrating Ripple’s technology and leveraging XRP, exchanges can offer faster and more cost-effective trading options. Ripple’s solutions enable exchanges to settle transactions instantly, enabling near-instantaneous funds transfers between cryptocurrencies. They gain access to a robust and scalable platform that enhances liquidity, reduces settlement times, and provides high security for their users’ digital assets;

- For Remittance Service Providers: Ripple’s value proposition for remittance service providers focuses on enabling faster and more affordable remittance services. By utilizing Ripple’s technology and network, they can bypass traditional correspondent banking networks, which are often slow and expensive. They gain access to a global network that allows for instant cross-border payments, reducing transaction costs and providing a seamless experience for their customers. Ripple’s solutions enable remittance service providers to offer faster and more reliable customer services, ultimately improving financial inclusion and accessibility;

- For Central Banks: Ripple provides a technology platform that enables central banks to digitize their fiat currencies and improve their domestic and international payment systems. Ripple’s solutions offer central banks increased control over their monetary policies, enhanced security, and faster settlement times. By leveraging Ripple’s technology, central banks can streamline payment systems, reduce costs, and improve financial inclusion within their economies;

- For Blockchain Developers and Innovators: Ripple’s value proposition for blockchain developers and innovators provides them with a platform and tools to build new applications and solutions using blockchain technology. They offer developers access to their technology stack, including APIs, software development kits (SDKs), and resources to leverage Ripple’s blockchain network. They enable developers to harness the benefits of blockchain technology in various industries beyond finance, fostering innovation and creating new use cases.

Ripple Channels

Ripple’s channels consist of:

- RippleNet: Ripple’s global payments network connects financial institutions and facilitates seamless cross-border transactions;

- RippleX: A developer platform that allows individuals and businesses to build applications and contribute to the development of the Ripple ecosystem;

- Partnerships: Ripple forms strategic alliances with banks, payment service providers, and other financial institutions to expand its network and reach more customers;

- Digital asset exchanges: Ripple utilizes cryptocurrency exchanges to enable the buying and selling of its native cryptocurrency, XRP, which is essential for its payment network.

Ripple Customer Relationships

Ripple’s customer relationships consist of:

- Financial Institutions: Ripple targets banks and financial institutions as its primary customers, aiming to assist them in enhancing their cross-border payment capabilities and reducing costs;

- Technology Partners: Ripple collaborates with technology companies to integrate its technology solutions directly into their platforms, creating added value for their customers;

- Developers: Ripple cultivates a community of developers through RippleX, fostering innovation and encouraging the creation of new applications and use cases.

Ripple Revenue Streams

Ripple’s key revenue streams include the following:

- XRP Sales

- Payment Fees

- Profits from Investments

- Interest Fees on Loans

Ripple Key Resources

Ripple’s key resources consist of:

- RippleNet: Ripple’s proprietary global payments network is a vital resource, facilitating secure and efficient cross-border transactions;

- Technology Infrastructure: Ripple relies on its advanced technology infrastructure, including its consensus algorithm (Ripple Protocol Consensus Algorithm) and Interledger Protocol, to ensure the reliability and scalability of its payment network;

- Partnerships: Collaborative partnerships with banks and other financial institutions are crucial, enabling Ripple to expand its network and access a more extensive customer base;

- Trust and Reputation: Ripple’s established reputation within the fintech industry and the trust it has garnered from its customers and partners contribute to its success as a key resource.

Ripple Key Activities

Ripple’s key activities consist of:

- Payment protocol development

- Cross-border payment solutions

- Liquidity management

- Security enhancements

- Partnership collaborations

Ripple Key Partners

Ripple’s key partners consist of:

- Financial institutions

- Banks

- Payment service providers

- Remittance companies

- Tech companies

Ripple Cost Structure

Ripple’s cost structure consists of:

- Research and development expenses

- Network maintenance costs

- Legal and regulatory compliance

- Marketing and sales efforts

- Employee salaries and benefits

Ripple Competitors

Ripple’s competitors, from traditional financial institutions to innovative fintech companies and cryptocurrencies, strive to dominate an industry undergoing significant technological advancements. These competitors include the following:

- SWIFT (Society for Worldwide Interbank Financial Telecommunication): SWIFT is a cooperative organization that enables secure and standardized messaging between financial institutions. It is widely used for cross-border payments, but its settlement process can be slow and costly compared to Ripple;

- Visa and Mastercard: These global payment networks provide convenient, card-based payment solutions. While they are dominant players in the consumer payments market, their cross-border payment offerings may still need help in terms of speed and cost-efficiency;

- Western Union: A well-established player in the remittance industry, Western Union has a vast physical network and a strong brand presence. However, the fees and settlement times associated with its services can be comparatively higher than Ripple’s;

- JPMorgan’s Interbank Information Network (IIN): JPMorgan‘s IIN aims to reduce friction in cross-border payments by leveraging blockchain technology. While it offers similar benefits to Ripple, it is limited to JPMorgan’s network of correspondent banks, unlike Ripple’s open network of participants;

- Wise: Wise is a prominent fintech company that provides low-cost international money transfer services. While it is known for competitive exchange rates, it operates on a peer-to-peer system and does not utilize blockchain technology like Ripple;

- Stellar (XLM): Stellar is a decentralized blockchain platform that enables fast and cost-effective cross-border transactions. It focuses on connecting financial institutions and simplifying the transfer of various currencies;

- Litecoin (LTC): Litecoin is a peer-to-peer cryptocurrency that offers faster transaction confirmation times than traditional digital currencies like Bitcoin. However, unlike Ripple, it is not explicitly focused on cross-border payments;

- Bitcoin (BTC): The first and most well-known cryptocurrency that can be used for cross-border payments. However, its slower transaction confirmation times and higher fees make it less efficient or cost-effective for this purpose than Ripple;

- Ethereum (ETH): Ethereum is a blockchain platform that allows the creation of decentralized applications and smart contracts. While it is not primarily focused on cross-border payments, its underlying technology can be utilized by other projects to facilitate such transactions.

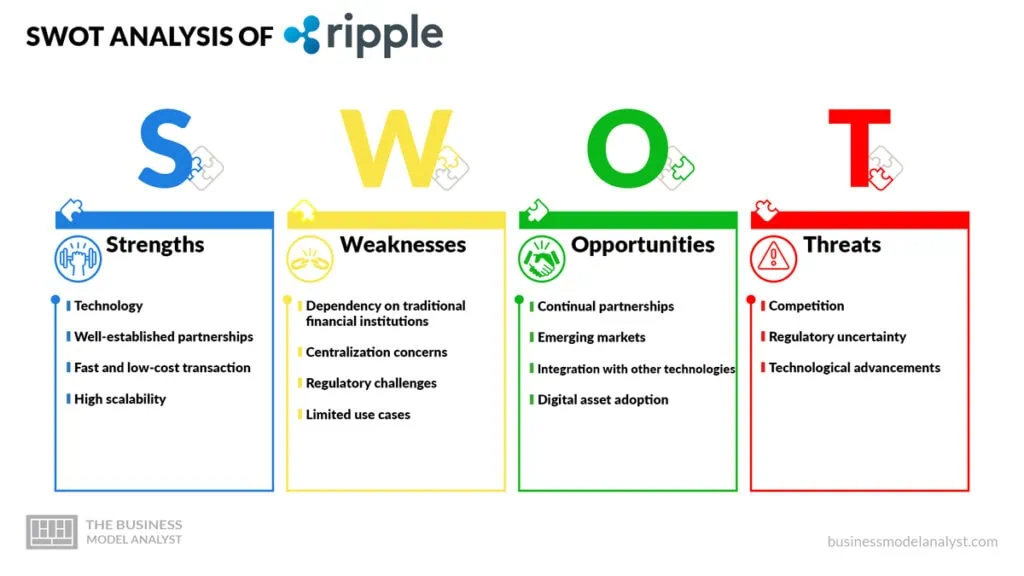

Ripple SWOT Analysis

The SWOT analysis is a crucial tool for evaluating a business’s strengths, weaknesses, opportunities, and threats. In the case of Ripple, conducting a SWOT analysis allows us to gain a deeper understanding of its business model and the factors that may impact its success. By examining Ripple’s strengths, weaknesses, opportunities, and threats, we can assess its current position in the market and identify potential areas for growth and improvement.

Ripple Strengths

- Technology: Ripple has developed a unique blockchain-based technology called the Ripple Protocol Consensus Algorithm (RPCA), which ensures speedy and efficient transactions;

- Well-established partnerships: Ripple has partnered with numerous banks and financial institutions globally, strengthening its position in the market and increasing its credibility;

- Fast and low-cost transactions: Ripple’s technology enables real-time and low-cost international transactions, solving the existing issues with traditional cross-border payments;

- High scalability: Ripple’s network is highly scalable, handling many transactions per second without significant congestion.

Ripple Weaknesses

- Dependency on traditional financial institutions: Ripple’s success is highly reliant on banks and financial institutions’ adoption and integration of its technology. More than delayed decision-making processes within these institutions can slow down Ripple’s growth;

- Centralization concerns: Some blockchain enthusiasts criticize Ripple for its centralized nature and control over the network validators. This raises concerns about decentralization, a fundamental principle of blockchain technology;

- Regulatory challenges: Ripple’s operations involve financial transactions, making it prone to regulatory scrutiny and compliance challenges, which could potentially hinder its expansion into certain markets;

- Limited use cases: Ripple’s technology primarily focuses on improving cross-border payments, leaving limited scope for diversification into other applications within the blockchain and cryptocurrency space.

Ripple Opportunities

- Continual partnerships: Ripple has the opportunity to expand its partnerships with more financial institutions worldwide, increasing its user base and market reach;

- Emerging markets: Ripple can target emerging economies with a greater need for efficient cross-border payment solutions and limited competition in the blockchain space;

- Integration with other technologies: Ripple can explore integration opportunities with emerging technologies such as the Internet of Things (IoT), smart contracts, and decentralized finance (DeFi), creating new use cases and opening up new market segments;

- Digital asset adoption: As cryptocurrencies gain wider acceptance, Ripple can leverage the growing prominence of digital assets to expand its presence and utility.

Ripple Threats

- Competition: Ripple faces intense competition from other blockchain-based solutions, such as Stellar, SWIFT, and traditional payment systems, which may limit its market share and adoption;

- Regulatory uncertainty: Evolving regulations concerning cryptocurrencies and blockchain technology can threaten Ripple’s operations, requiring continuous compliance efforts and adaptability to changing legal frameworks;

- Technological advancements: Rapid advancements in blockchain technology could render Ripple’s current offerings obsolete, making it crucial for the company to stay at the forefront of innovation.

Conclusion

Ripple’s business model showcases the company’s expertise in providing cross-border payment solutions through blockchain-based technology. By focusing on partnerships with financial institutions and ensuring regulatory compliance, Ripple has positioned itself as a leader in revolutionizing the traditional financial system. Using its native digital asset, XRP further enhances the efficiency and cost-effectiveness of international transactions.

With a focus on speed, scalability, and security, Ripple’s business model has the potential to transform the global remittance industry and establish itself as a critical player in the financial technology space.