The Acorns business model, developed by the innovative financial technology company nestled in Silicon Valley, Acorns, has quietly redefined the landscape of personal finance since its inception in 2012. Rapidly ascending as a game-changer, Acorns‘ approach ingeniously taps into the power of spare change, skillfully transforming everyday transactions into a pathway toward financial growth.

Much like Twitter’s succinct tweets, Acorns has staked its unique claim within the financial industry. Their model empowers users to automatically invest their spare change, seamlessly rounding up everyday purchases to the nearest dollar and channeling the difference into a diversified portfolio. This ingenious concept has struck a chord with millions of users, solidifying Acorns’ position as a prominent player in the realm of financial technology.

Contents

A brief history of Acorns

The story of Acorns traces its origins to the year 2012. It all began with the vision of two forward-thinking father-son entrepreneurs, Walter Wemple Cruttenden III and Jeffrey James Cruttenden, who shared a common goal: to democratize investing and make it accessible to everyone, regardless of their financial background or means.

Before Acorns came into existence, the world of investing was often seen as an exclusive club reserved for the wealthy. Traditional brokerage firms demanded substantial minimum investments, making it challenging for ordinary individuals to participate in the financial markets. Walter and Jeff aimed to change this paradigm.

In pursuit of their mission, they assembled a team of like-minded individuals who believed in the power of micro-investing. The concept was simple but revolutionary: round up everyday transactions to the nearest dollar and invest the spare change. This small change, when consistently invested, had the potential to grow into substantial savings over time.

Countless brainstorming sessions, prototypes, and late nights marked the journey of turning this idea into a reality. Walter and Jeff’s determination and dedication were unwavering. They recognized that making financial investing accessible required innovation and simplicity.

After months of hard work, the first version of Acorns was launched in 2014. It was an app that seamlessly integrated with users’ everyday spending habits. The app is linked to bank accounts, credit cards, and debit cards, rounding up purchases to the nearest dollar and investing the change in diversified portfolios.

As the platform gained traction, more and more people began to recognize the potential of Acorns. The user base expanded rapidly, reaching millions of users within a short period. This growth was fueled not only by the app’s innovative features, but also by a growing interest in financial literacy and the benefits of automated investing.

In the following years, Acorns continued to evolve and expand its offerings. The company introduced additional features, such as Acorns Later (a retirement account solution) and Acorns Early (a custodial account for children). These additions catered to the diverse financial needs of their users, further cementing Acorns’ position as a comprehensive financial platform.

Acorns’ commitment to financial education also played a pivotal role in its success. The platform provided users with educational content and tools to enhance their financial knowledge, empowering them to make informed investment decisions.

Strategic partnerships and investments from leading financial institutions further propelled the growth of Acorns. These collaborations helped the platform improve its services and broaden its reach.

Today, Acorns stands as a testament to the power of innovation and accessibility in the world of finance. It has revolutionized how people save and invest, proving that even small changes can make a significant impact on financial futures. With its user-friendly interface, educational resources, and commitment to financial inclusion, Acorns continues to empower individuals on their journey toward financial prosperity.

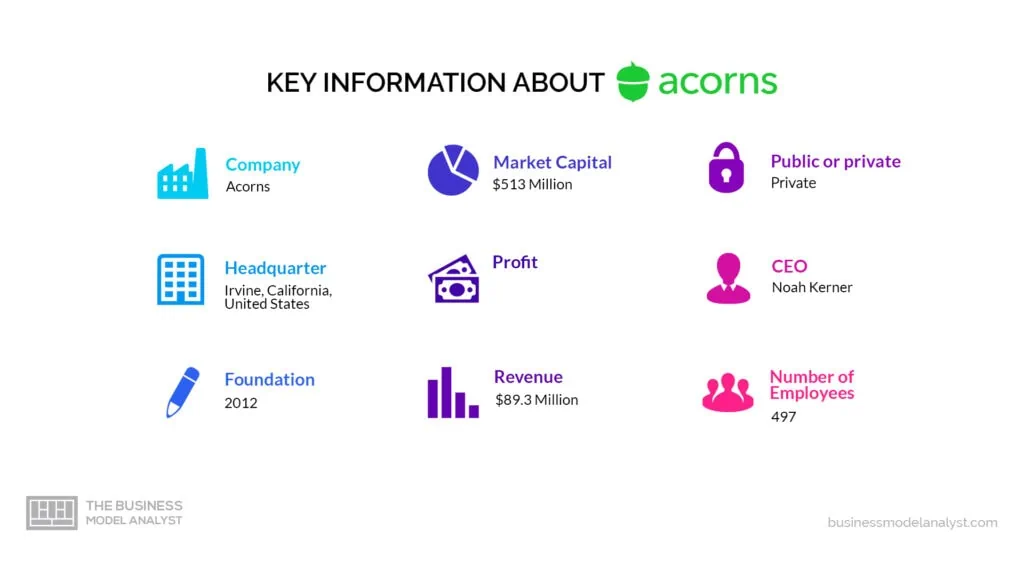

Who Owns Acorns

The Cruttenden family has maintained a significant stake in the company since its inception, with Noah Kerner an early investor in the company, coming on board in 2014 as the CEO.

In the early stages of Acorns’ development, the company relied on venture capital funding to fuel its growth. Prominent venture capital firms such as Greycroft, e.ventures, and Garland Capital invested in Acorns, securing their positions as stakeholders in the company. These investors collectively held a substantial ownership stake in Acorns, with their contributions vital to the company’s expansion.

Over the years, Acorns also attracted individual investors who believed in the company’s mission of making investing more accessible to everyone. In recent years, Acorns has undergone strategic partnerships and acquisitions to enhance its services and offerings.

These developments have led to changes in the ownership structure of the company, with new entities and individuals becoming stakeholders. Nonetheless, Acorns is a private company; therefore, much information about its ownership isn’t readily available.

Acorns Mission Statement

Acorns’ mission statement is “to look after the financial best interests of the up-and-coming, beginning with the empowering, proud step of micro-investing.”

How Acorns works

At the heart of Acorns’ business model is the concept of micro-investing. Acorns aims to break down the barriers to traditional investing by enabling users to grow their wealth in small, manageable increments. Here’s a step-by-step breakdown of how Acorns works:

- Account Creation: The journey begins when users create an account on the Acorns platform, either through their user-friendly website or mobile app. The process is straightforward and user-centric, ensuring that individuals of all financial backgrounds can participate;

- Linking Financial Accounts: To start investing, users link their bank accounts and credit cards to their Acorns account. This step is crucial, as it allows Acorns to track transactions and round up purchases to the nearest dollar;

- Round-Ups: One of Acorns’ flagship features is the “Round-Ups.” As users make everyday purchases, Acorns automatically rounds up each transaction to the nearest dollar. The spare change from these rounded-up transactions is then invested in a diversified portfolio of exchange-traded funds (ETFs). This “set it and forget it” approach makes investing effortless and convenient;

- Portfolio Customization: Acorns offers a range of diversified portfolios, each tailored to different risk profiles and investment goals. Users can choose the portfolio that aligns with their financial aspirations, whether it’s saving for a rainy day, retirement, or a specific financial milestone;

- Recurring Contributions: Acorns also allows users to set up recurring contributions, ensuring a consistent and disciplined approach to investing. Users can automate contributions to a daily, weekly, or monthly basis, reinforcing their commitment to financial growth;

- Acorns Later: For retirement planning, Acorns offers “Acorns Later,” an Individual Retirement Account (IRA) feature. Users can set up their IRA effortlessly, ensuring they’re prepared for a secure financial future;

- Acorns Early: Acorns recognizes the importance of early financial education and saving for future generations. “Acorns Early” empowers users to establish a tax-advantaged custodial investment account for their children, giving them a head start on their financial journey;

- Acorns Spend: To streamline financial management, Acorns provides users with a fully-fledged checking account through “Acorns Spend.” This account comes with a debit card and features like no hidden fees, real-time round-ups, and cashback rewards.

Acorns Commitment to Innovation

Acorns stands out in the financial services industry due to its unwavering commitment to innovation. The platform continuously evolves to cater to users’ changing needs and preferences. By harnessing the power of data insights and cutting-edge technology, Acorns ensures that it remains at the forefront of the micro-investing revolution.

How Acorns makes money

Acorns operates on a unique financial services business model that caters to individuals looking to invest and save money effortlessly. By leveraging the concept of micro-investing, Acorns makes money through several revenue streams, providing value to both its users and partners. Here’s a breakdown of how Acorns generates its revenue:

Subscription Fees

Acorns offers a subscription service/pricing plan with its service, which comes in three tiers: Acorns Personal, Acorns Personal Plus, and Acorns Premium. These subscriptions offer various features, including automatic investing, retirement planning, and financial education tools. Users pay a monthly fee ranging from $3 to $9, depending on their chosen tier. This subscription model constitutes a significant portion of Acorns’ revenue.

Found Money

Acorns partners with various brands and companies to offer a cashback-like feature called “Found Money.” When Acorns users shop with partner brands, a percentage of their purchase is invested into their Acorns account. Acorns earns a commission from these partner companies for driving customers to their businesses.

Investment Management Fees

Acorns invests users’ funds in a diversified portfolio of exchange-traded funds (ETFs). While the fees charged by these ETFs are relatively low, Acorns earns a small investment expense ratio (typically 0.05% to 0.18%) as its share.

By combining these revenue streams, Acorns ensures a steady income while encouraging its users to save and invest, ultimately helping them achieve their financial goals. This diverse range of services and revenue sources solidifies Acorns’ position in the fintech industry.

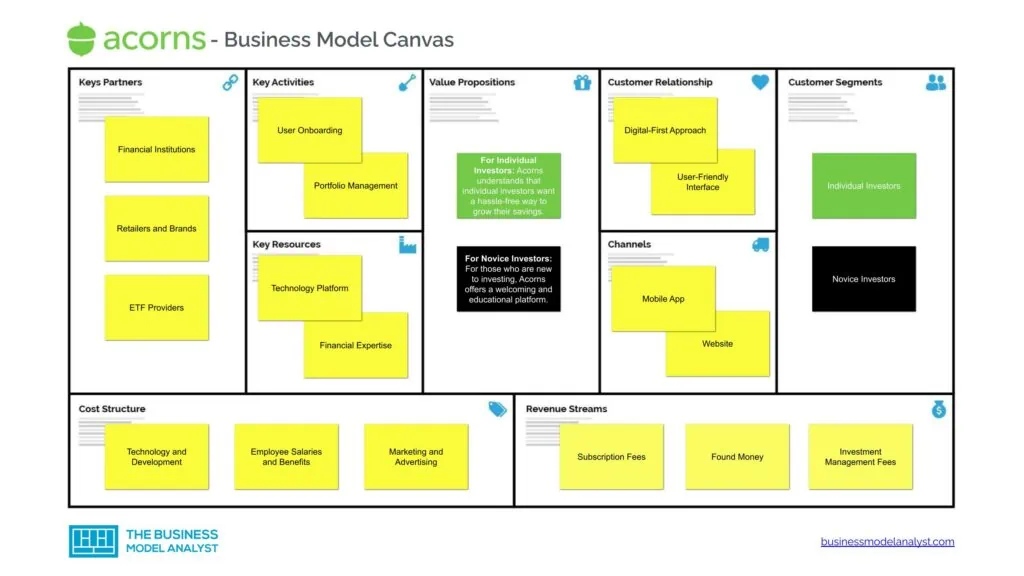

Acorns Business Model Canvas

The Acorns Business Model can be explained in the following business model canvas:

Acorns Customer Segments

Acorns’ customer segments can be categorized as follows:

- Individual Investors: Individual investors represent a significant portion of Acorns’ customer base. These users are typically interested in investing their money to grow their savings over time. Acorns offers them a convenient platform to invest their spare change, rounding up everyday purchases to the nearest dollar and investing the difference in diversified portfolios. These users often prioritize long-term financial goals like retirement or building wealth;

- Novice Investors: Acorns also appeals to novice investors who may be new to investing and want a simple, user-friendly platform to start. These users appreciate Acorns’ ease of use and educational resources, which help them understand the basics of investing and financial planning;

- Goal-Oriented Savers: Acorns attracts goal-oriented savers with specific financial objectives, such as saving for a vacation, a down payment on a home, or an emergency fund. Acorns’ feature that allows users to set financial goals and track their progress aligns with this customer segment’s needs;

- Young Professionals: Young professionals, including college students and recent graduates, make up a significant portion of Acorns’ user base. Acorns offers them a seamless way to start investing, even with limited funds. This segment values Acorns’ approach to micro-investing, which fits well with their lifestyle and financial goals;

- Financially Conscious Consumers: Acorns attracts individuals who are financially conscious and seek to make the most of their money. These users appreciate the automatic saving and investing features that Acorns offers, helping them effortlessly grow their wealth over time;

- Retirement Planners: Acorns caters to individuals who are planning for retirement. While Acorns’ primary focus is on investing for the long term, it provides tools and resources that help users set up retirement accounts like IRAs and 401(k)s, making it appealing to this customer segment;

- Ethical and Socially Responsible Investors: Acorns offers socially responsible investment portfolios that appeal to users who want their investments to align with their values and ethical principles. This segment appreciates the opportunity to invest in companies that prioritize sustainability and responsible business practices.

Acorns Value Propositions

Acorns’ value propositions consist of:

- For Individual Investors: Acorns understands that individual investors want a hassle-free way to grow their savings. They appreciate Acorns’ unique approach, which rounds up their everyday purchases to the nearest dollar and invests the spare change. With Acorns, they can effortlessly build wealth over time, making their money work for them without the need for extensive financial knowledge;

- For Novice Investors: For those who are new to investing, Acorns offers a welcoming and educational platform. They benefit from Acorns’ user-friendly interface and educational resources that help them learn the basics of investing. Acorns empowers them to start their investment journey with confidence;

- For Goal-Oriented Savers: Acorns recognizes that goal-oriented savers have specific financial objectives in mind. They appreciate Acorns’ goal-setting feature, which allows them to define and track their financial goals;

- For Young Professionals: Young professionals lead busy lives and may have limited funds to invest. Acorns caters to their needs by offering a convenient way to invest spare change. They can start building their financial future without the need for large initial investments, making it an ideal solution for their lifestyle;

- For Financially Conscious Consumers: Financially conscious consumers value Acorns’ automatic saving and investing features, which help them grow their wealth effortlessly. Acorns provides them with the tools to achieve their financial goals efficiently;

- For Retirement Planners: Retirement planners can trust Acorns to help them prepare for the future. Acorns offers retirement account options like IRAs and 401(k)s, enabling them to easily save for retirement;

- For Ethical and Socially Responsible Investors: Acorns is the platform for investors who want to align their investments with their values. They can appreciate Acorns’ socially responsible portfolios, which allow them to invest in companies committed to sustainability and ethical business practices. With Acorns, they can make a positive impact while growing their wealth.

Acorns Channels

Acorns’ channels consist of:

- Mobile App: Acorns operates through a mobile app available on both Android and iOS platforms. The app serves as the central hub for users to sign up, link their bank accounts, and start investing their spare change;

- Website: Acorns maintains a website that complements its mobile app. Users can sign up, access account information, and make portfolio changes through the website. It also serves as a platform for marketing and educational content;

- Partnerships: Acorns has established partnerships with various companies to expand its reach. For instance, it partners with major financial institutions, employers, and brands to offer Acorns as a financial wellness benefit to employees or customers;

- Referral Program: Acorns encourages user growth through a referral program. Users can refer friends and family to Acorns, and both parties receive a bonus when the referred person starts investing with Acorns;

- Social Media: Acorns maintains a presence on social media platforms such as Facebook, Twitter, and Instagram. They use these channels to engage with users, share educational content, and promote their services;

- Customer Support: Acorns provides customer support through various channels, including email and in-app messaging. This ensures that users can get assistance when needed and have a positive experience with the platform;

- Advertising: Acorns uses digital advertising and partnerships to reach potential customers. They often run ads on social media, search engines, and other online platforms to attract new users.

Acorns Customer Relationships

Acorns’ customer relationships consist of:

- Digital-First Approach: Acorns primarily maintains a digital-first approach to customer relationships. Users interact with the platform through the mobile app and website, which allows for easy access to their investment accounts and financial information;

- User-Friendly Interface: Acorns places a strong emphasis on providing a user-friendly and intuitive interface. The app and website are designed to be accessible to individuals with varying levels of financial expertise, making it easy for customers to manage their investments;

- Education and Guidance: Acorns offers educational resources to enhance customer relationships. These resources include articles, videos, and personal finance and investing tips. By providing educational content, Acorns helps users make informed decisions about their investments;

- Customer Support: Acorns provides customer support to assist users with any questions or issues they may encounter. Users can access customer support through channels such as email and in-app messaging. This responsive support system fosters positive customer relationships;

- Personalized Investment Approach: Acorns tailors its investment approach to individual users’ goals and risk tolerance. Through a questionnaire during the onboarding process, Acorns assesses users’ financial objectives and suggests investment portfolios that align with their preferences;

- Transparency: Acorns maintains transparency in its fee structure and investment strategies. Clear communication about fees and how they impact users’ portfolios helps build trust and maintain strong customer relationships;

- Gamification Elements: Acorns incorporates gamification elements into its app to engage and motivate users. Features like “Found Money” (cashback rewards) and round-up transactions make the platform more engaging and encourage continued use;

- Security and Trust: Maintaining strong security measures is essential for building trust with customers. Acorns takes data security seriously and uses encryption and other security protocols to protect user information and assets.

Acorns Revenue Streams

Acorns’ revenue streams consist of:

- Subscription Fees: Acorns offers subscription plans (Acorns Personal, Personal Plus, Premium) that provide automatic investing, retirement planning, and financial education tools, generating recurring monthly revenue;

- Found Money: Through partnerships with brands, Acorns offers cashback-like “Found Money.” It invests a portion of users’ purchases, earning commissions from partner businesses;

- Investment Management Fees: Acorns invests user funds in low-cost ETFs, earning a small investment expense ratio (typically 0.05% to 0.18%) as revenue.

Acorns Key Resources

Acorns’ key resources consist of:

- Technology Platform: The mobile app and website are essential resources that facilitate user interactions, account management, and investment transactions;

- Financial Expertise: Acorns relies on financial experts and algorithms to create and manage investment portfolios tailored to user preferences and risk profiles;

- User Data: User data is a valuable resource for personalizing investment recommendations and improving the user experience;

- Partnerships: Collaborations with financial institutions, brands, and retailers provide access to various investment products and the “Found Money” program;

- Compliance and Regulation: Compliance teams and regulatory knowledge ensure that Acorns operates within legal and industry standards.

Acorns Key Activities

Acorns’ key activities consist of:

- User Onboarding

- Portfolio Management

- Educational Content

- Marketing and Promotion

- Partnership Management

- Customer Support

Acorns Key Partners

Acorns’ key partners consist of:

- Financial Institutions

- Retailers and Brands

- ETF Providers

- Marketing and Advertising Partners

Acorns Cost Structure

Acorns’ cost structure consists of:

- Technology and Development

- Employee Salaries and Benefits

- Marketing and Advertising

- Compliance and Regulatory Costs

- Partnership Costs

- Customer Support

- Data Security

- Educational Content Creation

- Asset Management Fees

- Office and Infrastructure

Acorns Competitors

- Robinhood: Robinhood is a commission-free stock and cryptocurrency trading platform that competes with Acorns by offering investment and savings features, including fractional shares;

- Stash: Stash is a micro-investing app that allows users to invest in ETFs and individual stocks. It competes with Acorns in the micro-investing space and offers educational content;

- Betterment: Betterment is a robo-advisory platform that offers automated investment services, including portfolio management and retirement planning, in competition with Acorns’ investment management services;

- Wealthfront: Wealthfront is another robo-advisory platform that provides automated investment management and financial planning, targeting similar users as Acorns;

- Qapital: Qapital is a personal finance app focusing on saving and budgeting. It competes with Acorns in helping users save and invest their spare change;

- SoFi Invest: SoFi Invest offers a range of investment and financial products, including robo-advisory services and commission-free trading, making it a competitor in the fintech space;

- M1 Finance: M1 Finance combines automated investing with customizable portfolios, giving users control over their investments and competing with Acorns’ portfolio management;

- Varo Money: Varo Money offers a mobile banking platform with integrated savings and investment features, making it a competitor to Acorns in the financial services industry;

- Traditional Banks: Traditional banks often offer their own digital savings and investment solutions, competing with Acorns for customers looking to save and invest with established institutions.

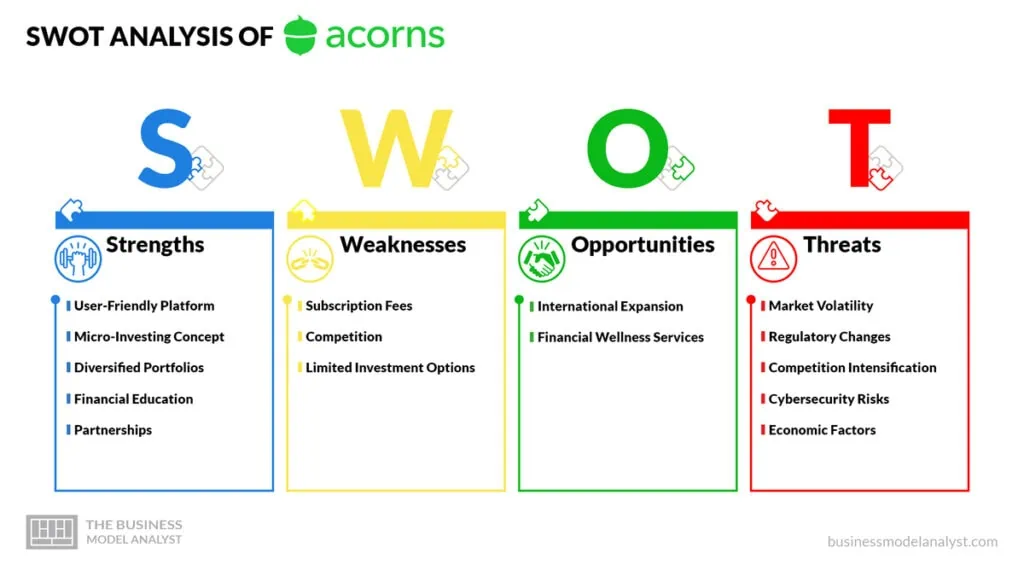

Acorns SWOT Analysis

A SWOT analysis reviews a company’s strengths, weaknesses, external opportunities, and threats.

Acorns Strengths

- User-Friendly Platform: Acorns offers an intuitive and user-friendly mobile app and website, making it easy for users to start investing;

- Micro-Investing Concept: Acorns’ micro-investing approach appeals to users who want to save and invest small amounts of money effortlessly;

- Diversified Portfolios: Acorns offers diversified portfolios of ETFs, providing users with access to a range of investment options;

- Financial Education: The platform provides educational content, enhancing users’ financial literacy and encouraging them to make informed investment decisions;

- Partnerships: Acorns has partnered with financial institutions, brands, and employers, expanding its user base and revenue potential.

Acorns Weaknesses

- Subscription Fees: Its subscription fees may deter cost-conscious users from fully utilizing the platform;

- Competition: The micro-investing space is highly competitive, with several fintech startups and established financial institutions offering similar services;

- Limited Investment Options: Acorns primarily offers ETF-based portfolios, limiting the range of investment choices compared to other investment platforms.

Acorns Opportunities

- International Expansion: Acorns could explore opportunities to expand its services to international markets, reaching a broader user base;

- Financial Wellness Services: Offering comprehensive financial wellness services, including debt management and financial planning, could broaden Acorns’ appeal.

Acorns Threats

- Market Volatility: Economic downturns and market fluctuations can impact users’ confidence in investing, potentially leading to reduced user activity;

- Regulatory Changes: Changes in financial regulations or tax laws can affect Acorns’ operations and compliance requirements;

- Competition Intensification: Competition from established players and emerging fintech startups could lead to customer acquisition challenges;

- Cybersecurity Risks: Data breaches or cybersecurity threats can damage Acorns’ reputation and erode user trust;

- Economic Factors: Economic recessions or adverse economic conditions may decrease user income and investment contributions.

Conclusion

Acorns’ business model has successfully leveraged the power of micro-investing to make investing more accessible to a broader demographic. By rounding up everyday purchases and automatically investing the spare change, Acorns has created a user-friendly platform encouraging individuals to save and invest for their future.

In addition, their subscription-based pricing model, coupled with a range of financial education tools, has allowed them to generate a sustainable revenue stream. As financial technology continues to evolve, Acorns’ innovative approach to wealth-building remains a notable example of how fintech companies can democratize investing and empower individuals to take control of their financial futures.