The Robinhood business model operates an online brokerage that offers commission-free trading by allowing users to buy and sell assets such as stocks, exchange-traded funds (ETFs), options, American depositary receipts (ADRs), and even cryptocurrencies.

This fintech company provides a mobile phone application and the users can also check on their financials through the company’s website or smartwatch apps.

Contents

A brief history of Robinhood

Robinhood was founded in 2013, by Vladimir Tenev and Baiju Bhatt, the current CEOs of the company, who met when they both studied at Stanford.

Sometime after they had their first work experiences post-graduation, they launched their first own company — that was back in 2009. Celeris, the business, was a hedge fund that used an algorithm to help make investment decisions. Two years later, the idea was abandoned.

So, in 2011, the business was Chronos Research. The startup — which never took off either — would sell low-latency trading software to banks, hedge funds, or other financial institutions.

The duo saw an opportunity in combining the familiarity that people have with smartphones and the lack of access that the average citizen faces to invest — since investments in America used to be reserved for only 1% of society.

To get started, they got to convince Tim Draper of Index Ventures and Marc Andreessen of Andreessen & Horowitz to invest $3 million into the startup’s seed round, in April 2013.

Within the first year, Robinhood got close to one million users, responsible for processing over $1 billion in transactions, and, in 2016, the fintech became the fastest brokerage in history to hit $2 billion in transactions.

In 2020, with the quarantine, Robinhood added another 3 million users to its platform and their customers began to make even riskier bets. Unfortunately, the flood of new users brought a few problems: 3 outages over the course of 2 weeks, which led to some filing class-action lawsuits, that are still up in the air.

In January 2021, the company blocked users from purchasing GameStop, AMC, and other stocks, and they were criticized for instating a trading halt. As a result, Robinhood had to raise more than $3.4 billion in funding to settle its collateral demands, as well as to comply with SEC regulations.

In June of that year, the Financial Industry Regulatory Authority (FINRA) issued a $70 million fine, stating that Robinhood had misled customers. Despite the fine, the fintech managed to go public in July, raising another $1.9 billion in the process. Nowadays, over 18 million customers are using Robinhood.

Who Owns Robinhood

The founders of Robinhood Markets Inc., Vladimir Tenev and Baiju Bhatt, are still today the current owners of the company, with Tenev being the CEO and Bhatt the CCO (Chief Creative Officer).

Robinhood’s Mission Statement

To democratize finance for all.

How Robinhood makes money

Rebates from Market Makers and Trading Venues

When users buy or sell stocks, ETFs, and options, Robinhood sends the order to market makers or exchanges. Market makers offer rebates to brokerages while ensuring better prices for users.

Robinhood’s algorithm seeks to send the order to the market maker most likely to give the best execution and a small portion to an exchange. Under proper exchange fee schedules, the fintech pays the exchange when it takes liquidity, and gets paid when provides liquidity.

The same occurs to Robinhood Crypto, which receives volume rebates from trading venues, that provide competitive prices.

Robinhood Gold

The user pays $5 a month to have access to Morningstar research reports, NASDAQ Level II Market Data, bigger instant deposits, and margin investing. When investing on margin, if the customer uses more than $1,000 of margin, they will pay 2.5% yearly interest on the settled margin amount above $1,000.

Stock Loan

Robinhood earns money from lending margin securities to counterparties.

Income from Cash

Robinhood earns income on uninvested cash that isn’t swept to the Cash Management network of program banks, by depositing this cash in interest-bearing bank accounts.

Cash Management

Robinhood offers a debit card in connection with a brokerage account provided through Robinhood Financial LLC, a member of SIPC and FINRA. Sutton Bank, which issues the card pursuant to a license by Mastercard, receives an interchange fee that is passed to Robinhood. The fintech also receives fees from program banks for sweeping funds to them.

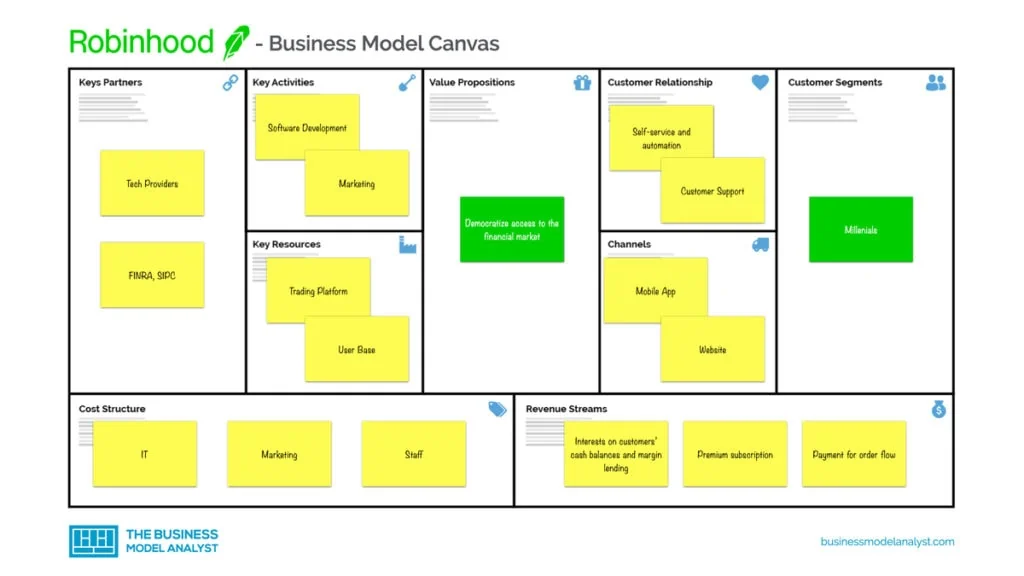

Robinhood’s Business Model Canvas

Let’s take a look at the Robinhood Business Model Canvas below:

Robinhood’s Customer Segments

Robinhood’s customer segments consist of:

- Millennials (18 to 29-year-old) interested in trading

- High-frequency traders

- Retail brokerage marketing

- Electronic trading firms

Robinhood’s Value Propositions

Robinhood’s value propositions consist of:

- Democratizing access to the financial market

- Trading stocks for free

- Providing real-time market data for trading

- Making comfortable to store money and trade stocks via the app

- Allowing investments in publicly traded companies and exchange-traded funds without commissions

- Enabling users to buy crypto assets

- Inspiring a new generation of investors

Robinhood’s Channels

Robinhood’s channels consist of:

- Mobile app

- Website

- API

- Social media

Robinhood’s Customer Relationships

Robinhood’s customer relationships consist of:

- Support via e-mail and social media

- Providing free stocks when referring new users

- Smart notifications

- Real-time market data

- Automation

- Self-service

Robinhood’s Revenue Streams

Robinhood’s revenue streams consist of:

- Interests on customers’ cash balances and margin lending

- Premium subscription

- Payment for order flow

Robinhood’s Key Resources

Robinhood’s key resources consist of:

- Trading platform

- User database

- Security developments

- Real-time market data

- Venture capital funding

- Tech and financial team

Robinhood’s Key Activities

Robinhood’s key activities consist of:

- App maintenance

- Software development

- IT platform operations

- Security measures

- Marketing

- International expansion

Robinhood’s Key Partners

Robinhood’s key partners consist of:

- Investors

- FINRA

- SIPC

- Tech providers

Robinhood’s Cost Structure

Robinhood’s cost structure consists of:

- Staff

- Process automation

- R&D

- Marketing

- Storage and IT architecture

- Security policies

Robinhood’s Competitors

- E*TRADE: It is a nice option for advanced traders, active day traders, derivatives traders, and those saving for retirement. Based on the website or mobile app, with a 24/7 support line;

- Webull: Good for intermediate and experienced self-directed investors and traders. The platform can be considered advanced for novice traders, but it is learnable. It offers trading courses and a trading simulator or demo trading account with real-time data and advanced charting;

- TradeStation: Commission-free stock and options trading on a technically advanced but easy-to-use platform. It beats Robinhood in the number of offered investible classes, with futures, mutual funds, and bonds;

- SoFi Active Investing: Designed for young investors, who can benefit from free educational seminars and meetings with financial advisors. It has no account minimum, so it’s easy to get started;

- TD Ameritrade: With one of the easiest to use platforms available on both mobile and desktop, researching stocks and investment opportunities get more intuitive, due to its multitude of available tools;

- Moomoo: A smart trading platform, it’s free, organized, and easy to use for both beginners and experienced traders. It offers a paper trading feature with real-time data for those who want to simulate the investment experience before going all in. There’s no minimum deposit to start;

- M1 Finance: A free automated hybrid platform that’s a cross between a traditional investment management service and a robo-advisor. The user completes an interview to set up a profile when signing up. It is not for day traders, but it provides a simple way to get started in long-term investing.

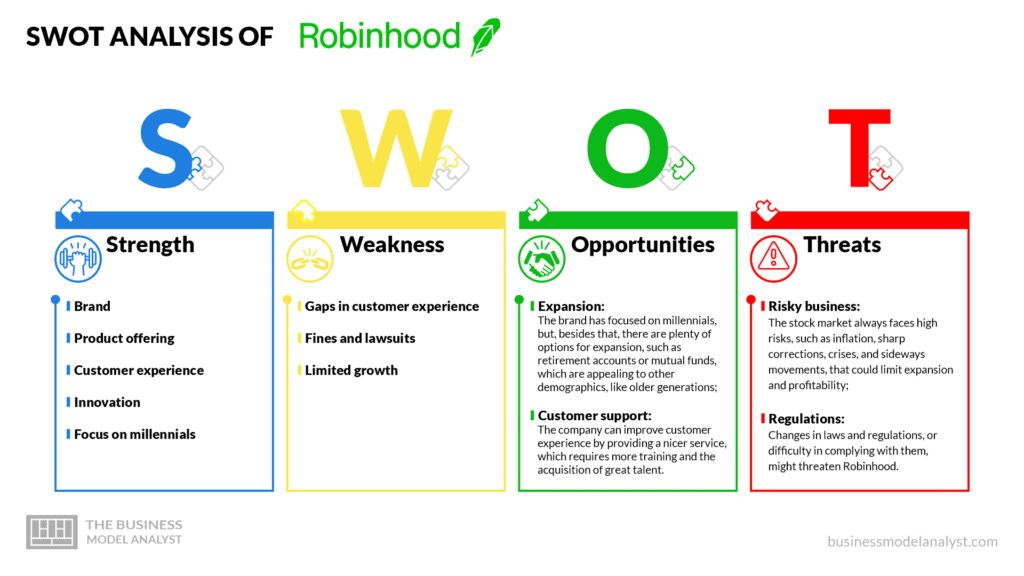

Robinhood’s SWOT Analysis

Below, there is a detailed swot analysis of Robinhood:

Robinhood’s Strengths

- Brand: It is the first commission-free trader, thus establishing strong brand recognition, and ensuring customer loyalty;

- Product offering: Its portfolio encompasses stocks, ETFs, options, cryptocurrency, American Depositary Receipts for over 250 global companies, and Fractional shares, thus enabling diversified revenues;

- Customer experience: Despite all the competitors that have come up later, Robinhood’s users still value the freedom and the low-cost experience offered by the company, which is well rated on review platforms;

- Innovation: Its pioneer idea has revolutionized the market, thus giving opportunity for investment to people with no experience and little knowledge of stocks. So, still today, Robinhood is recognized for its innovative business model against the competition;

- Focus on millennials: It is estimated that Robinhood has now over 31 million users, with an average age of 26 years old. Besides allowing the company to better personalize the service, it also offers a great future for the business, that leverages a customer base with long-term investments ahead.

Robinhood’s Weaknesses

- Gaps in customer experience: In spite of the high rating, the brand still has some areas that demand improvements in customer experience, such as outages that occur during market surges, with misleading information, which costs a lot for both users and the company;

- Fines and lawsuits: Robinhood has received the heaviest fines ever handed out by regulatory bodies and has faced some strong lawsuits over its history. That harms its image and cuts down its profit. The brand needs to raise its quality standards to avoid those issues from happening again in the future;

- Limited growth: Almost all the competitors now have adopted Robinhood’s strategy of low costs, taking off its competitive advantage. Now, the brand suffers in providing limited resources, especially for investors who want to grow their trading skills, but might need to seek other new options in the market.

Robinhood’s Opportunities

- Expansion: The brand has focused on millennials, but, besides that, there are plenty of options for expansion, such as retirement accounts or mutual funds, which are appealing to other demographics, like older generations;

- Customer support: The company can improve customer experience by providing a nicer service, which requires more training and the acquisition of great talent.

Robinhood’s Threats

- Risky business: The stock market always faces high risks, such as inflation, sharp corrections, crises, and sideways movements, that could limit expansion and profitability;

- Regulations: Changes in laws and regulations, or difficulty in complying with them, might threaten Robinhood.

Conclusion

The entrance of Robinhood into the online investing industry in 2019 has shaken the market, even making some of the biggest players — such as Charles Schwab and E*Trade — drop their fees for good.

The company’s rise has been based on some key factors, especially permitting users to trade for free, in a so simple way that enables them to start right away.

The brand has great opportunities yet to grow furthermore in the market, it just needs to ensure accurate compliance with regulatory frameworks to reduce risks.