The SoFi business model is focused on providing a variety of financial services to consumers, including personal loans, mortgages, and investment products. SoFi, which stands for Social Finance, was founded in 2011 with the goal of using technology and data to provide more personalized and affordable financial services to consumers. In recent years, the company has expanded rapidly, and it currently serves millions of customers across the United States.

Contents

A brief history of SoFi

SoFi, or Social Finance, was founded in 2011 by a group of students from Stanford University who were seeking a better way to finance their education. The company’s founders believed that traditional student loan providers were not meeting the needs of borrowers, and saw an opportunity to use technology and data to provide more personalized and affordable financing options.

In the early years of the company, SoFi focused primarily on refinancing student loans, offering borrowers lower interest rates and more flexible repayment terms. The company quickly gained popularity among students and recent graduates, and soon expanded its product offering to include personal loans, mortgages, and investment products.

In 2015, SoFi raised $1 billion in funding in a round led by SoftBank, which helped to accelerate the company’s growth and expansion into new markets. In the years that followed, SoFi continued to develop its technology platform and expand its product offering, including the launch of SoFi Money, a digital checking and savings account, and SoFi Invest, which offers customers access to a variety of investment options.

Today, SoFi is one of the leading digital finance companies in the United States, serving millions of customers across the country. The company continues to innovate and evolve its business model, with a focus on providing personalized and affordable financial services to its customers.

Who Owns SoFi

SoFi is a publicly owned company. It went public on June 1, 2021. As of December 7, 2022, 6.22% of the company’s shares are held by insiders, while 34.60% of shares are held by institutions. There are 580 institutions holding SoFi’s shares, with the Vanguard Group, Inc. holding the largest number of shares at 7.20%. Blackrock Inc. is the second largest institutional holder, with 3.41% of shares.

SoFi mission statement

The SoFi business model is “to help people reach financial independence to realize their ambitions.”

What Is SoFi & How Does It Work?

SoFi, or Social Finance, is a digital finance company that provides a variety of financial services to consumers, including personal loans, mortgages, and investment products. The company was founded in 2011 with the goal of using technology and data to provide more personalized and affordable financial services to consumers.

SoFi’s business model is based on offering a wide range of financial products to its customers, including personal loans, mortgages, student loan refinancing, and investment options. The company uses data and technology to provide personalized recommendations and services to its customers and aims to make the process of obtaining financial services more convenient and accessible.

To use SoFi’s services, customers must first create an account on the company’s website or mobile app. They can then browse the available financial products and services, and select the ones that best suit their needs. SoFi’s technology platform uses data and machine learning algorithms to provide personalized recommendations and tailored offers to customers and makes the application process for financial products quick and easy.

Once a customer is approved for a loan or other financial product, SoFi provides ongoing support and services to help them manage their finances and achieve their financial goals. This can include educational resources, financial planning tools, and access to a team of financial advisors.

SoFi also offers users a number of features and services such as the following:

- SoFi Borrow is a feature that allows customers to apply for and obtain personal loans and mortgages from SoFi. The process is designed to be quick and easy, and customers can use the feature to apply for a variety of loan products, including personal loans, student loan refinancing, and mortgages.

- SoFi Invest is a feature that allows customers to access a variety of investment options, including stocks, ETFs, and cryptocurrency. The feature provides personalized recommendations and tools to help customers manage their investment portfolio, and offers a variety of investment options to suit different risk profiles and investment goals.

- SoFi Insights is a feature that provides customers with access to a variety of educational resources and financial planning tools. It also provides customers with access to a team of financial advisors, who can provide personalized advice and guidance on a range of financial topics. The feature is designed to help customers make informed decisions about their finances and achieve their financial goals.

- SoFi Protect is a feature that offers customers access to a variety of insurance products, including life insurance, pet insurance, and home insurance. The feature provides personalized recommendations and makes it easy for customers to compare different insurance options and select the one that best meets their needs.

SoFi’s unique business model and focus on technology and data have helped the company grow rapidly and differentiate itself from other financial services providers. The company continues to innovate and evolve its offering, with a focus on providing personalized and affordable financial services to its customers.

How SoFi makes money

Loan products

SoFi makes money from its loan products by charging interest on the loans it provides to customers. The company used to offer peer-to-peer loans directly but now works with network partners to create loans. In some cases, SoFi may use its own collateral to underwrite loans. SoFi monetizes the loans it issues by bundling them into agreements and selling them to institutional firms and investors, who pay a premium upfront for access to the cash flows generated through the loan origination process.

Investment products

SoFi’s investment platform is a tool that allows users to manage their investments in stocks, ETFs, and cryptocurrencies. The platform offers a zero-brokerage trading feature, which means that users can buy and sell securities without incurring additional fees. The platform also offers automated robo-advisory services, which use algorithms to recommend investment strategies based on the user’s goals and risk tolerance. SoFi generates revenue from the platform by lending securities to other financial institutions and earning rebates from market makers. The company also earns through its FDIC-insured sweep programs and collects a markup on cryptocurrency purchases made through the platform.

Insurance products

SoFi offers insurance products to its customers through partnerships with various insurance providers. These products include life insurance, home insurance, and pet insurance. Customers can access these products through the SoFi app and purchase policies that are tailored to their needs. SoFi generates revenue from these insurance products through commissions and fees paid by the insurance providers. The company also offers a service called SoFi Protect, which provides protection for loans and accounts in the event of unexpected life events, such as job loss. This service is offered at no additional cost to customers who have qualifying loans or accounts with SoFi.

Deposit products

SoFi offers deposit products, such as savings and checking accounts, to its customers. These accounts are FDIC-insured and offer competitive interest rates. Customers can access their accounts and manage their money through the SoFi app, and can also use the app to set up direct deposit, pay bills, and transfer money. SoFi generates revenue from these deposit products through the interest earned on the money deposited in the accounts, as well as fees charged for certain services, such as overdraft protection and wire transfers.

Credit and debit cards

SoFi offers credit and debit cards to its customers through partnerships with various financial institutions. These cards can be used for making purchases and accessing cash at ATMs. The credit cards offer rewards and benefits, such as cashback on certain purchases, and no annual fees. The debit cards are linked to the customer’s checking account and offer the same features and benefits as credit cards. SoFi generates revenue from these card products through interchange fees charged on transactions made with the cards, as well as fees charged for certain services, such as balance transfers and cash advances. Customers can manage their cards and track their spending through the SoFi app.

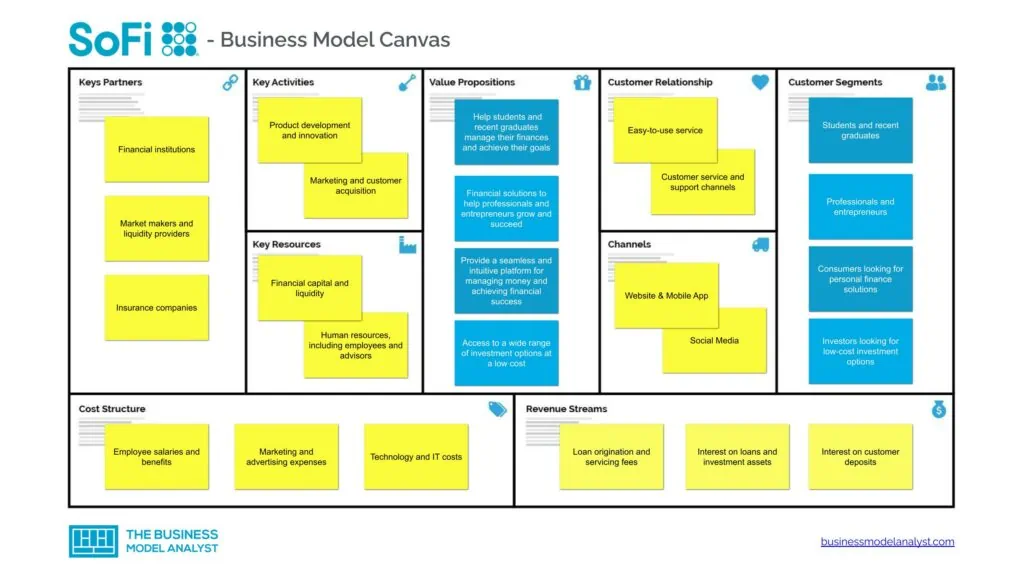

SoFi Business Model Canvas

The SoFi Business Model can be explained in the following business model canvas:

SoFi customer segments

SoFi’s customer segments consist of:

- Students and recent graduates: SoFi offers a range of products and services specifically designed for this customer segment, including student loan refinancing, career services, and financial planning tools.

- Professionals and entrepreneurs: SoFi targets this segment with its personal loan, mortgage, and wealth management products, as well as its business banking services.

- Consumers looking for personal finance solutions: SoFi offers a variety of products, such as savings and checking accounts, insurance, and credit and debit cards, to help customers manage their finances and achieve their goals.

- Investors looking for low-cost investment options: SoFi’s Invest platform offers a range of investment options, including stocks, ETFs, and cryptocurrency, with competitive pricing and no hidden fees.

- Consumers looking for insurance products: SoFi partners with various insurance providers to offer life, home, and pet insurance to its customers.

- Consumers looking for deposit and card products: SoFi offers deposit products, such as savings and checking accounts, as well as credit and debit cards that can be used for everyday purchases and cash access.

SoFi value proposition

SoFi’s value proposition consists of:

- Students and recent graduates: The company’s value proposition for this segment is to help students and recent graduates manage their finances and achieve their goals.

- Professionals and entrepreneurs: For this segment, the company provides convenient and affordable financial solutions to help professionals and entrepreneurs grow and succeed.

- Consumers looking for personal finance solutions: The company’s value proposition for this segment is to provide a seamless and intuitive platform for managing money and achieving financial success.

- Investors looking for low-cost investment options: SoFi provides this customer segment access to a wide range of investment options at a low cost.

- Consumers looking for insurance products: The company’s value proposition for this segment is to provide easy access to a range of insurance products that are tailored to the customer’s needs.

- Consumers looking for deposit and card products: Here, SoFi provides convenient and rewarding banking products that help customers save money and earn rewards.

SoFi channels

SoFi’s channels consist of:

- SoFi’s website

- SoFi’s mobile app

- Social media

- Online advertising

- Referral programs

- Partnerships with other companies

- In-person events and experiences

- Public relations and media outreach

- Content marketing and educational resources

SoFi customer relationships

SoFi’s customer relationships consist of:

- Easy-to-use service

- Social media

- Customer service and support channels

- In-person events and experiences

- Email marketing and newsletters

- SoFi’s website

- SoFi’s mobile app

- Rewards and loyalty programs

- Personalized financial advice and coaching

- Product updates and new features

SoFi revenue streams

SoFi’s revenue streams consist of:

- Loan origination and servicing fees

- Interest on loans and investment assets

- Interest on customer deposits

- Rebates from market makers

- Commissions on insurance products

- Transaction fees on credit and debit card usage

- Markup on cryptocurrency purchases

- Other fees and charges for additional services or features

SoFi key resources

SoFi’s key resources consist of:

- Financial capital and liquidity

- Human resources, including employees and advisors

- Intellectual property, such as patents and trademarks

- Technology and IT infrastructure

- Physical assets, such as office space and equipment

- Data and analytics capabilities

- Brand and reputation

- Partnerships and relationships with other companies

- Government licenses and regulatory compliance

- Customer relationships and feedback

SoFi key activities

SoFi’s key activities consist of:

- Product development and innovation

- Marketing and customer acquisition

- Sales and account management

- Loan origination and underwriting

- Investment management and trading

- Customer service and support

- Risk management and compliance

- Financial planning and advice

- Data analysis and decision-making

- Technology and IT support and maintenance

SoFi key partners

SoFi’s key partners consist of:

- Financial institutions

- Market makers and liquidity providers

- Insurance companies

- Investment and wealth management firms

- Government agencies and regulators

- Educational institutions

- Professional organizations and trade associations

SoFi cost structure

SoFi’s cost structure consists of:

- Employee salaries and benefits

- Marketing and advertising expenses

- Technology and IT costs

- Operations and infrastructure expenses

- Legal and compliance fees

- Interest expense on debt

- Office space

- Depreciation and amortization

- Customer acquisition and retention costs

- Other miscellaneous expenses

SoFi competitors

- Robinhood: a mobile-first investment platform that offers commission-free trading of stocks, ETFs, and options.

- Wealthfront: a digital wealth management company that provides robo-advisory services and personalized financial planning.

- Betterment: an online investment platform that offers automated portfolio management and financial planning tools.

- Acorns: a mobile app and investment platform that rounds up users’ purchases and invests the spare change in a diversified portfolio.

- Chime: a mobile-only bank that offers checking and savings accounts, credit cards, and loans, with a focus on budgeting and saving tools.

- LendingClub: an online lending platform that connects borrowers with individual and institutional investors for personal, business, and student loans.

- Prosper: a peer-to-peer lending platform that offers personal loans and investment opportunities.

- Ellevest: a digital investment platform that offers personalized portfolios and financial planning tools for women.

- Vanguard: a global investment management company that offers a wide range of mutual funds, ETFs, and other investment products.

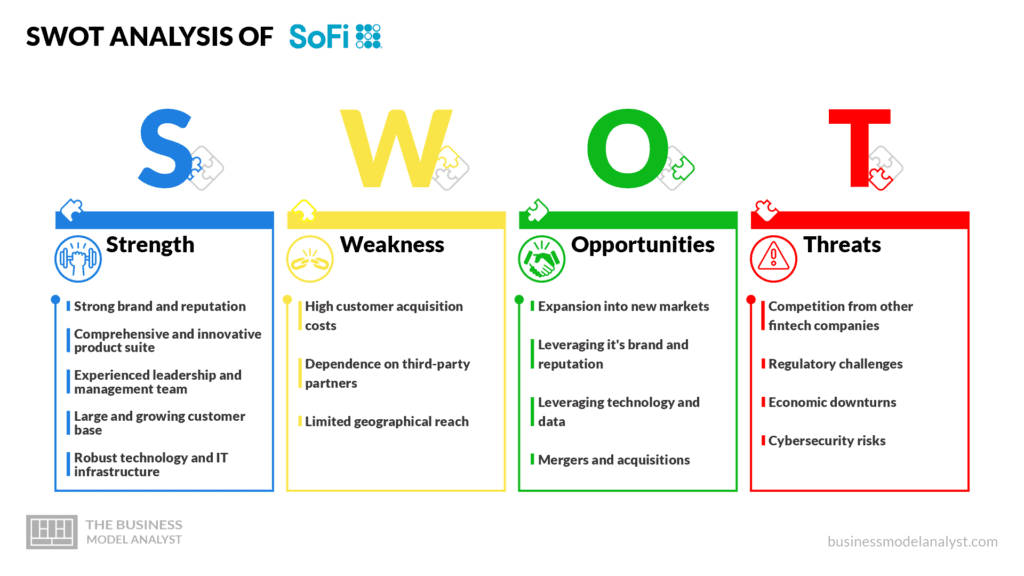

SoFi swot analysis

Below, there is a detailed swot analysis of SoFi:

SoFi Strengths

- Strong brand and reputation: SoFi has established a strong brand and reputation as a leader in the financial technology industry. This has helped the company attract and retain customers, as well as build partnerships with leading institutions and organizations.

- Comprehensive and innovative product suite: SoFi offers a wide range of financial products and services, including personal loans, mortgages, investment and wealth management, insurance, and deposit and credit products. These products are designed to meet the diverse needs of the company’s customer segments and are backed by innovative technology and user-friendly design.

- Experienced leadership and management team: SoFi’s leadership team is made up of experienced executives with a track record of success in the financial industry. The company’s CEO, Anthony Noto, has several years of experience in the field and has held leadership positions at leading firms such as Goldman Sachs and Twitter.

- Large and growing customer base: SoFi has a large and growing customer base, with over 3.8 million members and over $523 million in assets under management. The company has a strong customer retention rate and continues to expand its customer base through partnerships and new product offerings.

- Robust technology and IT infrastructure: SoFi has invested heavily in its technology and IT infrastructure, which is a key differentiator for the company. The company’s platform is scalable, secure, and user-friendly, and enables the company to deliver seamless and personalized experiences to its customers.

- Comprehensive regulatory compliance and risk management: SoFi has a strong compliance and risk management function that ensures the company adheres to all relevant laws, regulations, and standards. This enables the company to operate in a highly regulated industry and to maintain the trust and confidence of its customers, regulators, and other stakeholders.

- Partnerships with leading financial institutions and organizations: SoFi has established partnerships with leading institutions and organizations, such as Google and the NFL Players Association. These partnerships provide the company with access to new customers, markets, and opportunities, and help to enhance its brand and reputation.

SoFi Weaknesses

- High customer acquisition costs: SoFi spends a significant amount of money on marketing and advertising to attract new customers, which can impact the company’s profitability.

- Dependence on third-party partners: SoFi relies on partnerships with other companies to provide some of its products and services, which can create potential risks if these partnerships are disrupted or terminated.

- Limited geographical reach: SoFi primarily operates in the United States, which limits the company’s potential customer base and growth opportunities.

SoFi Opportunities

- Expansion into new markets: SoFi has the opportunity to expand its operations into new geographical regions, which could increase its customer base and revenue.

- Leveraging it’s brand and reputation: SoFi has built a strong brand and reputation in the financial services industry, and the company could leverage this to attract new customers and partnerships.

- Leveraging technology and data: SoFi has access to a large amount of customer data and could use advanced analytics and machine learning to improve its products and services and provide a more personalized experience for its customers.

- Mergers and acquisitions: SoFi could pursue mergers and acquisitions to acquire new customers, technology, and expertise, and accelerate its growth.

SoFi Threats

- Competition from other fintech companies: SoFi faces intense competition from other fintech companies that offer similar products and services. These companies may be able to offer more competitive pricing, better technology, or more innovative products and services, which could drive customers away from SoFi.

- Regulatory challenges: The financial services industry is heavily regulated, and SoFi must comply with a range of laws and regulations. Any failure to comply with these regulations could result in fines, legal action, or reputational damage, which could harm the company’s business.

- Economic downturns: SoFi’s business is sensitive to economic conditions, and a downturn in the economy could lead to increased defaults on loans and a decline in demand for its products and services.

- Cybersecurity risks: SoFi holds a large amount of sensitive customer data, and any data breaches or cyber-attacks could result in the loss or theft of this data, which could harm the company’s reputation and lead to legal and financial penalties.

Conclusion

SoFi’s business model is focused on providing a range of financial products and services to its customers. The company uses technology and data to offer personalized recommendations and advice to its customers, and it generates revenue through fees, interest, and rebates. While SoFi faces competition and regulatory challenges, it has a strong brand and a loyal customer base, which could help it continue to grow and expand in the future.