Is Square Profitable? No, Square is currently not profitable, their most recent net income figures from Macrotrends show that the company made a net loss of $123 million as of their last 2023 quarter income report. Looking at their 2022 annual income report, the company lost about $541 million.

Square, founded by Jack Dorsey and Jim McKelvey in 2009, has revolutionized how businesses process payments and manage financial transactions. Known for its flagship product, the Square Reader, which allows small and medium-sized businesses to accept card payments with ease, Square has expanded its offerings to encompass a wide range of financial services, including Cash App, Square Capital, and Square Online.

Recent net income figures for Square paint a complex picture of the company’s financial trajectory. Notably, Square reported a net income of -$0.123 billion for the quarter ending June 30, 2023, representing a substantial decline of 41.11% compared to the same period in the previous year.

Furthermore, the net income for the twelve months ending June 30, 2023, stands at -$0.268 billion, reflecting a significant year-over-year decrease of 45.21%. These figures raise questions about the company’s ability to achieve and sustain profitability and its response to the evolving dynamics of the financial technology industry.

Contents

Timeline of Square financial growth and funding

Here’s a comprehensive timeline outlining the company’s key milestones, funding rounds, significant product launches, and notable financial events:

2009: Square’s Inception and Launch

- In 2009, Jack Dorsey and Jim McKelvey founded Square with a vision to empower small businesses by simplifying card payments;

- The Square Reader, their first product, was a small, white, square-shaped device that plugged into the headphone jack of a smartphone or tablet, allowing businesses to accept card payments with ease;

- Square’s launch was revolutionary, providing a simple and cost-effective solution for businesses previously excluded from card payment processing due to high fees and complex equipment.

2010: Early Funding and Expansion

- With an initial investment of $10 million from Khosla Ventures and several other investors, Square was able to scale its operations and improve its hardware and software;

- This funding allowed Square to expand its reach and acquire more merchants, establishing a foothold in the competitive payment industry.

2011: Further Investment and Growth

- Square’s reputation and user base continued to grow, attracting a $27.5 million investment in a series B funding round led by Sequoia Capital;

- The company used this capital injection to enhance its product offerings and strengthen its position in the market.

2012: Going Public with IPO Plans

- Square’s announcement of plans for an IPO in 2012 signaled its ambition to become a publicly traded company, a significant step for any tech startup;

- While the IPO didn’t materialize that year, the company’s intent to go public underscored its confidence in its prospects.

2013: Square Cash (Now Cash App) Takes Flight

- In a significant move towards diversifying its financial services, Square launched Square Cash in October 2013. This innovative product, which later evolved into Cash App, marked Square’s foray into peer-to-peer payments and personal finance. Cash App, as it would come to be known, provided users with a simple and convenient way to send money to friends and family, making it a disruptive force in the payment industry.

2015: Square’s IPO

- In November 2015, Square debuted on the New York Stock Exchange, with its IPO priced at $2.9 billion. It was one of the most anticipated tech IPOs of the year;

- Going public provided Square with substantial capital, which it intended to use for continued growth and expansion.

2016: Major Product Launch – Square Capital

- Square launched Square Capital, a significant departure from its core payment processing business. This service offered business loans to its merchants based on their transaction data;

- Square Capital was designed to provide much-needed financing to small businesses, further deepening Square’s relationship with its customers.

2018: Acquisition of Weebly

- Square made a strategic move by acquiring Weebly, a website-building and e-commerce platform, for approximately $365 million;

- This acquisition allowed Square to offer an end-to-end solution for businesses, combining payment processing, online presence, and e-commerce capabilities.

2019: Profitable Year

- In 2019, Square achieved a significant financial milestone by reporting a profit, with an annual net income of $0.213 billion;

- This marked a turning point in Square’s financial performance and demonstrated the sustainability of its business model.

2020: Year of Financial Challenges

- Despite its previous profitable year, Square faced financial challenges in 2020, with its annual net income declining by 43.24% to $0.213 billion compared to the previous year;

- The COVID-19 pandemic disrupted many of the small businesses that Square served, impacting the company’s bottom line.

2021: Square’s Expansion in Music and Banking

- In March 2021, Jack Dorsey announced that Square was taking a majority stake in Tidal, the music-streaming service backed by Jay-Z, for $297 million. This move marked Square’s foray into the music industry;

- In November, Square shareholders approved the issuance of new shares for the Afterpay acquisition, bringing this massive deal a step closer to realization.

2023: Decline in Net Income

- Square reported a decline in its net income for the quarter ending June 30, 2023, with a net income of -$0.123 billion, marking a 41.11% decline year-over-year;

- The annual net income for the twelve months ending June 30, 2023, also saw a significant decline of 45.21% to -$0.268 billion compared to the previous year, indicating ongoing challenges in the rapidly evolving fintech landscape.

Square Financial Performance: Revenues, Expenses, and Profits

To assess Square Inc.’s financial health and performance, it is crucial to examine key financial metrics such as revenues, expenses, and profits. These figures provide valuable insights into the company’s ability to effectively generate income and manage its costs.

Square Revenue

Square’s revenue is a critical indicator of its financial performance and market presence. It reflects the total income generated by the company from its various business activities. Analyzing Square’s revenue over time provides insights into its growth trajectory and the diversity of its income streams.

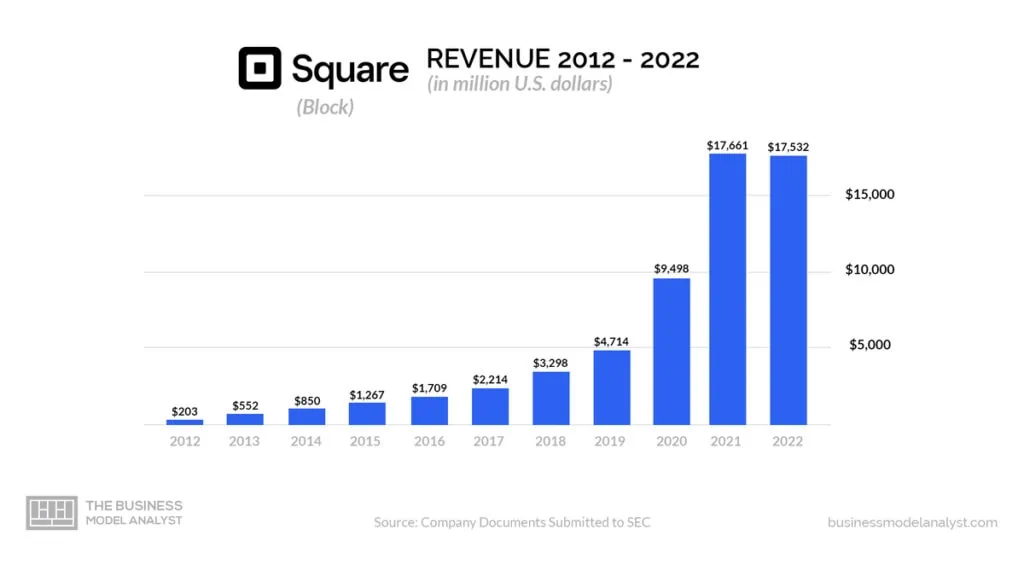

Annual Revenue

2022: $17,532 million

In 2022, Square reported an annual revenue of $17,532 million, marking a substantial increase compared to the previous year. This growth can be attributed to several factors:

- Expansion of Services: Square has expanded its services beyond payment processing, including Cash App, Square Capital, and Square Online, attracting a broader customer base;

- E-commerce Surge: The COVID-19 pandemic accelerated the shift towards e-commerce, benefiting Square as businesses sought digital payment solutions;

- Increasing User Base: The growing number of merchants using Square’s services contributed to higher transaction volumes and revenue.

2021: $17,661 million

Square’s 2021 revenue of $17,661 million represents a robust year for the company. Key factors driving this revenue include:

- Cash App Growth: Cash App became increasingly popular, offering peer-to-peer payments, investing, and cryptocurrency trading;

- Merchant Services: Square continued to serve a wide range of businesses, including restaurants, retailers, and online stores;

- Strategic Acquisitions: Square acquired Afterpay, expanding its buy now, pay later offerings.

2020: $9,498 million

The year 2020 brought in $9,498 million in revenue for Square, reflecting the company’s resilience during a challenging period. Factors contributing to this revenue figure include:

- Digital Payments: The pandemic accelerated the shift towards contactless and digital payments, benefiting Square’s core services;

- E-commerce Solutions: Square’s tools for online selling and curbside pickup supported businesses during lockdowns;

- Cash App Adoption: Cash App’s user base continued to grow, providing a new revenue stream.

2019: $4,714 million

In 2019, Square reported revenue of $4,714 million, marking significant growth. Key drivers of this growth include:

- Merchant Expansion: Square continued to onboard new merchants, increasing transaction volumes;

- Cash App Launch: The introduction of Cash App boosted Square’s revenue diversification;

- International Expansion: Square expanded its services to international markets, broadening its customer base.

Quarterly Revenue (Most Recent)

Q2 2023: $5,535 million

Square’s revenue for Q2 2023 was $5,535 million, indicating continued growth. Factors contributing to this quarterly revenue include:

- Economic Recovery: As economies rebounded from the pandemic, businesses resumed operations, driving transaction volumes;

- Cash App Growth: Cash App’s services, including investing and cryptocurrency, attracted more users;

- Afterpay Acquisition: The acquisition of Afterpay promises to add significant revenue potential in the buy now, pay later space.

Q1 2023: $4,990 million

In Q1 2023, Square reported revenue of $4,990 million, reflecting consistent growth. Key factors impacting this quarter’s revenue include:

- Digital Payments: Square’s core payment processing services remained in demand, especially among small businesses;

- Cash App Engagement: Cash App users engaged with various financial services within the app;

- Strategic Partnerships: Square’s business partnerships contributed to transaction volumes.

Square Expenses

Annual Operating Income

2022: $-625 million

- In 2022, Square reported an annual operating loss of $-625 million. This loss can be attributed to various factors:

- Investment in Growth: Square may have significantly expanded its services and entered new markets, impacting its operating income;

- Acquisition Costs: The acquisition of Afterpay and other strategic moves may have incurred substantial expenses.

2021: $161 million

- In 2021, Square reported an annual operating income of $161 million, marking a positive result for the year. Factors contributing to this positive operating income include:

- Revenue Growth: Square’s revenue growth outpaced its operating expenses during this period;

- Efficiency Improvements: The company may have implemented cost-saving measures to improve its operating income.

2020: $-19 million

- The year 2020 brought an annual operating loss of $-19 million for Square. The following factors likely influenced this result:

- Pandemic Challenges: The COVID-19 pandemic may have impacted Square’s operations and led to increased expenses;

- Investment in Technology: Square continued to invest in technology and product development.

2019: $27 million

- In 2019, Square reported a modest annual operating income of $27 million. While positive, this figure indicates that the company’s profitability was relatively lower than in subsequent years.

Quarterly Operating Income (Most Recent)

Q2 2023: $-132 million

- Square reported a quarterly operating loss of $-132 million for Q2 2023. This loss may be attributed to ongoing investments, acquisitions, or changes in market dynamics.

Q1 2023: $-6 million

- In Q1 2023, Square reported a smaller operating loss of $-6 million. This may indicate that the company is actively managing its expenses and working towards profitability.

Annual EBITDA

2022: $-876 million

- In 2022, Square reported an annual EBITDA loss of $-876 million. This substantial loss suggests significant non-operating expenses or investments during the year.

2021: $327 million

- In 2021, Square achieved a positive annual EBITDA of $327 million, reflecting a strong operational performance during that period.

2020: $142 million

- The year 2020 saw an annual EBITDA of $142 million for Square. This figure indicates profitability, although it was lower compared to subsequent years.

Quarterly EBITDA (Most Recent)

Q2 2023: $48 million

- Square reported a positive EBITDA of $48 million for Q2 2023, indicating an improved financial position compared to previous quarters.

Q1 2023: $2 million

- In Q1 2023, Square reported a smaller positive EBITDA of $2 million, suggesting that the company is making efforts to control expenses and improve profitability.

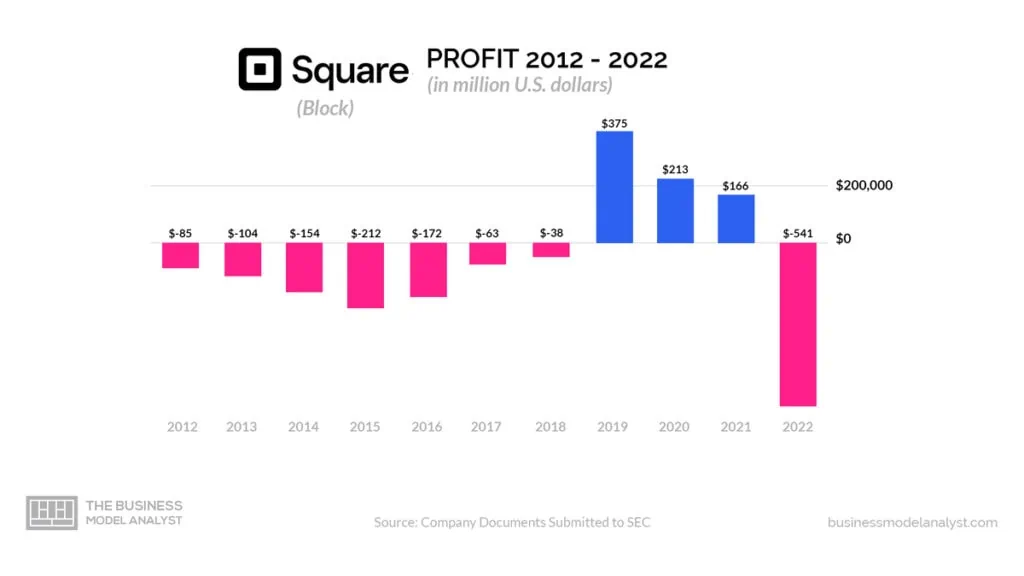

Square Profit

Annual Profit

In the fiscal year 2022, Square reported an annual net loss of $-541 million, marking a substantial decline from the prior year. Several factors contributed to this loss, including the company’s substantial investments in acquisitions, such as Afterpay, which likely impacted its financial performance.

Additionally, operating expenses and research and development costs may have risen as Square expanded its suite of services. The evolving competitive landscape and changing consumer preferences in the fintech sector also played a role in influencing profitability.

The year 2021, on the other hand, proved to be a profitable one for Square, with an annual net profit of $166 million. Key drivers of profitability in that period included the company’s strong revenue growth, fueled by its diverse financial services offerings. Moreover, Square may have implemented cost-saving measures to optimize its profit margins.

Quarterly Profit (Most Recent)

Looking at the most recent quarterly results for Q2 2023, Square reported a net loss of $-123 million. This loss indicates ongoing challenges or strategic investments that impacted profitability during the quarter. However, in Q1 2023, the company reported a smaller net loss of $-17 million, signifying efforts to manage expenses and suggesting a path towards improved profitability.

Square’s profit figures can fluctuate significantly from year to year and quarter to quarter due to various factors, including investments in acquisitions, research and development endeavors, market conditions, and the adoption of its financial services. While Square has demonstrated profitability in certain years, it has also reported losses in others, reflecting the dynamic nature of the fintech industry.

The company’s strategies to control expenses, diversify its revenue streams, and expand its user base remain pivotal in its quest for sustained profitability. Investors, industry observers, and Square itself will closely monitor its financial performance as it continues to navigate the evolving landscape of digital payments and financial services.

Potential for Profitability

Square’s journey in the fintech industry has been marked by significant growth, acquisitions, and evolving market dynamics. To understand its potential for profitability, we’ll explore key drivers, challenges, and strategies that Square can leverage.

- Diverse Revenue Streams: Square has successfully diversified its revenue streams beyond traditional payment processing. The introduction and growth of Cash App, Square Capital, and other financial services have expanded its customer base and income sources. This diversification provides resilience and revenue stability, which can contribute to sustained profitability;

- Acquisitions and Strategic Investments: Square’s strategic acquisitions, such as Afterpay, have the potential to unlock new revenue opportunities. By capitalizing on the buy now, pay later trend, Square can generate incremental income and expand its financial ecosystem. Proper integration and optimization of these acquisitions will be critical to profitability;

- Market Expansion: Square’s efforts to expand its presence internationally offer growth potential. As it taps into new markets and serves a broader range of businesses globally, it can drive increased transaction volumes and revenues, potentially leading to higher profits;

- Cost Management: Effective cost management and operational efficiency will be paramount in achieving profitability. Square must carefully balance its investments in innovation and growth with prudent expense control. Streamlining operations and optimizing resources can help enhance its bottom line;

- Cash App Monetization: The Cash App’s popularity presents an opportunity to monetize its user base further. By introducing new features, financial products, and services within the app, Square can generate additional revenue streams and leverage the platform’s massive user engagement;

- Market Trends and Competition: Staying attuned to market trends and effectively competing in the evolving fintech landscape will be crucial. Square must anticipate and respond to shifts in consumer behavior and technological advancements to remain competitive and profitable;

- Regulatory Environment: Fintech companies like Square operate within a complex regulatory landscape. Adhering to compliance requirements and navigating regulatory changes will be vital to avoid fines and disruptions that could impact profitability;

- Economic Conditions: Economic factors, such as inflation and interest rates, can affect Square’s profitability. A robust strategy for managing financial risks in changing economic conditions is essential for long-term success;

- Customer Trust and Loyalty: Maintaining the trust and loyalty of both merchants and consumers is pivotal. A positive reputation and strong relationships can foster customer retention and acquisition, contributing to sustained revenue and profitability;

- Innovation and Product Development: Continued innovation and the development of compelling products and services will be key to Square’s ability to attract and retain customers. Products that solve real financial challenges can drive growth and profitability.

Conclusion

Based on the provided financial data and analysis, Square has not been consistently profitable in recent years. The company has reported losses in various quarters and years, indicating that it has faced challenges in achieving sustained profitability.

While Square has made strategic investments, diversified its revenue streams, and expanded its services, it has also encountered significant expenses and market dynamics that have impacted its bottom line. Achieving and maintaining profitability in the competitive fintech industry remains a key challenge for Square.