Many of us fail to realize the importance of instant payment services to the modern consumer economy. Not only did these platforms change the way we shop, save and send money, but they also added convenience, speed, and flexibility to the banking sector. At the forefront of this evolution is Zelle. Let’s take a look at the Zelle business model and how this company set the stage for one of the most pivotal shifts in digital finance since the credit card.

Contents

A brief history of Zelle

Zelle is a U.S.-based digital payments service that allows registered users to transfer money between their bank accounts, as long as both of the banks are partnered with the service. However, many people don’t know that the company currently known as Zelle started off as a platform called clearXchange.

ClearXchange was a digital payment platform founded in 2011 and owned by Bank of America, JPMorgan Chase, and Wells Fargo. The platform supported payments between individuals (peer-to-peer or P2P), business-to-consumer (B2C) and government-to-consumer (G2C).

For the P2P services, all you needed to make a transfer was the receiver’s email or mobile number (which must be registered to an account under one of the participating banks). One of the features that made the platform stand out was its cheap services and how you did not require information like the receiver’s account number or routing number, though there were initial complaints over its speed and clunky design.

Other financial institutions such as banks and credit unions joined, further increasing their user base, but the service struggled to take off. All this changed when the platform was sold in 2016 to Early Warning Services, LLC, a fintech company owned by Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, and Wells Fargo.

Rather than rename the platform, Early Warning Services decided to launch a parallel platform for P2P accounts called Zelle in September 2017. It was announced that all P2P accounts operated on clearXchange would be shut down by the end of 2017, with the company prompting users to transfer their accounts to the Zelle platform, which operated quite similarly to the former clearXchange platform by associating user bank accounts with specific numbers or email addresses.

The platform contended initially with the digital payment service known as Venmo (which was a subsidiary of PayPal). Although Venmo was initially more well-known and had a larger user base, the close integration between Zelle and the banking sector allowed them to offer faster, cheaper and more streamlined payment services. This allowed Zelle to quickly outgrow its main competitor in terms of transfer volume, supporting over $75 billion in transfer volume in its first year alone.

It wasn’t long before Zelle outpaced them based on the number of registered users as well in 2017, continuing to widen this gap steadily over the years. Currently, the service has over 56 million active users in 2022 and has supported over $1.5 trillion worth of payments since its inception. The platform is partnered with over 1700 banks and credit unions all over the U.S. and continues to offer users an easy and quick way to send money.

Who Owns Zelle

Zelle is owned by Early Warning Services, LLC, a fintech company owned by Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, and Wells Fargo.

Zelle’s Mission Statement

Zelle aims to “connect financial institutions of all sizes, enabling consumers and businesses to send fast digital payments to people and businesses they know and trust with a bank account in the U.S. Funds are available directly in bank accounts, generally within minutes when the recipient is already enrolled with Zelle.”

How Zelle makes money

Now that we know a bit about it, let’s take a look at how Zelle makes money.

Zero Revenue from Transactions

Unlike what you would expect from a company which boasted of processing almost half a $1 trillion in 2021, the Zelle service does not make that much money. In fact, the platform officially does not make any money at all since it is completely free and does not charge the users or the banks which operate with it. This is one of the reasons that Zelle is so popular, as this allows them to keep their transaction costs much lower than other third-party digital payment systems, since the fees charged to the users are only what the banks levy.

So why does the platform still exist? Although no official explanation has been offered, many business analysts believe that Zelle exists as a way for banks to avoid the fees charged to them by third-party services such as Cash App (owned by Block Inc, formerly Square) and Venmo. Therefore, Zelle is a strategy used by banks to reduce their costs by avoiding the necessity of third-party digital payment services.

However, it is suspected that the participating banks pay the platform a base fee for maintenance. Though this has never been explicitly confirmed by the company itself.

Commission from Purchase Made Using Zelle Business Accounts

In 2018, Zelle introduced a new function called the Zelle business account. This type of account allows businesses to receive payments directly from their customers and charges the business a 1% processing fee for the service.

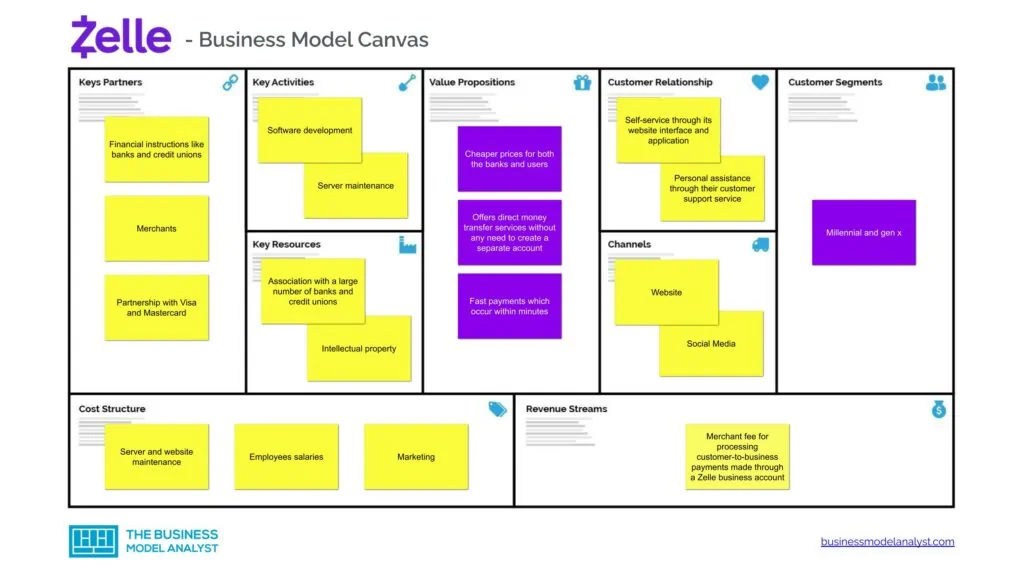

Zelle’s Business Model Canvas

The Zelle Business Model can be explained in the following business model canvas:

Zelle’s Customer Segments

Zelle customer segments consist of:

- Merchants;

- Financial institutions like banks and credit unions;

- People who bank with financial institutions partnered with the service.

Zelle’s Value Propositions

Zelle value propositions consist of:

- Offers cashless and paperless digital payments;

- Cheaper prices for both the banks and users;

- Fast payments which occur within minutes;

- Allows you to send money to friends and family using other banks;

- Facilitates quick payments for merchants.

Zelle’s Channels

Zelle channels consist of:

- Zelle app

- Website

- Social media

- Advertising

- Customer services

- App Store

- Google Play

Zelle’s Customer Relationships

Zelle customer relationships consist of:

- The platform offers its users self-service through its website interface and application;

- Zelle also offers personal assistance through their customer support service;

- Lastly, it offers a sense of community by facilitating quick payments between users and businesses through its platform.

Zelle’s Revenue Streams

Zelle revenue streams consist of:

- Merchant fee for processing customer-to-business payments made through a Zelle business account.

Zelle’s Key Resources

Zelle key resources consist of:

- Association with a large number of banks and credit unions

- Intellectual property

- Payment technology

- Website and mobile app

Zelle’s Key Activities

Zelle key activities consist of:

- Software development

- Research and Development

- Marketing and advertising

- Human resource management

- Customer services

- Server maintenance

Zelle’s Key Partners

Zelle key partners consist of:

- Financial instructions like banks and credit unions

- Merchants

- Partnership with Visa® and Mastercard®

Zelle’s Cost Structure

Zelle cost structure consists of:

- Server and website maintenance costs;

- Operating expenses, such as facility maintenance, employee wages, legal fees, IT costs, etc.;

- Marketing and advertising costs;

- Research and Development.

Zelle’s Competitors

- Cash App: Cash App is a mobile payment service that allows users to transfer funds to each other (for a fee) through a mobile app;

- Venmo: Venmo is also a mobile payment service, but it is owned by PayPal and is considered by some to be a more P2P-friendly form of the PayPal platform;

- Google Pay and Apple Pay: These are online payment services which are available for Android and iOS devices respectively;

- PayPal: PayPal is an American e-commerce platform which allows businesses and individuals to transfer money electronically;

- Stripe: Stripe is a company which supports a suite of APIs which provide online payment processing and e-commerce solutions and thereby supporting internet businesses of all sizes.

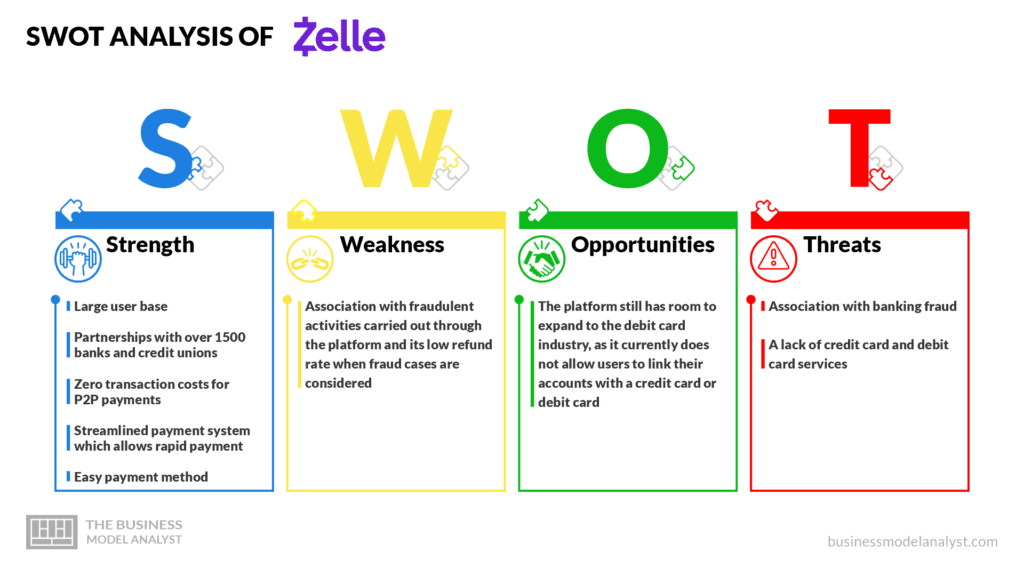

Zelle’s SWOT Analysis

Below, there is a detailed swot analysis of Zelle business model.

Zelle’s Strengths

- Large user base (over 56 million registered users);

- Partnerships with over 1500 banks and credit unions;

- Zero transaction costs for P2P payments;

- Streamlined payment system which allows rapid payment;

- Easy payment method, which requires just the receiver’s email or phone number.

Zelle’s Weaknesses

- Association with fraudulent activities carried out through the platform and its low refund rate when fraud cases are considered.

Zelle’s Opportunities

- The platform still has room to expand to the debit card industry, as it currently does not allow users to link their accounts with a credit card or debit card.

Zelle’s Threats

- Association with banking fraud;

- A lack of credit card and debit card services.

Conclusion

Zelle is more than just another digital payment service. About 100,000 Americans join the platform every single day, with the service boasting a 15% increase in users every quarter. It’s clear that Zelle will play a large part in the future of the digital payment ecosystem and will continue to shape the way we transfer money for many years to come.