The Revolut business model revolves around disrupting the traditional banking industry by providing users with a seamless and cost-effective way to manage their money.

Revolut is a revolutionary fintech company that offers a wide range of financial services through its mobile app. Unlike traditional banks, the company allows users to open an account within minutes, requiring no paperwork or credit checks. Users can then effortlessly send and receive money, exchange currencies at competitive rates, withdraw cash from ATMs worldwide, and make payments using their smartphone or Revolut card.

One of the key features of the Revolut business model is its focus on providing transparency and control to its users. Users can track their spending, set budgets, and receive real-time notifications through the app, empowering them to make informed financial decisions. Revolut also offers a wide range of services, such as cryptocurrency trading, stock trading, and peer-to-peer payments, expanding its value proposition even further.

With its user-friendly interface, extensive features, and competitive pricing, Revolut has quickly gained popularity among individuals, small businesses, and even larger corporations. Its user base has multiplied, reaching over 35 million customers worldwide.

Contents

A brief history of Revolut

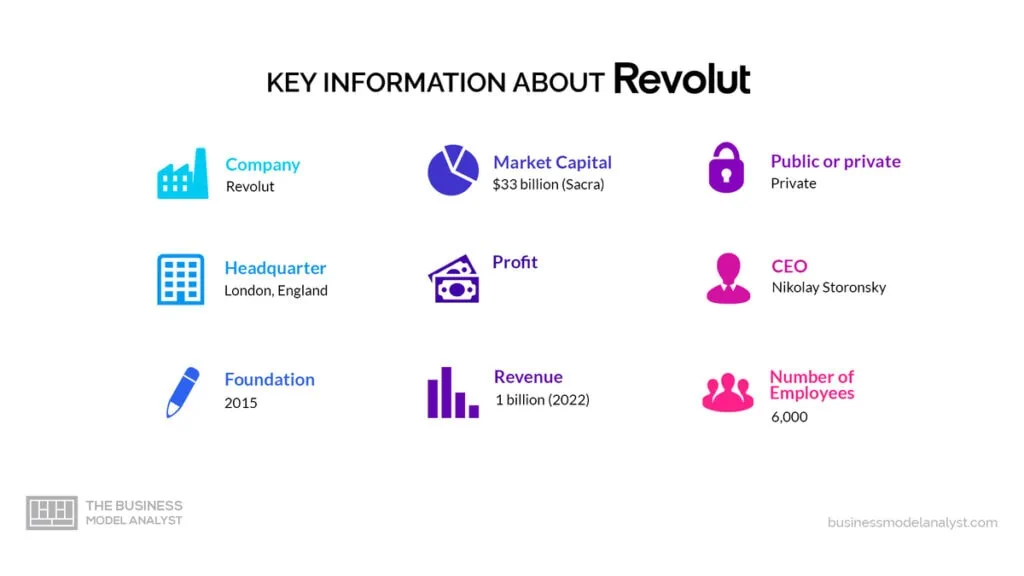

Revolut was founded in 2015 by Nikolay Storonsky, a former investment banker, and Vlad Yatsenko, a software developer, who identified a need for a more efficient and affordable way to manage finances while traveling. The initial idea for Revolut came when Storonsky was charged exorbitant fees for using his traditional bank card while abroad.

Storonsky and Yatsenko believed that traditional banks were not adequately serving their customers’ needs regarding international transactions, currency exchange, and fees. They recognized the potential for leveraging technology to disrupt the financial industry and provide a better user experience.

Storonsky and Yatsenko assembled a team of developers and designers to bring their vision to life. They set out to create a mobile app enabling users to hold and exchange money in different currencies at the interbank exchange rate, without any hidden fees. This concept became the foundation of Revolut’s business model.

In July 2015, Revolut launched its beta app, offering a range of features to customers, including the ability to make international money transfers, exchange currencies, and spend money abroad with a multi-currency card. The app quickly gained traction and attracted many users looking for a more convenient and cost-effective way to manage their finances.

As Revolut gained popularity, the company expanded its offerings to include additional services such as cryptocurrency trading, investment products, and a subscription-based premium account with enhanced features. Revolut could cater to a broader customer base and establish itself as a comprehensive financial platform.

With its innovative business model and user-friendly app, Revolut experienced rapid growth, attracting millions of customers globally. The company raised significant funding from venture capital firms, enabling it to expand its operations, enter new markets, and develop new features.

Today, Revolut continues to evolve its business model, focusing on enhancing its suite of financial services and expanding into new territories. The company’s commitment to transparency, low fees, and convenience has made it a formidable player in the fintech industry, challenging traditional banks and redefining how people manage their money.

Who Owns Revolut

Revolut remains privately owned with a unique ownership structure. The co-founder and CEO, Nik Storonsky, holds a substantial stake in the company, amounting to 20% of its ownership. As one of the founders, Storonsky has played a pivotal role in shaping Revolut’s business model and guiding its growth.

Apart from Storonsky’s stake, the largest portion of Revolut’s share ownership is in the hands of corporate investors, who collectively own approximately 75% of the firm’s stock.

In addition to institutional ownership, Revolut also has private shareholders who hold a portion of the company’s equity. These private shareholders contributed to Revolut’s early stages of development and have remained invested in its success. Moreover, former Revolut employees also have a stake in the company’s ownership.

Revolut Mission Statement

Revolut’s mission statement is “to simplify all things money.”

How Revolut works

Revolut’s business model revolves around its mobile app, which serves as a one-stop solution for all financial needs. Customers need to download the app and create an account to get started. Once registered, they have access to a variety of features and services designed to meet their financial needs.

Revolut offers banking services that include a current account, as well as the ability to send and receive money globally in multiple currencies. The app provides customers with real-time notifications and insights into their spending habits, helping them to better manage their finances.

In addition to banking services, Revolut offers a range of investment options. Customers can buy, sell, and hold stocks, exchange-traded funds (ETFs), and cryptocurrencies directly from the app. Revolut provides personalized recommendations and tools to help customers make informed investment decisions.

The app also offers users the option to obtain various types of insurance coverage, including travel, mobile phone, and medical insurance. Customers can easily compare insurance options and make the best choice for their needs, all within the app.

One of the key features of Revolut is its ability to provide customers with competitive currency exchange rates. The app allows users to exchange currencies at an interbank exchange rate without hidden fees or commissions. This feature is particularly useful for travelers or individuals who frequently transfer international money.

Revolut employs advanced security measures, including two-factor authentication, biometric authentication, and transaction monitoring to ensure the security and protection of customers’ funds. The app also allows customers to block and unblock their physical or virtual cards instantly, providing an additional layer of security and control.

Revolut’s unique business model has been instrumental in its rapid growth and success. By leveraging technology, data, and innovative financial solutions, Revolut has provided a seamless and personalized experience for its customers.

How Revolut makes money

Revolut operates a diversified business model with multiple revenue streams contributing to its overall financial success. The company has strategically designed its business model to cater to the evolving needs of its customers while generating substantial revenue.

Cards and interchange revenue

One of Revolut’s primary revenue streams comes from cards and interchange revenue. Customers who use their Revolut debit cards for purchases earn revenue through interchange fees. Merchants pay these fees to Revolut for processing the transactions. With a large and growing user base, Revolut benefits from a high volume of transactions, resulting in significant revenue from cards and interchange.

Subscription fees

Revolut offers paid plans, known as premium or metal plans, that provide customers with access to additional benefits and features. These subscription fees contribute to the company’s revenue and help to enhance its customer experience.

Premium and metal plan members enjoy perks such as higher withdrawal limits, exclusive card designs, travel insurance, and cashback on purchases. By offering premium services, Revolut generates recurring revenue and strengthens customer loyalty.

Forex revenue

Revolut’s innovative foreign exchange (forex) approach has positioned it as a leading player in the market. The company offers competitive exchange rates and low fees for foreign currency transactions.

Revolut charges a markup or fee on exchange rates, allowing it to generate substantial revenue from forex transactions. With its global presence and popularity among travelers and international business users, Revolut benefits from a high volume of forex transactions, further bolstering its revenue.

Wealth products

Revolut has expanded its services beyond traditional banking and now offers various wealth products. This includes investing in cryptocurrencies, trading commodities, and engaging in savings products. Revolut generates revenue by charging fees on these wealth products.

Cryptocurrency trading has gained significant traction, with Revolut providing a user-friendly platform for buying, selling, and holding cryptocurrencies. This has contributed to an additional revenue stream for the company.

By diversifying its revenue streams across cards and interchange, subscription fees, forex, and wealth products, Revolut has created a resilient and sustainable business model. This approach ensures a consistent flow of revenue and allows the company to cater to the evolving needs and demands of its diverse customer base.

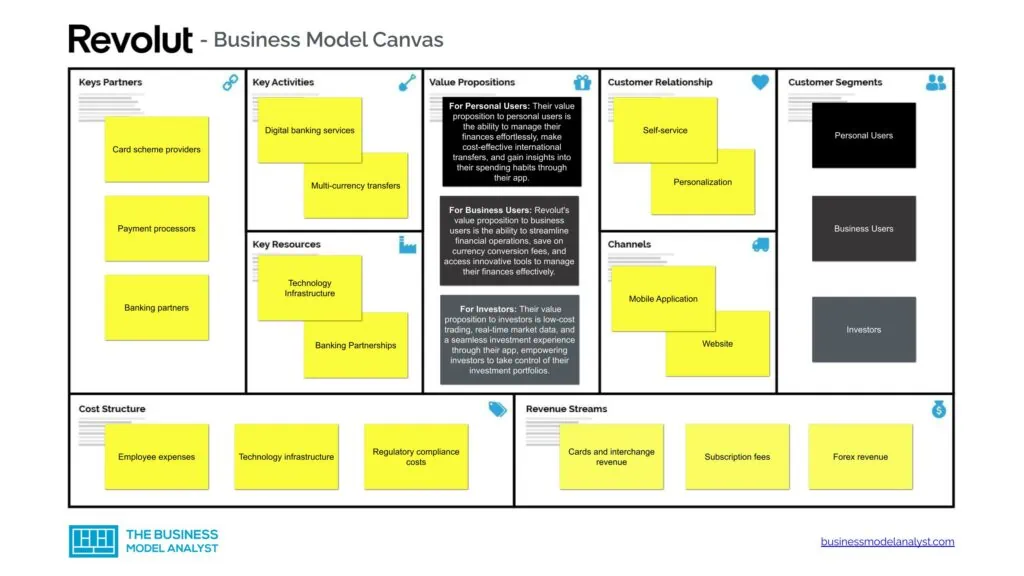

Revolut Business Model Canvas

The Revolut Business Model can be explained in the following business model canvas:

Revolut Customer Segments

Revolut’s customer segment comprises a diverse range of individuals and businesses who take advantage of its innovative financial services. The following are the key customer segments for Revolut:

- Personal Users: Personal users form a significant part of Revolut’s customer segment. These individuals sign up for Revolut’s services to manage their personal finances, make international money transfers, and access various banking features. Personal users include people from all walks of life, ranging from tech-savvy millennials to older individuals seeking a modern banking experience;

- Business Users: Revolut also caters to business users, including small and medium-sized enterprises (SMEs), startups, and freelancers. These users benefit from Revolut’s business accounts, which offer features such as expense management, multi-currency transfers, and simplified business payments. By providing an efficient and cost-effective banking solution, Revolut supports the financial needs of businesses of all sizes;

- Investors: Revolut’s customer segment also includes investors who use its platform for investment purposes. Revolut allows users to trade stocks, exchange-traded funds (ETFs), cryptocurrencies, and other investment instruments through its investment services. The app lets Investors easily manage their investments, monitor market trends, and access real-time pricing information;

- Travelers: Revolut has gained popularity among frequent travelers due to its convenient foreign exchange services. Users can exchange currencies at interbank rates, hold multiple currencies in their accounts, and make card payments abroad without incurring exorbitant fees. This customer segment includes both leisure travelers and business travelers who appreciate the flexibility and cost savings offered by Revolut;

- Online Shoppers: Revolut’s customer segment also includes online shoppers relying on digital platforms for purchases. With its virtual cards and enhanced security features, Revolut provides a safe and seamless payment solution for e-commerce transactions. Online shoppers can benefit from features such as instant card virtualization, disposable virtual cards, and spending insights to manage their online spending;

- Remittance Users: Revolut attracts a customer segment consisting of individuals who need to send money internationally. Revolut provides a competitive alternative to traditional remittance services by offering low-cost international transfers and real-time exchange rates. This customer segment includes expatriates, international students, and individuals supporting families in different countries;

- Businesses and Merchants: Revolut’s business customer segment extends beyond the business users mentioned earlier, encompassing merchants and enterprises. With its business accounts and payment solutions, Revolut caters to the needs of merchants who seek simplified payment processing, online invoicing, and customizable payment solutions. Additionally, Revolut offers integration options and APIs for businesses to connect their financial systems to the platform seamlessly.

By catering to these diverse customer segments, Revolut has positioned itself as a comprehensive financial services provider, leveraging technology and innovation to meet the evolving needs of individuals, businesses, and investors.

Revolut Value Propositions

Revolut’s value propositions to its customer segments include the following.

- For Personal Users: Their value proposition to personal users is the ability to manage their finances effortlessly, make cost-effective international transfers, and gain insights into their spending habits through their app;

- For Business Users: Revolut’s value proposition to business users is the ability to streamline financial operations, save on currency conversion fees, and access innovative tools to manage their finances effectively;

- For Investors: Their value proposition to investors is low-cost trading, real-time market data, and a seamless investment experience through their app, empowering investors to take control of their investment portfolios;

- For Travelers: Revolut’s value proposition to travelers lies in their foreign exchange services. They offer interbank exchange rates, the ability to hold multiple currencies in one account, and no hidden fees for card usage abroad. Travelers can benefit from convenient and secure spending, as well as easy access to their money anywhere in the world;

- For Online Shoppers: Their value proposition to online shoppers includes instant card virtualization, disposable virtual cards, and spending insights to help manage online spending effectively;

- For Remittance Users: Revolut’s value proposition to remittance users is competitive rates and real-time exchange rates for international money transfers. They aim to provide a cost-effective alternative to traditional remittance services, enabling users to send money internationally efficiently and conveniently;

- For Businesses and Merchants: Revolut’s value proposition to businesses and merchants revolves around simplified payment solutions. They offer merchant accounts, payment processing, invoicing, and customizable payment solutions to streamline financial operations. Their value proposition lies in providing businesses with a seamless and efficient payment experience, ultimately helping them grow and succeed.

Revolut Channels

Revolut’s channels consist of:

- Mobile Application: A mobile application is the primary channel through which Revolut interacts with its customers. The app is available on both iOS and Android platforms, enabling users to perform various financial transactions, access account information, and manage their finances on the go;

- Website: Revolut also has a website that provides information about the company, and its services, and allows potential customers to sign up and download the mobile app;

- Customer Support: Revolut offers customer support through various channels, including in-app chat, email, and phone support, ensuring that customers can reach out for assistance whenever needed;

- Affiliate Partnerships: Revolut collaborates with other businesses, such as travel companies or e-commerce platforms, to offer exclusive promotions or discounts to its customers through affiliate partnerships.

Revolut Customer Relationships

Revolut’s customer relationships consist of:

- Self-service: Revolut focuses on enabling customers to manage their finances independently through its mobile app and website. Users have control over their accounts, including making payments, exchanging currencies, and managing budgets;

- Personalization: Revolut aims to provide a personalized experience to its customers by offering tailored financial services, such as savings and investment features, based on individual preferences and usage patterns;

- Customer Support: Revolut offers support when needed through the in-app chat, email, and phone, ensuring that customers receive timely assistance.

Revolut Revenue Streams

Revolut’s revenue streams consist of:

- Cards and interchange revenue

- Subscription fees

- Forex revenue

- Wealth products

Revolut Key Resources

Revolut’s key resources consist of:

- Technology Infrastructure: Revolut heavily relies on its technology infrastructure, including its mobile app, cloud-based systems, and backend processes, to provide seamless financial services to its customers;

- Banking Partnerships: Revolut collaborates with various banking partners to ensure that customer funds are securely held in licensed and regulated financial institutions;

- Regulatory Compliance: Revolut invests in maintaining compliance with financial regulations to ensure the legal and secure operation of its services;

- Talent and Expertise: Revolut’s team of professionals in finance, technology, and customer support forms a valuable resource in delivering high-quality and innovative financial solutions;

- Brand and Reputation: Revolut’s strong brand image and reputation contribute to its ability to attract and retain customers, as well as forge partnerships with other financial institutions;

- Intellectual Property and Branding: Revolut’s intellectual property, including its technology patents and trademarks, as well as its brand elements, contribute to its competitive advantage and recognition in the market.

Revolut Key Activities

Revolut’s key activities consist of:

- Digital banking services

- Multi-currency transfers

- Foreign currency exchange

- Cryptocurrency trading

- Account management

- Card and payment services

- Insurance offerings

- Money management tools

Revolut Key Partners

Revolut’s key partners consist of:

- Card scheme providers

- Payment processors

- Banking partners

- Insurance providers

- Fintech integration partners

Revolut Cost Structure

Revolut’s cost structure consists of:

- Employee expenses

- Technology infrastructure

- Regulatory compliance costs

- Marketing expenses

- Customer support costs

- Transaction processing fees

- Insurance premiums

Revolut Competitors

Revolut operates in a highly competitive landscape, with several competitors challenging its position in the market. Here are a few of Revolut’s key competitors:

- Monzo: Monzo is a UK-based digital bank that offers features similar to Revolut, including budgeting tools, international money transfers, and fee-free spending abroad. Monzo has a strong user base and has gained popularity for its user-friendly interface;

- N26: N26 is a German mobile bank that provides services similar to Revolut, including a digital wallet, multi-currency accounts, and overseas spending. N26 has a significant presence in Europe and has expanded its operations to the U.S.;

- Wise (formerly known as TransferWise): Wise is a UK-based fintech company that specializes in international money transfers and multi-currency accounts. While Revolut offers similar services, Wise has a strong reputation for its transparent and low-cost exchange rates, particularly for larger international transfers;

- PayPal: Although it is known for its online payment system, PayPal has entered the digital banking space with offerings that directly compete with Revolut. It provides services like debit cards, money transfers, and currency conversion, making it a formidable competitor in the fintech industry;

- Traditional Banks: Revolut’s competitors also include traditional banks that have started to offer digital banking services. These banks leverage their well-established brand reputation, extensive customer base, and existing infrastructure to compete with Revolut in terms of financial services and international transactions;

- Paysera: Paysera is a Lithuanian-based fintech company that offers a range of financial services, including online payments, currency exchange, and financial management tools. Paysera competes with Revolut by providing competitive fees for international money transfers and convenient money management solutions;

- Chime: Chime is a U.S.-based digital banking platform that offers a combination of traditional banking services, including spending accounts, savings accounts, and fee-free overdraft protection. It directly competes with Revolut in terms of providing a user-friendly banking experience and innovative features;

- Starling Bank: Starling Bank is a UK-based digital bank that operates exclusively through its mobile app. It offers services like current accounts, debit cards, and money management tools, catering to individuals and businesses alike. Starling Bank is a strong competitor to Revolut, especially in the UK market;

- Ally Bank: Ally Bank is a U.S.-based online banking institution that provides services such as checking accounts, savings accounts, and investment options. While it may not offer the same range of international services as Revolut, Ally Bank competes by providing competitive interest rates and a seamless digital experience.

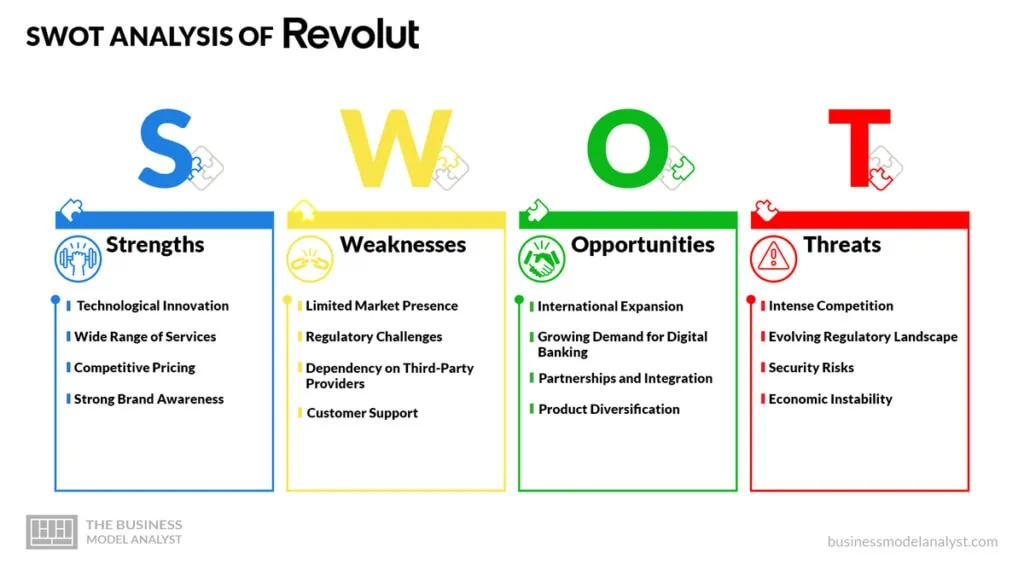

Revolut SWOT Analysis

In order to gain a deeper understanding of Revolut’s position in the market, it is essential to conduct a comprehensive SWOT analysis, which examines the company’s strengths, weaknesses, opportunities, and threats.

Revolut Strengths

- Technological Innovation: Revolut’s strength lies in its cutting-edge technology and digital platform, allowing users to manage their finances seamlessly;

- Wide Range of Services: Revolut offers a comprehensive suite of financial services, including money transfers, currency exchange, stock trading, and cryptocurrency transactions, attracting a diverse customer base;

- Competitive Pricing: With low fees, favorable exchange rates, and free basic services, Revolut is highly competitive in the market, providing cost-effective solutions to its users;

- Strong Brand Awareness: Revolut has rapidly gained recognition and built a strong brand reputation in the industry, particularly among tech-savvy millennials and digital nomads.

Revolut Weaknesses

- Limited Market Presence: Although Revolut has expanded to multiple countries, its market penetration is still relatively low compared to traditional banks. It needs to enhance its presence in more regions to reach a wider customer base;

- Regulatory Challenges: Revolut has faced regulatory scrutiny and challenges in various markets. Complying with complex financial regulations and obtaining the necessary licenses may restrict the pace of its expansion;

- Dependency on Third-Party Providers: Revolut relies on various third-party providers for some of its services, such as card processing, which poses a vulnerability if any of these providers face operational issues or disruption;

- Customer Support: Some customers have reported issues with Revolut’s customer support, including delayed responses to queries and difficulties resolving. Improving customer support should be a priority for Revolut.

Revolut Opportunities

- International Expansion: Revolut has the opportunity to expand its services into more countries, particularly emerging markets, where traditional banking services may be less accessible. This would allow the company to tap into a larger global customer base;

- Growing Demand for Digital Banking: As consumers increasingly adopt digital banking services, Revolut has the opportunity to capitalize on this trend and acquire more customers who are seeking convenient and efficient financial solutions;

- Partnerships and Integration: Collaborating with other fintech companies or established financial institutions can provide Revolut with opportunities to offer new services and reach a broader audience;

- Product Diversification: By expanding its product range and introducing new services, such as wealth management or consumer lending, Revolut can attract additional revenue streams and increase customer engagement.

Revolut Threats

- Intense Competition: Revolut operates in a highly competitive fintech landscape, facing competition from both traditional banks and other digital banks. New entrants expanding into the same markets can pose a threat to Revolut’s market share;

- Evolving Regulatory Landscape: Constant changes in financial regulations can pose threats to Revolut’s business model. Compliance with evolving regulations requires ongoing investment and adaptability;

- Security Risks: As a digital platform handling sensitive financial information, Revolut is vulnerable to cyber-attacks and data breaches. The increased frequency and sophistication of cyber threats pose significant risks to customer trust and reputation;

- Economic Instability: Economic downturns or financial crises may impact customer behavior, reducing spending and investment activities. Revolut’s revenue streams and growth could be affected by the overall economic conditions.

Conclusion

Revolut’s business model is revolutionizing the way people manage their finances. Their innovative approach combining digital banking with a wide range of financial services has positioned them as a disruptive force in the industry.

By offering a seamless user experience, low fees, and a multitude of features, Revolut has quickly gained a significant customer base and achieved impressive growth. Their reliance on technology, constant product development, and strategic partnerships have been vital in retaining and attracting new customers. However, challenges and regulatory concerns remain as they expand globally.

All in all, Revolut’s business model is a powerful combination of technology, customer-centricity, and a disruptive vision that is reshaping the financial landscape for the better.