The PayPal business model is a fintech, and also a classic two-sided platform. On one side, there are merchants, the businesses that use PayPal services in order to make financial transactions, with security and trust. On the other side, there are the consumers, the users, mostly individuals, who will make payments through the platform, inside the merchants’ websites. If you think back some decades, sending money overseas was a big problem, and PayPal offered a revolutionary solution, by allowing the transactions to be done in a much simpler and cheaper way than banks and other financial companies. Nowadays, PayPal reaches over 200 countries and has more than 300 million users all over the world. Let’s understand how PayPal’s business model has grown so much over the past years.

Contents

A brief history of PayPal

PayPal was founded in 1998 and launched one year later, as a money transfer system of Confinity. Back then, Confinity had a strong competitor, X.com, founded by Elon Musk. Instead of fighting for the market, both merged, grew, and took over the industry. The great advantage of PayPal’s business model was using the dollar as an exchange currency and e-mail as a transfer medium. Any customer could just open an account online, and either deposit money or link it to a bank or credit card account. Within only eight months, the company grew from 12,000 to 2.7 million accounts. And in the summer of 2001, it exploded to nine million users and over 120,000 transactions every day. With these high figures, PayPal went public in 2002 and was acquired by eBay not much longer later.

The reasons for the purchase have never been completely explained by eBay, but it is known that 60% of PayPal’s transactions were from eBay auctions. Plus, most PayPal users were coming from eBay, who were already used to the payment platform. Currently, PayPal has become the most powerful financial tool in the world, leading online payment solutions.

PayPal’s Solutions

- Digital wallet: You can save and access details of your debit and credit cards through your PayPal account, being able to shop and transfer money simply via PayPal ID and password;

- One-Touch: PayPal technology allows you to save login details on your personal device, so you can check out websites without even typing your username and password;

- Money transfer: You are able to transfer money to more than 200 countries and over 100 currencies, both to and from a bank account or a PayPal account;

- Payment gateway: With a business account, you can sell online and offline and receive payments via PayPal;

- Debit card: A PayPal debit card works just like any other bank, so it can be used to shop (online or offline), withdraw money, and earn rewards over your purchases;

- Credit: You are able to get a no-interest credit of $99 — or even more, if the payment is entirely finished within six months.

- Capital loan: A daily payable loan with a lower fee than banks.

Who Owns PayPal

PayPal Holdings, Inc. has many divisions (PayPal Inc., PayPal Pte. Ltd, PayPal Payments Pte. Holdings, PayPal Payments Pte Limited) and subsidiaries (Braintree, Paydiant, Honey, Venmo, PayPal Credit, Xoom Corporation, Zettle, Tradera) and has John Donahoe as the company’s current Chairman, with Dan Schulman as its current President and CEO.

PayPal’s Mission Statement

PayPal’s mission statement is “To democratize financial services to ensure that everyone, regardless of background or economic standing, has access to affordable, convenient and secure products and services to take control of their financial lives“.

How PayPal makes money

Transaction fees

Regarding individuals, PayPal charges a fee that changes according to the country, each time you send and receive money online. This fee is calculated on the amount sent using a debit or credit card, or PayPal credit. As to business accounts, merchants who use PayPal to sell online pay a fee of 2.9% on the amount they receive for sale, plus US$ 0.30 per transaction. However, bigger amounts have their fees reduced.

International payments

When receiving payments from different countries, PayPal charges fees that include currency conversation costs besides the international payment fee-fees also vary according to the currency.

Business accounts

The Payment Pro-business accounts have some special resources and services, at a cost of $30 per month.

Withdrawal fees

You can receive money through a custom link, but PayPal will charge you when you withdraw the amount. In the USA, the fee is 2.9% of the total received, plus $0.30. Also, the company charges a fee for each time you withdraw money with your debit card.

Interests

The money kept in PayPal is deposited in liquid investments, that provide interests as revenue.

Payflow

Payflow is the gateway the merchant accounts can integrate into their websites. There is a free plan, by which the customer enters the payment details on a page hosted by PayPal, and there is a premium option, at a cost of $25 per month, by which the user may design their checkout page. Moreover, PayPal charges a fee of $0.10 for credit card payments and offers other optional features, such as fraud protection, recurring billing, and buyer authentication.

Working capital

You can borrow up to 15% of the last 12 months of sales (up to $85,000). There are no interests and the fee is fixed, and the payments are made as a percentage of PayPal sales. The larger the percentage allocated, the lower the fee.

Business in a box

PayPal offers some solutions in association with Xero and Woo Commerce, and the company earns an affiliate commission on that.

Credit Interest

If you use a credit of $99 or more, paid fully within 6 months, you don’t pay for it. But, for any other conditions, the annual percentage rate is 19.99%, counting from the posting date.

PayPal Here

It is an offline mobile application and card reader, that allows you to receive payments from any kind of card.

Other companies

PayPal owns other companies, such as Braintree, Xoom, and Venmo, that add value and revenue sources to the company.

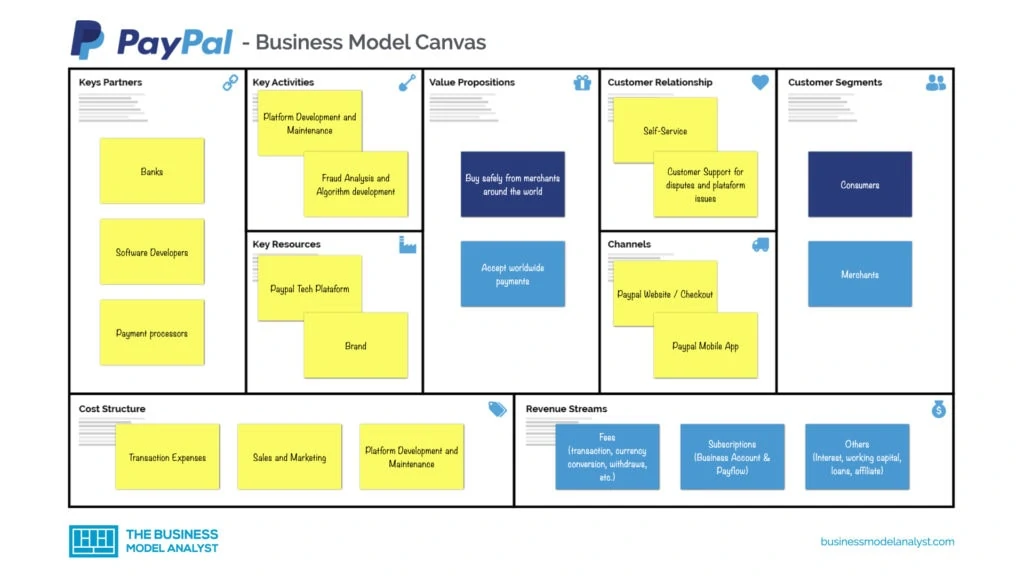

PayPal’s Business Model Canvas

Let’s take a look below at the PayPal Business Model designed in the business model canvas:

Now, let’s take a look at the elements of the PayPal Business Model:

PayPal’s Customer Segments

As PayPal is a two-sided platform, there are two customer segments, consumers and merchants. Consumers are the individuals who shop, send and receive money. Merchants are the businesses that accept payments, both online and offline.

PayPal’s Value Propositions

PayPal’s value propositions are:

- Convenience

- Security

- A trustful brand

- Global scale

PayPal’s Channels

The main channel is PayPal’s website, where the customer has most of the transactions. Moreover, there are the PayPal mobile app, as well as Venmo and Xoom, two mobile payment subsidiaries.

PayPal’s Customer Relationships

Regarding customer relationships, PayPal is basically self-service, without interaction with the company’s team. Anyway, there are more than 8,000 employees in customer service. Besides, the company offers its Buyer and Sellers Protection Programs, in order to ensure satisfaction and confidence on both sides.

PayPal’s Revenue Streams

The revenue streams are mainly transaction fees, but there’s much more than this. They are better described in the next item, about the sources of income of PayPal.

PayPal’s Key Resources

PayPal’s key resources include:

- Its global technology platform

- Bank financing

- Human resources

PayPal’s Key Activities

PayPal’s key activities can be described as the three parties that mainly require platform management: consumers, merchants, and banks — both for its website and mobile app.

PayPal’s Key Partners

PayPal’s key partners include:

- Banks

- Payment processors

- Software developers

PayPal’s Cost Structure

When it comes to cost structure, PayPal has a cost-driven structure, and its biggest cost is the transaction expenses. Moreover, there are customer support, sales and marketing, product development, operations, and general expenses.

PayPal’s Competitors

- Google Pay: Formerly known as Google Wallet, Google Pay is a payment system that allows users with to use their Android smartphones with NFC technology to pay wirelessly with it, as long as the debit/credit card is properly registered in it. Besides that, it offers to request and send money through the app, which makes it a top competitor to PayPal;

- Apple Pay: Working through the app Wallet, Apple Pay allows users to pay with their iPhones, as long as the debit/credit card is properly registered in it. Furthermore, it also works with the iPad, the Apple Watch, and the recently launched models of Apple’s computers;

- WePay: Backed by JPMorgan Chase, WePay was founded in 2008 and is based in Boston, Massachusetts. It provides financial services to business platforms, making money through charging service fees when processing funds;

- 2Checkout: Founded in 2000, 2Checkout is the top competitor for electronic payment service, as it is an all-in-one monetization platform that allows its business clients to quickly expand internationally;

- Authorize.Net: Founded even before 2Checkout, Authorize.Net was launched in 1996 in California and is now a subsidiary of Visa. It is considered the top competitor as it has the most customers in the market for payment services. Focused on small and medium-sized merchants, it also provides API and software development kits for Android and iOS systems;

- Stripe: Dual-headquartered in San Francisco, California, and in Dublin, Ireland, Stripe is another top competitor, as it offers financial services and software as a service (SaaS) to its business clients globally.

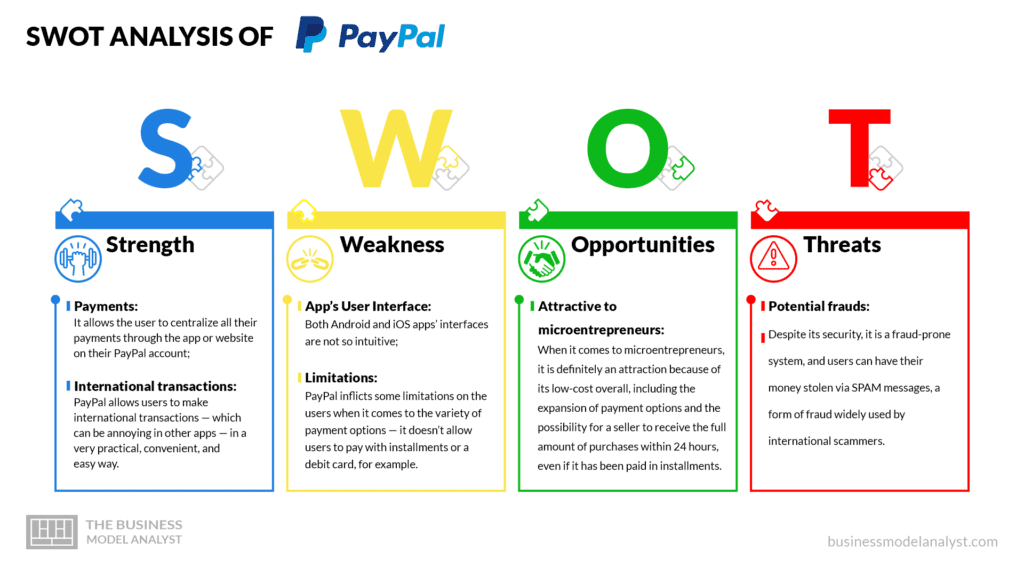

PayPal’s SWOT Analysis

Below, there is a detailed swot analysis of PayPal:

PayPal’s Strengths

- Payments: It allows the user to centralize all their payments through the app or website on their PayPal account;

- International transactions: PayPal allows users to make international transactions — which can be annoying in other apps — in a very practical, convenient, and easy way.

PayPal’s Weaknesses

- App’s User Interface: Both Android and iOS apps’ interfaces are not so intuitive;

- Limitations: PayPal inflicts some limitations on the users when it comes to the variety of payment options — it doesn’t allow users to pay with installments or a debit card, for example.

PayPal’s Opportunities

- Attractive to microentrepreneurs: When it comes to microentrepreneurs, it is definitely an attraction because of its low-cost overall, including the expansion of payment options and the possibility for a seller to receive the full amount of purchases within 24 hours, even if it has been paid in installments.

PayPal’s Threats

- Potential frauds: Despite its security, it is a fraud-prone system, and users can have their money stolen via SPAM messages, a form of fraud widely used by international scammers.

Conclusion

To sum up, as mentioned, PayPal is, still up today, one of the most powerful and efficient financial tools in the online payment solutions market. Its financial services cover worldwide business and clients, providing international transitions that concern different currencies — all of that within its website or mobile app.