The MoviePass business model is a subscription-based all-you-can-eat service for movies. The original idea was that the users would watch as many movies as they wanted, at any movie theater in America, just by paying a monthly fee. However, MoviePass’ business model was a struggle since its foundation, back in 2011, and did not survive for long. The company’s last years were a complete mess, that ended at the beginning of 2020, when it shut down permanently, completely liquidated in bankruptcy.

Contents

How MoviePass Used to Work

As said before, MoviePass was founded in 2011, by Stacy Spikes, who became the company’s CEO. His purpose was to modernize the movie industry, by changing spectators’ experience, through a subscription business model that would attract crowds to American theaters. The initial business model was quite simple: The subscribers would pay monthly fees between $29 and $34, according to their locations, to be entitled to watch a movie (2D) per day of the current month. Before its bankruptcy, the subscription plans were divided into three options, and their prices depended on the subscriber’s city:

- $10 to $15: selected movies at specific times;

- $15 to $20: any 2D movie, anytime;

- $20 to $25: unlimited access and some IMAX, 3D, and similar option included.

When the user subscribed, they would receive a MasterCard, linked to their account and operated via smartphone. When the subscriber was 45 meters away from a movie theater, they could check the sessions available on their cell phone application, load the ticket price on their card and buy it at the ticket office as if using any debit or credit card. Nevertheless, if the idea seemed promising, its history didn’t prove to be.

A brief history of MoviePass

The subscription service trial was released in San Francisco city and quickly reached 20,000 users. However, MoviePass hadn’t worked out all the details with the major movie theater chains until the time of launch. For this reason, movie theaters rejected MoviePass’s users, causing significant discomfort right away.

The next year, 2012, a new version of the service was launched, but it kept being ignored by major American movie theater networks, such as AMC. But this rejection didn’t last more than two years. In 2014, due to the drop in the number of regular customers, the networks had to throw in the towel, and embrace MoviePass subscribers as their new audience.

In 2017, a new problem came up. MoviePass altered its subscription business model, aiming at the exponential increase of the audience: The monthly fees fell from $29 to $50 dollars (current price at the time) to only $9.95 as a single plan option. The service experienced a growth of one million users in just four months.

However, then, MoviePass lost AMC, again. According to the chain, the new price was unsustainable. In addition, in the year following the price change, the platform began to fail, the sending of cards was delayed, the quality of the service left something to be desired, and the service changed too often.

While in a month users would be able to watch a movie per day, in the next one, MoviePass would decide that would change to up to only three within the current 30 days. Clients started to leave the subscription service and Helios & Matheson, its parent company back in 2017, recorded losses of millions of dollars.

In 2018, MoviePass tried to pivot its business model for content production and witnessed yet another failure in its attempts. And to top it all, MoviePass had to face the entry of major competitors into the market, watching networks such as AMC and Regal launch their own subscription services.

The result: In July 2019, with only 225,000 active users — nothing compared to the former three million — MoviePass reported an indefinite suspension. And two quarters later, it shut down permanently.

Who Owned MoviePass

MoviePass was owned by Helios & Matheson through an acquisition.

MoviePass’ Mission Statement

MoviePass’ mission statement was “To support independent filmmakers and distributors by collaborating with creatives, co-acquiring equity stakes in films, and offering them enhanced performance in the theatrical window“.

How MoviePass used to (try to) make money

The idea of MoviePass was to profit from several revenue streams: subscription fees, advertising, user data, and sales by distributors. When Helios & Matheson acquired the company, the focus was on data, which was already their product. That’s why MoviePass opted for that inexplicable reduction in plans’ price to $9.95: The greater the volume of users, the greater the volume of data for commercialization.

This strong client base would also allow for better agreements with the major chains, increasing the income from concessions, in addition to the possibility of creating their own content — their own studio — which would also share space in the movie theaters of the major players. But, truth be told, MoviePass actually didn’t find out how to make money! And, when the new big entrants came into the market, that was the last straw.

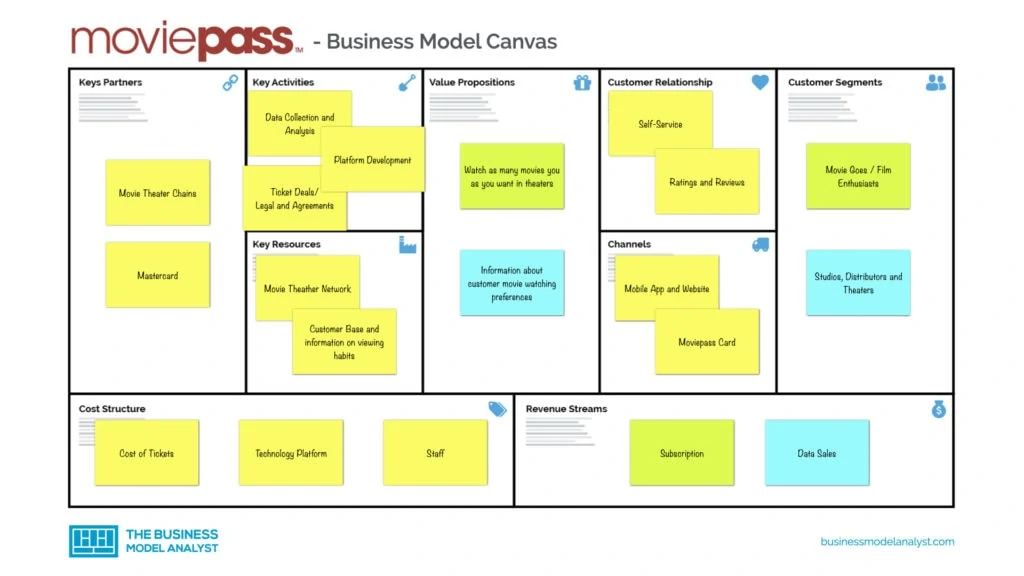

MoviePass’ Business Model Canvas

Let’s take a look at the MoviePass business model canvas:

MoviePass’ Customer Segments

- Moviegoers

- Film enthusiasts

- Studios

- Movie theaters

- Distributors, mainly when it switched the business model to selling data

MoviePass’ Value Propositions

To watch as many movies as one wanted in the theaters at a fixed monthly fee. Later, when it focused on data, it was an easy and simple source of information about customer preferences.

MoviePass’ Channels

- Mobile app

- Website

- Apple’s App Store and Google’s Play Store

- MoviePass card

- Social media

- Advertising

MoviePass’ Customer Relationships

- Invite-only launches

- FAQs

- Customer support

- The rating system for movies and theaters so that customers could rate their experiences

MoviePass’ Revenue Streams

- Subscription fees

- Sale of data

MoviePass’ Key Resources

- Platform

- Contracts with American movie chains and theaters

- Customer preferences information

- Data

MoviePass’ Key Activities

- Operations

- Customer care

- Platform development

- Agreements with movie chains and theaters

- Data collection and analysis

MoviePass’ Key Partners

- The parent company (Helios & Matheson)

- MasterCard

- Movie chains and theaters’ partnerships

- Affiliates

MoviePass’ Cost Structure

- Tickets with discount

- Customer service

- Product development

- Card fees

- Legal

- Administrative

- IT infrastructure

- Staff

MoviePass’ Competitors

- AMC Stubs: AMC Stub was a guest loyalty program offered by the movie theater chain AMC Theatres. It presented three programs — Insider, Premiere, and A-List —, which, depending on the program, provided free entries to the theaters, as well as perks like birthday gifts and free size-upgrade to purchased popcorn and drinks;

- Regal Unlimited: Regal Cinemas offers a paid movie ticket subscription service known as Regal Unlimited, which allowed the users to watch an unlimited number of movies and receive discounts on concessions;

- Cinemark Movie Club: The giant movie theater chain Cinemark also has its own reward program, Cinemark Movie Rewards, which offers Cinemark Movie Club, a paid membership for members to get discounts, free tickets, and concessions every visit;

- Alamo Season Pass: As a celebration of its 25th anniversary, Alamo Drafthouse launched Alamo Season Pass, a paid membership that guarantees free entry for one movie a day in several cities across the U.S.;

- ArcLight Membership: No longer free, the ArcLight Membership now comes with a cost, but it gives its members concessions, discounts at theater cafés and gift shops, concessions, and a free ticket for members birthdays.

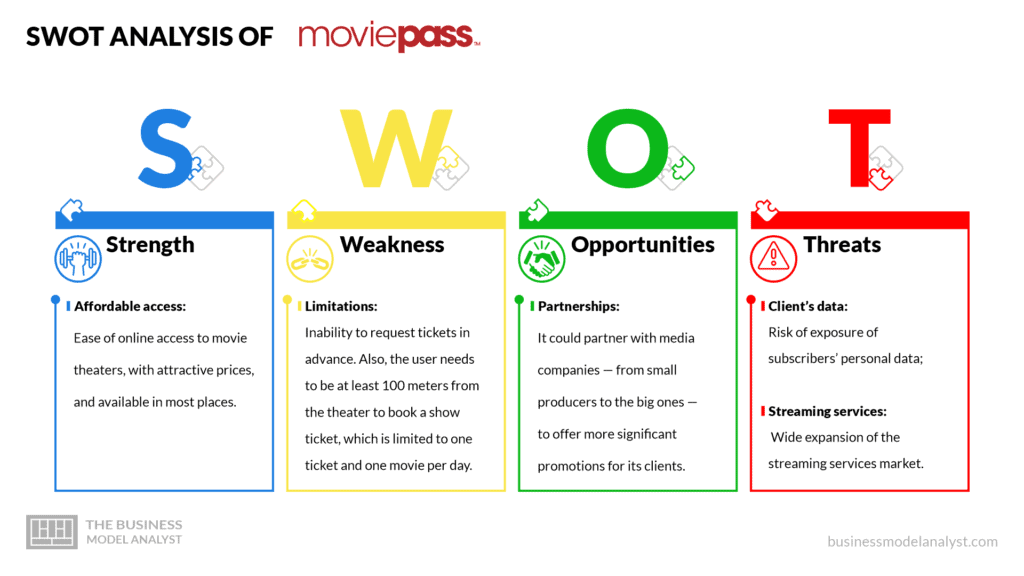

MoviePass’ SWOT Analysis

Below, there is a detailed swot analysis of MoviePass:

MoviePass’ Strengths

- Affordable access: Ease of online access to movie theaters, with attractive prices, and available in most places.

MoviePass’ Weaknesses

- Limitations: Inability to request tickets in advance. Also, the user needs to be at least 100 meters from the theater to book a show ticket, which is limited to one ticket and one movie per day.

MoviePass’ Opportunities

- Partnerships: It could partner with media companies — from small producers to the big ones — to offer more significant promotions for its clients.

MoviePass’ Threats

- Client’s data: Risk of exposure of subscribers’ personal data;

- Streaming services: Wide expansion of the streaming services market.

Conclusion

The problem with MoviePass is that the movie theater companies did not buy it in the first three years. Although they’ve finally entered the business with MoviePass in 2014, with AMC leaving, things just started to go wrong.

The prices went up, subscriptions went down, and MoviePass just never got back on its feet. The bankruptcy at the beginning of 2020 was the saddest closure that the company could have.