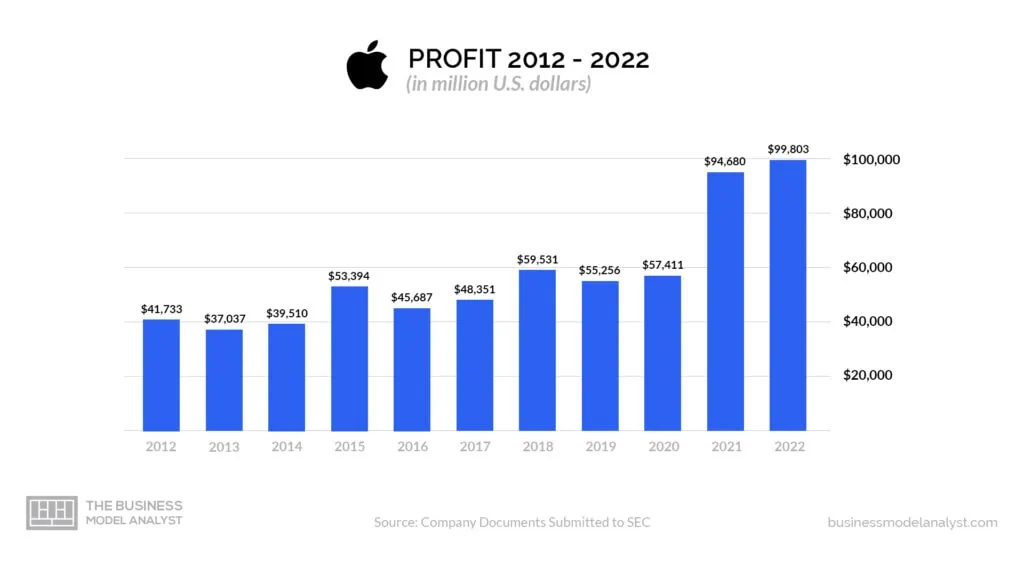

According to Fortune Global’s 500 list for the 2020 fiscal year, Apple was the most profitable company globally — so yes, Apple is profitable. The company’s profit rode by 3.9% to hit $57.41 billion, outshining some of the biggest retailers in America. In 2021, Apple became the most profitable American firm, raking in $365.8 in revenue and generating $94.7 billion in profit. Apple has been ranked first on the Fortune 500 most profitable companies for seven years straight, save for 2019 when Berkshire Hathaway toppled it from the first place.

Contents

Timeline of Apple’s Financial Growth and Funding

1976-1987: Steve Wozniak, Steve Jobs, and Ronald Wayne partnered to establish Apple Computer Company in 1976. Apple I, a computer Wozniak designed and built from scratch, was the firm’s inaugural product. While he (Wozniak) sold his HP-65 calculator to finance the project, Jobs traded his Volkswagen bus.

Woznialk launched the premier prototype of Apple I in July 1976 at the Homebrew Computer Club. Apple I would later be sold as a motherboard with RAM, CPU, and basic textual-video chips (a base kit hypothesis that the team couldn’t market as a finished personal computer.) The product went on sale for $666.66 soon after its inauguration. Wozniak and Jobs incorporated Apple Computer Company in 1977 as Apple Computer, Inc. Ronald Wayne had since left and sold his shares to Wozniak and Jobs for $800.

During Apple’s incorporation, Jobs and Wozniak received financial funding and business advice from Mike Markkula, a multimillionaire who provided them with $250,000. After the incorporation, the team launched Apple II, becoming the premier mass-produced microcomputer and a bestseller. Apple’s revenues grew tremendously between 1977 and 1980, from $775,000 to $118 million, with an annual average growth rate of 533%. In 1980,

Apple went public and achieved instant financial success. Apple’s inaugural personal computer, the Macintosh, was launched in 1984 and sold without a programming language. Jobs resigned in 1985, albeit remaining a shareholder, taking with him some of Apple’s employees, with whom he founded NeXT.

Wozniak also left to pursue other matters, even though he has remained an Apple employee. By 1988, Apple had sold more than a million Macintosh computers, with most sold to corporations.

1989-2000: Apple announced its plans to launch a new operating system the following year and allow the Macintoshes to operate tasks on multiple programs simultaneously. That same year, Apple recorded its first drop in sales, resulting in a 20% decline in Apple’s stock price. In 1990, Apple introduced low-cost models; the Macintosh IIsi, the Macintosh LC, and the Macintosh Classic.

In the same year, 11% of all the PCs sold through computer dealers in the U.S. were Macs. In 1991, Apple collaborated with IBM to develop a new generation of reduced-instruction-set computing (RISC) chip, the PowerPC. The two firms established two software companies, Kaleida Labs, Inc. and Taligent, Inc., to facilitate operating system software development.

The former would develop multimedia software, while the latter would enable versions of the IBM OS/2 and macOS to run on the CHRP (common hardware reference platform), a new computer hardware standard. However, wrangles arose between IBM and Apple over the engineering specifications of CHRP.

When Taligent’s and Kaleida Labs’ costs rose to around $200 million and $400 million, respectively, Apple pulled out of the deal. By 1995, Apple’s unfilled orders were worth $1 billion, resulting in a 15% drop in Apple’s stock value. In 1996, Apple was on the verge of going bankrupt when the board opted to purchase Steve Jobs’s NeXT for $429 million.

Apple launched the iMac in 1998, which was an instant success. Apple purchased Macromedia’s Key Grip Software Project and launched it in 1999 as Final Cut Pro before launching the iBook. In 2000, Jobs became the official CEO of Apple.

2001- 2022: Apple launched the iPod portable digital audio player, selling more than 100 million units within six years. The company introduced iTunes the same year. In 2005, Apple’s revenue was $290 million, an equivalent of $3.24 billion in shares. By 2015, Apple had evolved into the most publicly traded firm globally, with an estimated value of $1 trillion in 2018 and a revenue exceeding $150 billion per annum.

In August 2020, Apple’s share price topped the charts briefly, trading at $467.77, making Apple the first company in the U.S. to have a $2 trillion market capitalization. In the 2022 fiscal year, Apple’s net income was $99.8 billion, the company’s highest net income since its inception.

Apple Financial Performance: Revenues, Expenses, and Profits

Apple’s financial performance improved tremendously when Tim Cook and Steve Jobs became the official CEOs. In 2000, Apple’s assets were $6.8 billion, rising to $351 billion in 2021. The company’s liabilities were $287 billion, while the total Shareholder’s equity was $63.09 billion. Apple holds marketable securities equivalent to $27.79 billion and $34.94 worth of cash and cash equivalents. The company’s non-current marketable securities are worth $127.88 billion.

In January 2023, Apple’s market value dropped below $2 trillion, prolonging a sharp decline that has erased around $1 trillion off the company’s market capitalization. The massive decline in Apple’s market capitalization represents a turnaround from its first trading day in 2022, when Apple made history as the only firm to hit a $3 trillion valuation. The company’s shares recently dropped by over 3.5%, marking its lowest since June 2021.

Despite the decline, Apple has performed better than other tech-based firms. Apple’s financial performance during the coronavirus pandemic was pretty strong. The company reported consistent growth for 14 successive quarters. By September 2022, Apple recorded $394 billion in revenue and almost $100 billion in net profit.

Reports from Counterpoint Research suggest that Apple shipped only 14% of all smartphones worldwide in the initial nine months of 2022, accounting for 82% of all profits, its highest since 2015, and 43% of all revenues. However, Apple has experienced turbulence in recent months. In November 2022, the company admitted to experiencing massive disruptions in assembling advanced iPhones, attributed to a COVID-19 outbreak at its mega factory assembler in Zhengzhou, China.

While announcing the 2022 fourth fiscal quarter financial results, Tim Cook, Apple CEO, said: “This quarter’s results reflect Apple’s commitment to our customers, to the pursuit of innovation, and to leaving the world better than we found it. As we head into the holiday season with our most powerful lineup ever, we are leading with our values in every action we take and every decision we make. We are deeply committed to protecting the environment, to securing user privacy, to strengthening accessibility, and to creating products and services that can unlock humanity’s full creative potential.”

Apple Revenue

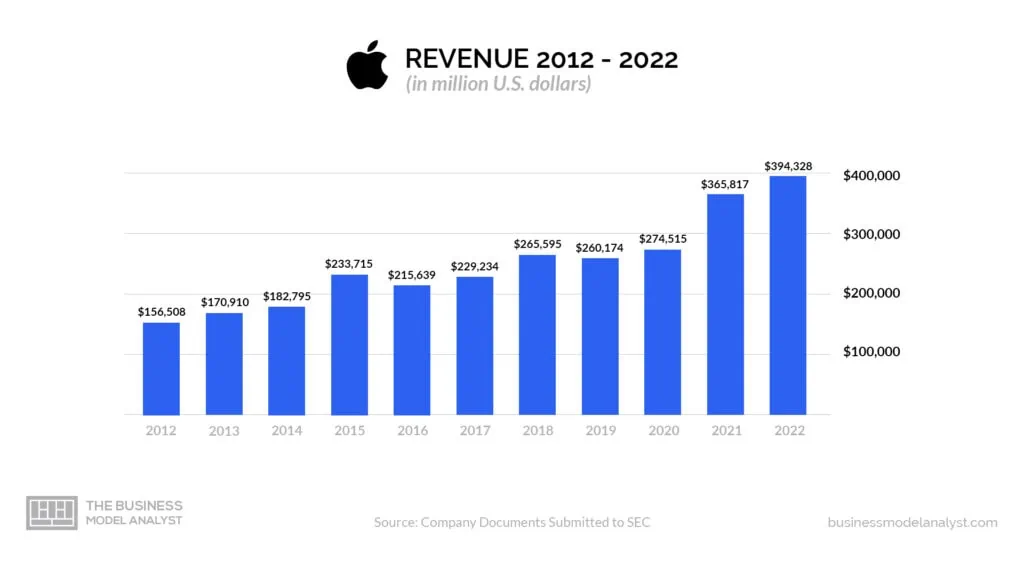

Apple reported a total net sales of $394.33 billion in its 2022 financial year. This was a sharp increase from its 2020 financial year record of $274. 52 billion. The company’s annual revenue quadrupled in the last decade. In the last few years, Apple has evolved with the development of innovative products like the Apple Watch, iPad, iPhone, and Mac computer. These products enjoy massive commercial success in the market.

Apple’s share price has also surpassed a tenfold growth, pushing the company to become the inaugural trillion-dollar company market capitalization-wise. By 2022, Apple had become the most treasured brand globally. Apple’s revenue stands at $365.8 billion annually. After thorough research, financial analysts came up with the following critical financial metrics.

- Apple’s revenue growth between 2000 and 2021 was 4.482%;

- The company’s peak quarterly revenue in 2022 was $123.9 billion;

- Apple’s employee per revenue is $2,375,435. The company has 154,000 employees;

- In 2021, Apple reported a $365.8 billion peak revenue;

- Apple’s 2020 annual revenue was $274.5 billion. This was a 5.51% growth from the previous year;

- Apple’s 2021 $365.8 billion annual revenue was a 33.26% rise from 2020;

- Apple’s revenue for the December 2022 quarter was $117.154B. This was a 5.48% drop year-over-year;

- Apple’s twelve-month revenue for the year ending December 2022 was $387.537B. This was a 2.44% rise year-over-year;

- Apple’s 2022 annual revenue was $394.328B, a 7.79 rise from the previous year.

Apple Expenses

Apple’s median operating expenses for 2018 to 2022’s fiscal years were $208.2 billion. The operating costs climaxed in September 2022 to hit $274.9 billion. In the 2022 fiscal year, Apple spent $26.25 billion on development and research, an increase of approximately $4 billion from the previous year. Over the years, Apple’s massive development and research budget has resulted in the launch of robust products like the iPad, MacBook, iPod, and iPhone.

The company also spends more than $100 million annually on Twitter adverts. The company’s cost of sales rose from $131 billion to $162 billion between 2016 and 2019. The rise was attributed to the high price of proprietary components and memory. The percentage increase was between 61% to 62%. Research and development costs rose from $10 billion to $16.2 billion between 2016 and 2019.

Apple usually invests in long-term projects that don’t affect revenues immediately. Selling, general, and administrative expenses (SG&A) rose from $14.2 billion to $18.2 billion between 2016 and 2019. Apple’s non-operating income rose from $1.3 billion to $1.8 billion between 2016 and 2019.

The rise was attributed to the high dividend and interest income from its investments. The company’s income tax costs dropped from $15.7 billion to approximately $10.5 billion between 2016 and 2019. This drop was attributed to the U.S. Federal income tax reforms.

Apple Profits

Investors leverage a company’s profit margin to gauge whether its management is making sufficient profit from its sales while containing overhead and operating costs. Apple’s gross profit for the December 2022 quarter was $50.332B. This was a 7.21% drop year-over-year. The company’s gross profit for 2022 was $166.871B, a 2.54% rise year over year. In 2022, Apple’s annual gross profit was $170.782B, 11.74% more than in 2021, which was $152.836B.

Potential for Profitability

Profitability and growth are critical factors to the success of a business. Apple has remained the most successful publicly traded firm globally, with a market capitalization of $2.7 trillion as of September 2022. Apple’s rise started with innovation and a series of product launches.

The company has managed to keep its loyal customers anxious with every launch as they await the upgrades on the latest releases. However, some financial analysts and market experts doubt whether Apple can hold on to the lead or whether competitors will eventually take over.

Apple still lingers in the virtuous cycle, meaning it has a practical pattern where solid solutions generate success or the desired results. This leads to a series of subsequent achievements or results. If Apple holds on to its innovation practices, the demand for its services and products will continue to rise. This will result in pricing power, better cash flow, and enhanced profit margins, increasing the stock price while allowing the company to pay dividends.

Worth mentioning is the difference between the virtuous cycle and the vicious cycle. The latter leads to swift losses. It starts with losing market share, resulting in low prices, laying off staff, cost reduction, and eventually, customer dissatisfaction.

A company stuck in a vicious cycle usually takes on debt, and its share prices drop. Apple is not in a vicious cycle, having maintained its share in the U.S. smartphone industry, despite the rising competition from other players.

Apple’s smartphone market share in the U.S. as of 2022’s second quarter was 48%. Some critics say Apple lost its innovative edge when Steve Jobs died. However, the company has leveraged its brand to reach a broad audience and boost sales. Some analysts believe that Apple’s prime times of innovative development are over. However, the company has remained steadfast in announcing advancements in its technology. Apple’s latest smartwatches come with cellular service, while its most advanced smartphones have inbuilt wireless charging systems.

Further, the latest Apple phones come with facial recognition. Recently, Apple announced that it would leverage the corporate tax break it receives under the latest tax laws to invest approximately $350 billion in the U.S. This venture will provide employment for over 20,000 people. Apple also mentioned its plans to develop the U.S.’ second corporate campus, which would create jobs for up to 2,000 people.

Conclusion

Despite its internal battles and the slight drop we’ve seen above, Apple has generally been a financially stable company since its inception. The company is the first to hit $1 trillion in revenue in 2018 and $2 trillion in 2020. Still, Apple is the first company to attain $3 trillion in revenue.