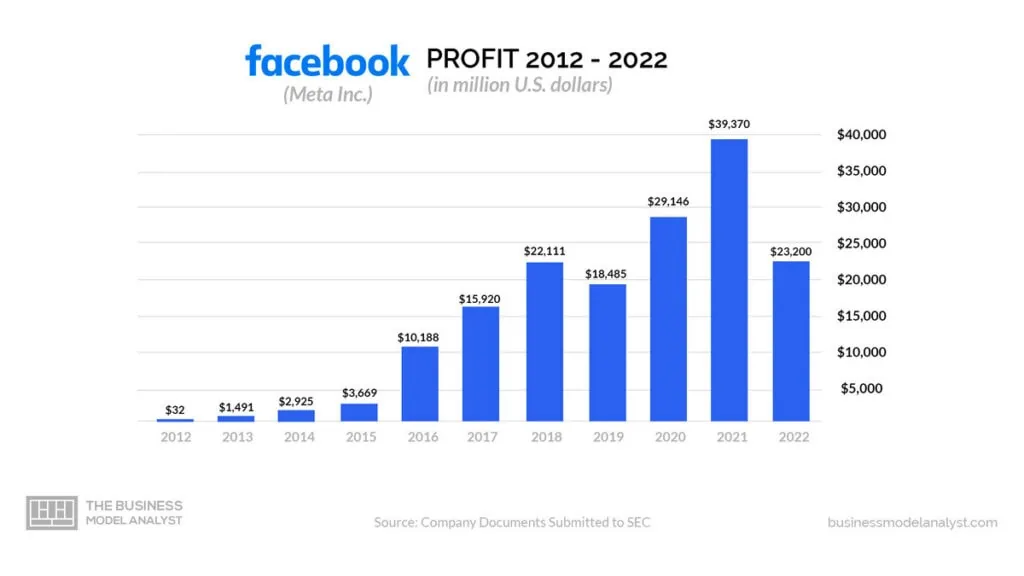

Yes, Facebook is profitable. In 2022, Facebook reported a net profit of $23.1 billion. While this is a massive decline from the $39.3 billion profit made in 2021, it is still a significant amount of money. This decline in 2022 accounts for Facebook’s biggest net loss since 2012.

In 2020, Facebook recorded a net income of $29.1 billion and saw a huge increase in 2021, when the company registered a net income of $39.3 billion. The decline in Facebook’s net income in 2022 can be attributed to several factors, including increased competition from other social media platforms, changes in privacy regulations, investment in the metaverse, amongst other things.

Over the years, Facebook, now known as Meta Platforms, Inc., has consistently been a financial powerhouse, reaping substantial revenues and driving innovation in the online advertising space. The company’s ability to monetize its vast user base through targeted advertising has significantly contributed to its financial success.

In the realm of social media dominance, few companies have reached the level of impact and influence of Facebook. With its extensive user base and a suite of platforms under its umbrella, Facebook has become a behemoth in the digital landscape.

However, evaluating Facebook’s profitability requires a closer examination of its financial performance, revenue streams, and market dynamics. As users connect, share, and engage on its various platforms, an intriguing question arises: Is Facebook profitable?

This article delves into the question of Facebook’s profitability, exploring its financial trajectory from historical perspectives up until the present day. By considering key factors such as advertising revenue, user growth, and emerging challenges, we aim to provide a comprehensive analysis of Facebook’s financial standing.

Contents

Timeline of Facebook’s financial growth and funding

The journey of Facebook from birth to globalization is a remarkable tale of entrepreneurial vision, innovation, and staggering financial success. From its humble beginnings in a Harvard University dorm room to its current status as a global tech giant, Facebook has experienced a phenomenal journey, marked by significant financial growth and substantial funding.

2004-2006: The Early Days and Seed Funding: In February 2004, Mark Zuckerberg, along with co-founders Eduardo Saverin, Andrew McCollum, Dustin Moskovitz, and Chris Hughes, launched “TheFacebook” as a social networking platform exclusively for Harvard students. Facebook quickly gained popularity amongst Harvard students. Recognizing its potential, Zuckerberg and his team expanded the platform to other Ivy League universities and eventually colleges across the United States, marking the beginning of Facebook’s rapid expansion. To fuel this growth and scale their operations, the team sought external funding. In 2004, Peter Thiel, co-founder of PayPal, became the first significant investor in Facebook, injecting $500,000 into the company. Thiel’s investment not only provided crucial financial backing, but also brought credibility and validation to the platform.

Building on this early success, Facebook secured additional funding in April 2005 from Accel Partners, a renowned venture capital firm. With $12.7 million in investment, Facebook was able to accelerate its growth and expand beyond its initial user base, reaching universities nationwide. Accel Partners’ support and expertise proved instrumental in shaping Facebook’s trajectory.

Another milestone in Facebook’s financial journey came in October 2007 when Microsoft invested $240 million, acquiring a 1.6% stake in the company. This partnership with Microsoft not only solidified Facebook’s position in the tech industry, but also granted Microsoft access to Facebook’s growing user base for its search engine and advertising endeavors.

The seed funding received during this critical period allowed Facebook to refine its platform, scale its operations, and lay the groundwork for future monetization strategies. It provided the necessary resources and investor confidence that propelled Facebook’s expansion from a college-focused social network to a global tech giant.

2007-2010: Monetization Efforts and Rapid Expansion: The period from 2007 to 2010 marked a pivotal phase in Facebook’s financial growth and expansion. With its user base rapidly expanding and the platform gaining immense popularity, Facebook shifted its focus to monetization strategies, paving the way for substantial financial success.

One of the notable milestones during this time was the launch of Facebook’s advertising platform in 2007. This marked a pivotal shift for the company as it sought to capitalize on its growing user base. The advertising platform enabled businesses to target users based on their demographics and interests, opening up new avenues for revenue generation.

As Facebook’s user base expanded exponentially, surpassing the 500 million active users mark by 2010, the company ventured into international markets, solidifying its global presence. This rapid growth laid the foundation for Facebook’s emergence as a dominant force in the social media landscape.

To further bolster its monetization efforts, Facebook introduced Sponsored Pages, providing businesses and brands with dedicated pages to engage directly with users. This move enhanced user interaction and facilitated targeted advertising. Additionally, Engagement Ads were introduced, allowing advertisers to initiate conversations with users through interactive ads, deepening user engagement and offering new revenue streams.

Facebook also secured significant investments to support its growth. In 2009, Digital Sky Technologies (DST), a Russian investment firm, injected $200 million into Facebook, valuing the company at an impressive $10 billion. This substantial investment provided the necessary financial backing for further expansion and innovation.

As part of its growth strategy, Facebook made strategic acquisitions, such as the purchase of FriendFeed in 2009. This acquisition broadened Facebook’s offerings and enhanced its user engagement capabilities, further solidifying its position as a leading social media platform.

2012-2014: Initial Public Offering (IPO) and Continued Financial Success: During the years 2012 to 2014, Facebook reached significant milestones in its financial growth and funding journey. This period marked a turning point for the company as it went public through its highly anticipated Initial Public Offering (IPO) and continued to experience remarkable success. The IPO in May 2012 was a monumental moment for Facebook.

Going public meant that the company offered its shares to the public for the first time. The IPO raised approximately $16 billion, valuing the company at over $100 billion. It became one of the largest IPOs in history, signaling the company’s arrival as a major player in the tech industry. This move allowed Facebook to tap into new avenues of funding and increased its visibility on a global scale.

Facebook focused on refining its monetization strategies, particularly in the realm of mobile advertising. Recognizing the growing importance of mobile devices, Facebook developed innovative advertising platforms to reach users on their mobile devices. These efforts proved successful, contributing to the company’s growing revenue stream. Facebook also made strategic acquisitions to enhance its market presence.

The acquisition of Instagram in 2012 and WhatsApp in 2014 significantly bolstered Facebook’s offerings and expanded its user base. These acquisitions solidified Facebook’s position as a leader in the mobile space and social media, further strengthening its financial prospects.

Throughout this period, Facebook experienced continued user growth and engagement. In October 2012, the company surpassed the impressive milestone of 1 billion monthly active users. To enhance user experience, Facebook introduced new features such as Timeline and Graph Search, further fostering user engagement and loyalty.

Facebook’s financial performance during this period exceeded expectations. The company reported strong quarterly earnings, surpassing revenue projections. This consistent growth and ability to monetize its vast user base instilled investor confidence and solidified Facebook’s position as a leading force in the tech industry.

2015 till date: Diversification and Ongoing Financial Dominance: Facebook continued to diversify its offerings, expand its user base, and solidify its position as a dominant player in the tech industry during this period. Facebook’s user base continued to expand, and it surpassed the impressive milestone of 2 billion monthly active users in 2017. The company actively pursued growth in emerging markets, striving to increase internet accessibility and affordability in underserved regions.

Advertising remained the primary driver of revenue for Facebook, and the company continuously refined its advertising platforms and targeting capabilities. This allowed businesses of all sizes to reach their desired audiences effectively. Additionally, Facebook ventured into sponsored content, video ads, and expanded its advertising network to include third-party apps and websites, broadening its revenue streams.

Recognizing the rising prominence of mobile devices, Facebook made significant efforts to optimize its platforms for mobile experiences. This included improving ad placements and enhancing user experiences on mobile devices. Furthermore, the company recognized the power of video content and introduced features like Facebook Live, while also investing in original video content.

This strategic move aimed to capture a share of the booming digital video advertising market. Strategic acquisitions also played a crucial role in Facebook’s expansion and diversification strategy. In 2014, Facebook acquired Oculus VR, marking its entry into the virtual reality space. The acquisitions of WhatsApp and Instagram further strengthened Facebook’s dominance in messaging and social media, respectively.

Facebook also prioritized artificial intelligence (AI) research and development during this period. Leveraging AI technology, the company enhanced user experiences, refined ad targeting capabilities, and actively fought against misinformation and harmful content. Facebook also embarked on innovative projects like Aquila, which aimed to provide internet access through high-altitude drones, and Connectivity Lab, which focused on expanding internet availability to underserved areas.

Throughout this period, Facebook consistently reported robust financial performance. Year after year, the company achieved substantial revenue growth, enabling investments in research and development, infrastructure, and future growth opportunities. Facebook’s financial success served as a testament to its ability to leverage its massive user base and remain at the forefront of technological advancements.

Despite its financial success, Facebook has faced some setbacks in recent years. In 2022, the company experienced a major decline in revenue and net income, making it the second-biggest case since 2012. This decline is a result of several factors that majorly affect the company’s sources of revenue. While these factors are all expected to impact Facebook’s net income in 2023, it is unclear how long this decline will continue.

Facebook Financial Performance: Revenues, Expenses, and Profits

Facebook has been a consistently profitable company over the years. Its revenue has shown significant growth, primarily driven by advertising sales. Facebook’s revenue is primarily derived from advertising, with a substantial portion attributed to mobile advertising. The company’s ability to leverage its massive user base and target advertisements effectively has contributed to its revenue growth.

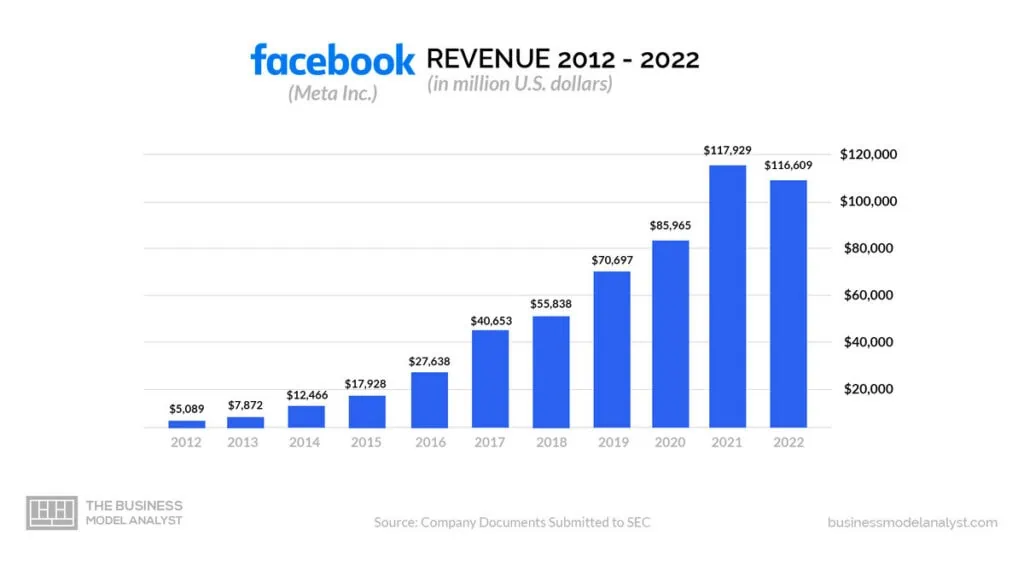

In 2019, Facebook’s revenue was $70.6 billion. This increased by 22.28% and grew to $85.9 billion in 2020, and increased by 35.81% to $117.9 billion in 2021. Facebook’s net income also grew during this period, increasing 35.08% from $29.1 billion in 2019 to $39.3 billion in 2020. However, there was a 41.17% decrease, which amounted to $23.1 billion in 2021.

Facebook Revenue

According to CNBC, the total revenue realized by Facebook in the first quarter of the year 2023 amounted to $28.65 billion, as opposed to the $27.65 billion projected by analysts. This is approximately a 2.65% increase from the $27.91 billion generated in the first quarter of the year 2022. According to Statista, the total revenue generated by Facebook in 2022 amounted to $116.6 billion.

This was the first time that the social media company experienced a decline in revenue, as its total revenue for the year 2021 was $117.9 billion. Facebook’s revenue is majorly derived from advertising. The company sells ads that appear on its platforms, such as Facebook, Instagram, and WhatsApp.

Facebook’s advertising business is highly profitable, and the company’s profit margins have remained relatively stable over the past few years. In 2022, about 99% of the company’s revenue was generated from advertising. The remaining 1% of revenue came from other sources, such as licensing and fees.

Facebook’s revenue is generated from users all over the world. According to Business of Apps, in 2022, the company’s revenue was distributed as follows:

- United States of America and Canada: $54.5 billion (46.78%)

- Europe: $25.7 billion (22.04%)

- Asia-Pacific: $23.4 billion (20.07%)

- Rest of the world: $12.7 billion (10.90%)

Facebook Expenses

Facebook’s expenses for the first quarter of 2023 were $21.42 billion, an increase of 10% year-over-year. This includes charges related to its restructuring efforts of $1.14 billion in the first quarter of 2023.

The company’s expenses are broken down into the following categories:

- Cost of revenue: The cost of revenue is the cost of providing the company’s products and services. In the first quarter of 2023, Meta’s cost of revenue was $12.44 billion, an increase of 11% year-over-year. This increase was driven by the growth of the company’s advertising business;

- Selling, general, and administrative (SG&A) expenses: SG&A expenses are the costs of running the company’s business, such as marketing, sales, and administration. In the first quarter of 2023, Meta’s SG&A expenses were $8.98 billion, an increase of 9% year-over-year. This increase was driven by the growth of the company’s business and the investments it is making in new products and technologies;

- Research and development (R&D) expenses: R&D expenses are the costs of developing new products and technologies. In the first quarter of 2023, Meta’s R&D expenses were $1.00 billion, an increase of 13% year-over-year. This increase was driven by the company’s investments in new products and technologies, such as the metaverse;

- Other expenses: Other expenses include the costs of restructuring and other one-time items. In the first quarter of 2023, Meta’s other expenses were $100 million, an increase of 20% year-over-year. The costs of restructuring the company drove this increase.

Facebook Profit

Facebook’s profits are the amount of money the company makes after paying all of its expenses. In 2022, Facebook’s profits were $23.1 billion. This is a decrease from the $39.3 billion in profits generated in 2021. The decrease in profits was driven by the decrease in revenue, as well as by increased costs associated with Meta’s investments in the metaverse.

Facebook’s net profit, on the other hand, is the amount of money that the company has left after paying all of its expenses and taxes. In 2022, Facebook’s net profit was $23.1 billion. This is a decrease from the $39.3 billion in net profit generated in 2021. The decrease in net profit was also driven by the decrease in revenue, as well as by increased costs associated with Meta’s investments in the metaverse.

According to published data, Facebook’s profits and net profit decreased in 2022 compared to 2021. This was driven by a number of factors, including:

- Increased competition from other social media platforms: Facebook is facing increased competition from other social media platforms, such as TikTok and Instagram. These platforms are attracting younger users, which is a key demographic for Facebook;

- Changes in privacy regulations: Facebook is facing increasing scrutiny from regulators around the world. These regulators are concerned about Facebook’s data collection practices and its role in the spread of misinformation. These concerns are leading to changes in privacy regulations, which are making it more difficult for Facebook to target ads and collect data on users;

- Concerns about the spread of misinformation: Facebook has been criticized for its role in the spread of misinformation. This criticism has led to a decline in trust in Facebook, which is making it more difficult for the company to attract advertisers.

Despite the decrease in profits and net profit, Facebook is still a profitable company. The company has a strong advertising business and a large user base. It is possible that Facebook will be able to overcome the challenges it is facing and continue to grow its business in the future.

Potential for Profitability

As one of the largest and most influential companies in the tech industry, Facebook has demonstrated remarkable financial success over the years. However, the pursuit of profitability remains an ongoing goal for the social media giant. The following are opportunities that Facebook could exploit to drive its future financial growth and improve its profits:

- Monetizing Messaging Platforms: Facebook owns popular messaging platforms such as WhatsApp and Messenger, which collectively have billions of active users. While these platforms have been primarily focused on user engagement and communication, there is an opportunity to monetize them effectively. Introducing targeted advertising or sponsored messaging within these platforms, while ensuring user privacy and experience, could open up a new revenue stream for Facebook;

- Embracing E-commerce and Marketplace: Facebook’s Marketplace has gained traction as a platform for buying and selling products within the Facebook community. With the rising popularity of e-commerce, there is a significant opportunity for Facebook to further develop its Marketplace and explore additional e-commerce features. This would not only generate additional revenue, but also strengthen user engagement and loyalty within the Facebook ecosystem;

- Leveraging Virtual Reality (VR) and Augmented Reality (AR): Facebook’s acquisition of Oculus has positioned the company at the forefront of the virtual reality market. As VR and AR technologies continue to evolve, there is immense potential for Facebook to monetize these platforms. By integrating advertising, content, and commerce into virtual and augmented reality experiences, Facebook can tap into new revenue streams. From immersive advertising opportunities to virtual storefronts, the possibilities for profitability in the VR and AR space are vast;

- Continued Innovation and Product Development: Facebook has a track record of innovation, constantly introducing new features and products to enhance user experience and engagement. By maintaining a strong focus on research and development, Facebook can stay ahead of emerging trends and technologies.

As Facebook evolves, its ability to seize opportunities and adapt to the changing landscape will be crucial in achieving long-term profitability.

Conclusion

In conclusion, Facebook has consistently demonstrated its profitability over the years, driven by its robust advertising platform, expanding user base, and strategic acquisitions. Despite facing challenges and controversies along the way, the company has successfully navigated the digital landscape, evolving its business model and capitalizing on new opportunities.

As Facebook continues to adapt and innovate, its ability to maintain profitability will rely on its commitment to privacy, trust, and delivering value to its global community of users, advertisers, and investors.