The Disney SWOT Analysis is essential to evaluate the current position of the multinational entertainment conglomerate and determine its growth potential. Disney is an American multinational, mass media, and entertainment conglomerate that is widely known for its extensive range of businesses, including media networks, theme parks, resorts, and consumer products. The company has been a household name around the globe for almost a century. Disney was founded by Walt Disney and his brother Roy O. Disney in 1923, as a small animation studio, known as Brothers Studio, in Los Angeles, California. The studio produced a series of animated shorts, including “Steamboat Willie,” which introduced the world to Mickey Mouse, the iconic character that would become the face of Disney.

Throughout the 1920s and 1930s, Disney continued to produce animated shorts, feature-length films, and merchandise featuring its beloved characters, including Snow White, Pinocchio, and Bambi. In the 1950s, Disney expanded into television with the launch of “Disneyland,” a weekly TV show that showcased the company’s films and characters. The show was a hit, and Disney soon launched a second TV program, “The Mickey Mouse Club,” which became a cultural phenomenon for children. Disney’s success in television paved the way for the company’s expansion into theme parks and resorts. In 1955, Disney opened Disneyland, the first-ever theme park in Anaheim, California. The park was an immediate success, and Disney began expanding its theme park empire by opening Disney World in Florida in 1971 and Disneyland Paris in 1992. Today, Disney operates six theme parks and two water parks worldwide, including Disneyland Tokyo, Hong Kong Disneyland, and Shanghai Disney Resort.

Disney’s expansion into media networks began in 1984 when the company acquired ABC, one of the major television networks in the United States. The acquisition gave Disney access to a vast audience and helped the company diversify its revenue streams beyond its theme parks and consumer products. Today, Disney owns a wide range of media networks, including ESPN, Disney Channel, National Geographic, and FX. Disney’s consumer products business has been a cornerstone of the company since its early days. The company’s merchandising division began producing merchandise featuring its characters in the 1930s. It has since expanded to include a wide range of products, from toys and clothing to home decor and food products. Disney’s consumer products division is one of the largest and most successful in the world, with merchandise sales generating billions of dollars in revenue each year.

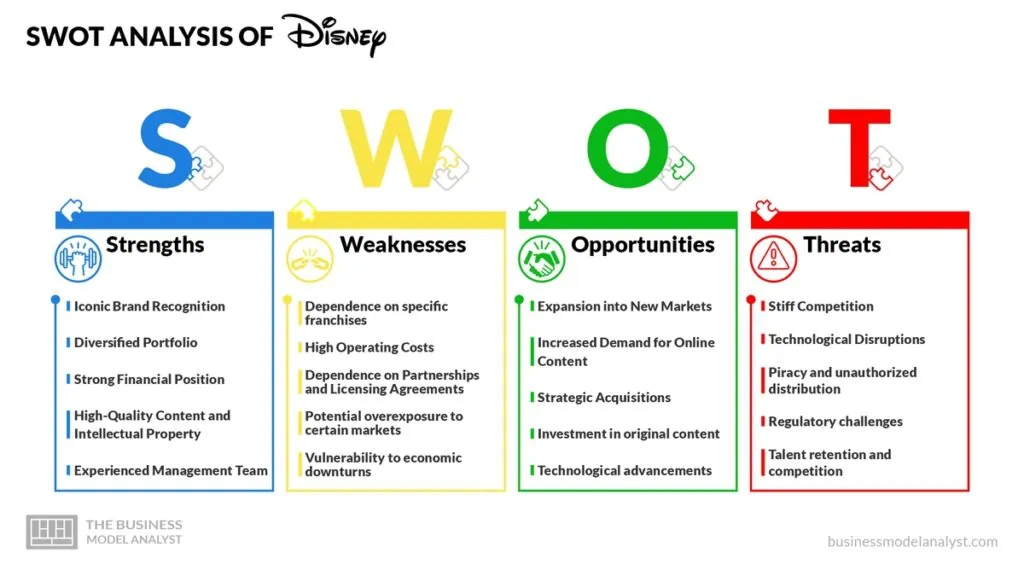

However, even with Disney’s impressive track record, it is essential to take a closer look at the company’s strengths, weaknesses, opportunities, and threats (SWOT) to understand its current position and potential for growth. In this article, we will conduct a comprehensive SWOT analysis of Disney, examining the internal and external factors that shape its competitive landscape. This will help provide insights into how the company can leverage its strengths to overcome its weaknesses and capitalize on emerging opportunities.

Contents

SWOT Analysis of Disney

Disney Strengths

The following are the strengths of Disney that have helped the company to dominate the entertainment industry for a long time:

- Iconic Brand Recognition

Disney’s iconic brand recognition is undoubtedly one of the company’s most significant strengths. The brand has been a household name for nearly a century, and it has become synonymous with entertainment and childhood memories for many generations. The company’s brand is built on a foundation of beloved characters, timeless stories, and unforgettable experiences that have captured the hearts of millions of people around the world. Disney’s brand recognition gives the company a significant competitive advantage and helps the company to create a solid emotional connection with consumers. In addition, Disney’s brand recognition makes it easier for the company to expand into new markets and product categories. It also gives the company a robust platform for marketing and advertising.

- Diversified Portfolio

Disney’s diversified portfolio provides it with a range of products and services across multiple industries. The company’s portfolio includes film and television production, theme parks, consumer products, and now, even streaming services. This diversity has enabled Disney to weather economic downturns and shifts in consumer preferences, making it one of the most stable and prosperous media conglomerates in the world. The company’s vast array of businesses ensures that if one industry experiences a downturn, other areas of the company can offset the losses. Also, Disney’s diversified portfolio provides multiple revenue streams, allowing the company to continue to invest in new projects and technologies. It also makes it very challenging for competitors to match the breadth and depth of the company’s offerings.

- Strong Financial Position

Disney’s strong financial position sets the company apart in the competitive entertainment industry. This strength is reflected in the company’s ability to generate consistent profits and cash flows. With a market capitalization of over $183B and annual revenues of over $70 billion, Disney’s financial prowess is a testament to its successful business strategies and robust performance. The company’s financial strength provides a solid foundation for its operations and investments. It also empowers Disney to weather economic downturns more effectively than many of its competitors. In conclusion, Disney’s financial prowess supports its strategic acquisitions and partnerships, which drive growth and profitability.

- High-Quality Content and Intellectual Property

Disney’s ability to consistently produce high-quality content is a significant driver of its success. The company’s rich history of storytelling and treasure trove of iconic characters and franchises has established the company as a global leader in creating captivating and enduring content. Disney’s commitment to excellence in storytelling, animation, and production values retains its loyal and dedicated fan base. Also, the company’s ownership of valuable intellectual property gives the company a unique competitive advantage. This can be used to generate substantial revenue streams and maintain a dominant presence in the entertainment industry. Finally, Disney’s high-quality content provides significant opportunities for cross-promotion and synergy across its various businesses. The integration of characters and storylines from films into merchandise, theme park attractions, and television shows creates a seamless and immersive experience for consumers.

- Experienced Management Team

Disney’s experienced management team plays a crucial role in the company’s success and shapes its strategic direction. Disney has built a leadership team that possesses a wealth of industry knowledge, expertise, and a deep understanding of the company’s unique brand and culture, over its years of existence. Many of the company’s executives have spent their careers in the entertainment and media industry, gaining valuable insights and building relationships that contribute to Disney’s success. The company’s experienced management team has a strong track record of executing successful strategies. Finally, Disney’s team has the ability to adapt and embrace new technologies and platforms. They have successfully navigated the digital transformation and capitalized on emerging opportunities, such as the launch of Disney+, the company’s streaming service.

Disney Weaknesses

The following are weaknesses that may undermine Disney’s domination in the entertainment industry:

- Dependence on specific franchises

While Disney boasts a vast portfolio of beloved franchises and characters, its heavy reliance on a few specific properties, such as Star Wars and Marvel, introduces inherent risks and challenges. Overdependence on other key brands can leave the company vulnerable to changes in consumer preferences and market trends. This is because the taste of the audience can shift, and what may be in high demand today might lose relevance or face saturation in the future. Also, an overdependence on specific franchises can lead to a lack of innovation and risk-taking. If a significant portion of Disney’s resources, attention, and creative talent is dedicated to a few franchises, other potentially promising projects may receive less focus or investment.

- High Operating Costs

The advantages of Disney’s diversified portfolio are numerous; however, the substantial expenses associated with its operations create challenges that must be addressed. One of the primary factors contributing to Disney’s high operating costs is the maintenance and operation of its theme parks and resorts worldwide. These iconic destinations, such as Disneyland and Walt Disney World, require extensive infrastructure, regular maintenance, and a large workforce to ensure optimal guest experiences. Also, the production and distribution of high-quality content is another reason for Disney’s high operating costs. Whether it’s producing blockbuster films, developing television shows, or creating animated features, Disney invests substantial financial resources in pre-production, production, marketing, and distribution. These costs include talent fees, production equipment, special effects, marketing campaigns, and the global distribution of films and television content. Finally, Disney is committed to technological innovation and advancement, hence the company’s considerable investments in research and development to enhance its theme park experiences, develop cutting-edge visual effects for its films, and improve its digital platforms. These factors increase Disney’s operation costs, taking a toll on the company’s profitability and pricing strategies.

- Dependence on Partnerships and Licensing Agreements

Despite Disney’s vast array of beloved characters and franchises, a significant portion of its intellectual property is licensed by external entities. This is a weakness of the company because reliance on licenses introduces a level of uncertainty, limitations, and potential restrictions. It limits Disney’s autonomy and flexibility in fully leveraging its intellectual property. Also, the costs associated with licensing agreements can be huge. Disney often pays significant fees and royalties to secure the rights to use popular characters and franchises from other companies. These financial obligations can eat into the company’s profitability and overall financial performance. In conclusion, relying heavily on licenses limits Disney’s ability to fully control and shape the creative direction of its intellectual property.

- Potential overexposure to certain markets

Although Disney has established a strong global presence, an overreliance on specific markets, such as the United States of America, can leave the company vulnerable to adverse changes or disruptions specific to those regions. Disney’s potential overexposure to specific markets creates a high level of dependency on the economic conditions and trends within those regions. It also limits the company’s ability to diversify its revenue streams and mitigate risks. Finally, consumer trends and preferences are constantly changing, and different markets may exhibit diverse patterns of consumption. By focusing heavily on specific markets, Disney may miss opportunities to tap into emerging trends or cater to the evolving needs and desires of consumers in other regions.

- Vulnerability to economic downturns

Regardless of a company’s financial and marketing prowess, economic fluctuations can have a profound impact on its business. Disney’s business model heavily relies on consumer spending, which is susceptible to changes in the economic landscape. During economic downturns, consumers often tighten their budgets and prioritize essential expenses over discretionary spending on entertainment and leisure activities. Also, economic downturns can affect Disney’s advertising and marketing budgets, which play a crucial role in promoting the company’s content and products. This reduction in advertising budgets can limit Disney’s ability to reach its target audience effectively. The consequences of this are reduced consumer awareness, lower engagement, and a decline in demand for Disney’s products.

Disney Opportunities

The following are opportunities that Disney can exploit to continue dominating the entertainment industry:

- Expansion into New Markets

As a global entertainment powerhouse, Disney has the potential to tap into untapped markets, reach new audiences, and diversify its revenue streams. Expanding into new markets will allow Disney to access a larger consumer base and increase its global presence. By entering new geographical regions, Disney would be opening doors to new revenue streams and growth opportunities. Also, expansion into new markets will help Disney to capitalize on emerging trends and cultural shifts. Finally, new markets present Disney with opportunities for strategic partnerships and collaborations. With this, the company can diversify its risk and reduce dependence on specific regions.

- Increased Demand for Online Content

Disney’s subscription video-on-demand and over-the-top streaming service, known as Disney+, is one of the company’s famous product offerings. As the world increasingly embraces digital platforms and streaming services, Disney has the potential to capitalize on the growing appetite for online entertainment. The shift towards online consumption presents Disney with a vast and expanding audience base. The rise of streaming services and digital platforms allows Disney to have greater control over the distribution and monetization of its content. Through its streaming platform, Disney has direct access to its audience, and this approach provides Disney with more flexibility, allowing it to experiment with various pricing models, release strategies, and content formats.

- Strategic Acquisitions

Disney has the potential to expand its business and enhance its capabilities through targeted acquisitions, as a renowned entertainment company. Strategic acquisitions allow Disney to broaden its portfolio of intellectual property, characters, and franchises. Also, Disney can gain access to new technologies, distribution channels, and expertise, through its acquisitions. In addition, acquisitions can foster synergy and collaboration among different entities within the Disney ecosystem. Finally, strategic acquisitions can help Disney diversify its revenue streams and reduce dependency on specific business segments.

- Investment in original content

While Disney depends on specific franchises for the majority of its content, the company has the potential to create and produce compelling original content that captivates audiences around the world. Investing in original content will allow Disney to differentiate itself in a highly competitive entertainment landscape, thereby creating a strong brand identity. Disney can exercise full creative control by producing content in-house and maintaining artistic integrity. This creative autonomy allows Disney to craft compelling narratives, develop complex characters, and deliver high-quality productions that resonate with audiences of all ages. Also, investment in original content strengthens Disney’s intellectual property portfolio. It provides the company with flexibility and adaptability in meeting changing consumer preferences.

- Technological advancements

As an entertainment industry leader, Disney has the potential to leverage emerging technologies to enhance its offerings, reach new audiences, and create immersive experiences. Technological advancements allow Disney to push the boundaries of storytelling and entertainment experiences. With advancements in visual effects, animation, and virtual reality, Disney can create more captivating and realistic worlds for its audiences. Also, technology provides new avenues for content distribution and engagement. With the rise of streaming platforms, mobile devices, and smart TVs, Disney can reach audiences directly and deliver its content anytime, anywhere. In conclusion, technology provides data-driven insights that can inform Disney’s decision-making and optimize the company’s operations.

Disney Threat

The following are the threats to Disney’s dominance in the entertainment industry:

- Stiff Competition

Disney is a renowned entertainment company that operates in a highly competitive industry where rivals continuously vie for market share and consumer attention. The entertainment industry is characterized by intense competition from both traditional and emerging players. Major studios, streaming platforms, and content creators are constantly striving to capture audiences and deliver compelling content. The rise of digital platforms and social media has also given smaller content creators and influencers the ability to reach large audiences directly. Therefore, the competitive landscape increases the pressure on Disney to continually produce high-quality and innovative offerings that can stand out in a crowded market.

- Technological Disruptions

Rapid technological advancements can disrupt traditional business models and consumer preferences in a dynamic landscape. Technological disruptions can alter how content is created, distributed, and consumed. Emerging technologies such as virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) have the potential to disrupt the entertainment industry further. If Disney fails to adapt to these disruptions, it may result in a decline in audience reach and revenue generation. Technological advancements have also empowered content creators and independent studios to produce high-quality content at lower costs. Therefore, this might empower emerging creators and pose a threat to Disney’s dominance, as they capture the attention of younger demographics and challenge the traditional model of content production and distribution.

- Piracy and unauthorized distribution

As a renowned entertainment company with a vast library of intellectual property, Disney faces the ongoing challenge of combating piracy and unauthorized distribution of its content. Piracy undermines the revenue streams of Disney’s content. Unauthorized distribution of movies, TV shows, and other forms of entertainment through torrent websites, streaming platforms, and unauthorized streaming devices deprive Disney of the revenue it would have otherwise generated from legitimate sales and licensing deals. Also, piracy dilutes the value of Disney’s intellectual property. The illegal availability of Disney’s content diminishes its exclusivity and diminishes the perceived value associated with its brands.

- Regulatory challenges

Disney is a global entertainment company operating in various jurisdictions; therefore, the company must navigate a complex web of regulations and compliance requirements. Each jurisdiction has its own set of rules and regulations governing content creation, distribution, intellectual property rights, labor practices, and data privacy. As a result, Disney needs significant resources, expertise, and an understanding of local laws to comply with these regulations. Drastic changes in these regulations and government policies can impact Disney’s business strategies and profitability. It could also limit Disney’s creative freedom and impact its ability to cater to diverse audiences.

- Talent retention and competition

Disney relies on a diverse range of talented individuals to create and deliver its world-class content and experiences. Therefore, the intense competition for skilled professionals poses a threat to Disney’s ability to attract and retain top talent. This potentially leads to a loss of creative vision, industry knowledge, and fresh perspectives that are essential for staying relevant and appealing to audiences. Talent retention is closely tied to organizational culture and employee satisfaction. Disney’s ability to provide a supportive, inclusive, and engaging work environment will directly impact its talent retention efforts. As a result, the company must continuously invest in fostering a positive culture that values creativity, collaboration, and professional growth.

Conclusion

Disney, with its iconic brand recognition, diversified portfolio, strong financial position, high-quality content and intellectual property, and experienced management team, has built a solid foundation for success. However, the company also faces several challenges that must be addressed to ensure the continuity of growth and development. By leveraging its strengths, capitalizing on opportunities, and proactively addressing weaknesses and threats, Disney can continue to enchant audiences, innovate, and shape the future of entertainment.