CarMax originated in 1993 in Richmond, Virginia, initially operating under Circuit City Stores, Inc. Today, it boasts 238 locations nationwide and thrives in the used car marketplace. Interestingly, CarMax expanded its footprint to include new car franchises over the years, although it sold its last new vehicle dealership in 2021.

CarMax’s presence is undeniable as a publicly traded company (NYSE: KMX). With a staggering revenue of $18.95 billion and a net income of $2.37 billion in FY2021, it’s an influential player in the market.

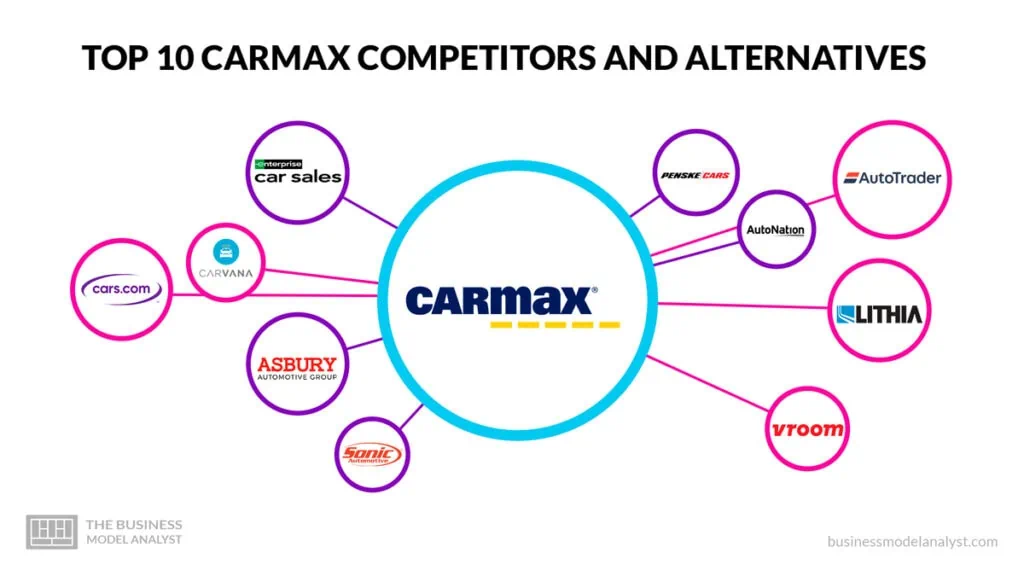

However, the beauty of any marketplace lies in its competition, and the used car market is no exception. Several companies offer consumers choices and experiences, enriching market dynamics. That’s what this blog post aims to address. We will explore the entities that compete with CarMax, offer distinct services, or approach the used car market differently.

From the well-established AutoNation to relative newcomers like Vroom and Carvana, we’ll walk you through various alternatives. We’ll also visit some unique platforms, including Auto Trader and Cars.com, which have significantly reshaped the online used car market since their launches in 1997 and 1998, respectively.

The traditional dealership models, like Lithia Motors and Penske Automotive Group, Inc., and even the enterprise car rental service, Enterprise Car Sales, won’t be overlooked. Remember, the goal isn’t to determine which company is superior, but rather to understand the various options available. This understanding can empower you to make the best choice when navigating the used car market.

Contents

AutoNation

AutoNation, based in Fort Lauderdale, Florida, is an auto retailer with a comprehensive presence in the US. H. Wayne Huizenga established this publicly traded company in 1996 as a small network of twelve AutoNation locations, and it has since expanded into a network of over 300 retail locations. As of 2022, it boasts an impressive revenue of $26.99 billion, an increase from the previous year, and employs over 21,000 people.

AutoNation made a name for itself by offering new and pre-owned vehicles and associated services in the United States. They created a unique position in the market by selling cars and investing in other areas of the auto industry.

For example, they acquired multiple companies in the car rental business, including National Car Rental, Spirit Rent-A-Car, Value Rent-A-Car, and Snappy Car Rental. This strategy made them a direct competitor to used car retailers like CarMax and rental car services.

They achieved a significant milestone in 2011 when they became the first auto retailer in the United States to sell 8 million vehicles, showcasing their extensive reach in the market. As of 2022, AutoNation had sold its 14 millionth vehicle in the United States, further emphasizing its dominant presence in the automotive industry.

What sets AutoNation apart from its competitors is its continuous drive for innovation. Notably, in January 2023, they acquired RepairSmith, a full-service mobile solution for automotive repair and maintenance, for $190 million. This move demonstrated their commitment to offering their customers a holistic auto service experience, underpinning their competitive edge in the market.

Penske Automotive Group, Inc.

Penske Automotive Group, Inc., otherwise known as PAG, is a giant in the world of transportation services and is considered one of the top automotive and commercial truck retailers globally.

PAG’s roots are in Bloomfield Hills, Michigan, but they’ve spread their wings far and wide. They have a significant presence in the United States, the United Kingdom, Canada, Germany, and Italy.

They deal with the distribution and retail of commercial vehicles, engines, and power systems, mainly in Australia and New Zealand.

One interesting thing to note about PAG is its sizable stake in Penske Transportation Solutions. They own 28.9% of this business, which manages a massive fleet of over 400,000 trucks, tractors, and trailers. This business offers innovative transportation, supply chain, and technology solutions for North American fleets.

They’re not just in the business of selling cars; they’re also big on commercial vehicles and trucks. Their customers range from individuals looking for a new ride to businesses needing a fleet of trucks. They’re part of the Fortune 500 and have several subsidiaries. One to highlight here is CarShop, which is a direct competitor to CarMax in the used car market.

PAG is a bit of a multitasker, juggling various aspects of the automotive and transportation services industries. This breadth gives them a competitive edge, but it also means they must stay on top of multiple areas to stay ahead. Their revenues hit US$22.8 billion in 2019, with a net income of US$470.3 million. They’re not a minor player in the market.

Sonic Automotive, Inc.

Sonic Automotive, headquartered in Charlotte, North Carolina, is a Fortune 500 company in the automotive retail industry. They deal in new and used vehicles, have some financing services thrown into the mix, and provide vehicle maintenance and repair services. Basically, they cover a lot of ground in the car business. CarMax and Sonic are all about allowing people to buy easy, hassle-free cars, but there are differences in how they do it.

Sonic Automotive operates through two segments: franchise dealerships and EchoPark. The franchised dealership segment sells new and used cars and light trucks across various brands. They’ve got a lot of brands under their belt, which means customers have a lot of choices.

Then there’s EchoPark, which is Sonic Automotive’s pre-owned vehicle segment. Now, this is where things get interesting for CarMax. EchoPark is designed to offer customers a whole new way to shop for pre-owned cars, which puts it in direct competition with CarMax’s used-car business. They aim to give customers a fast, transparent experience that is all about high quality.

Sonic Automotive is a big player in the automotive retail industry. They have over 100 dealerships spread across 13 states, representing around 25 different brands of cars and light trucks. They’re serious about what they do, and their reach is extensive.

Asbury Automotive Group

Founded in 1995, Asbury is based in Atlanta and runs auto dealerships throughout the United States. With 148 dealerships, 198 franchises, and a lineup of 31 brands from America, Europe, and Asia, Asbury stands as the third-largest automotive retailer in the United States as of March 2022.

Like CarMax, Asbury sells both new and used cars, so they’re in the same market. The main competition comes from used cars, where both companies try to outdo each other by offering customers the best deal. But Asbury has a broader scope, given its brand diversity and the fact that it sells new cars.

A key thing that makes Asbury stand out is their journey. They started small in 1995 and have spread their wings far and wide. Their expansion saw them purchase various dealerships, like Jim Nalley’s dealerships in Atlanta, Plaza Motors in St. Louis, and David McDavid’s Texas dealerships.

Later on, they moved to South Carolina, Arkansas, Mississippi, Oregon, and more. Today, they’re a recognized name in the car dealership business. In 2020, they launched Clicklane, their online platform for buying and selling new and used vehicles.

Asbury’s journey continued in 2021 when they acquired Larry H. Miller Dealerships, a Utah-based company, and its Total Care Auto (TCA) vehicle protection plan business. Not stopping there, they even acquired Stevinson Automotive Group in Denver, Colorado, in the same year.

Lithia Motors

Lithia Motors, a heavyweight in the automotive dealership industry, surely presents an interesting challenge for CarMax. Lithia, established way back in 1946, has made a name for itself as one of the largest vehicle dealerships in the United States. They’re a significant player in the market and definitely well-established, having been around for over 77 years.

This company’s headquarters are in Medford, Oregon, a place it’s been calling home since its early days. The brains behind the operation are Bryan DeBoer, president and CEO, and Sidney DeBoer, chairman.

In 2021, the company reported impressive revenues of $22.9 billion, an increase from previous years. With a whopping 21,150 employees as of 2022, Lithia Motors is a force to be reckoned with. They own and operate an extensive network of stores. As of May 2022, they had 267 stores spread across 24 states in the U.S., plus 14 in Canada.

Then, there are the numerous divisions under Lithia Motors, including Driveway, DCH Auto Group, Carbone Auto Group, Baierl Auto Group, Downtown LA Auto Group, Day Auto Group, and Prestige Auto Stores. These divisions represent various brands and offer various services, further enhancing Lithia’s competition with CarMax.

What’s interesting about Lithia Motors is its growth story. They started small, with just one dealership in 1946, and look at them now-they’re a publicly traded company on the NYSE and a part of the S&P 400. They’ve also made the Fortune 500 list multiple times, ranking #294 in 2018.

In terms of products, Lithia sells new and used cars from big names like General Motors, Chrysler, Toyota, Honda, Jaguar, Land Rover, BMW, Volkswagen, Mazda, and Porsche. They’ve even created an e-commerce platform called Driveway, which enables online used car sales, directly competing with CarMax’s digital presence.

To add more feathers to their cap, Lithia has received numerous awards, including Sports Illustrated’s All-Star Dealer Award and Time’s Quality Dealer Award. They were also ranked No. 9 on Automotive News’ list of the 125 largest U.S. dealership groups in 2013.

Carvana

Ernest Garcia III, Ryan Keeton, and Ben Huston co-founded Carvana, a public company that started operating in 2012. Based in Tempe, Arizona, it operates throughout the United States. Its core business is selling used cars online.

In 2022, they saw revenues of $13.6 billion but lost $1.6 billion. Despite this, their assets climbed to $8.70 billion. The main attraction of Carvana is its innovative approach to selling cars: online transactions and multi-story car vending machines. Their first vending machine popped up in 2013, and they’ve since expanded to 32 locations around the U.S. as of May 2022.

In 2017, Carvana leaped and went public, trading on the New York Stock Exchange under the ticker CVNA. That same year, they bought out their competitor, Carlypso, to ramp up their vehicle data and analytical tools. They also shelled out $22 million in 2018 to buy Car360, a company backed by Mark Cuban and known for its smartphone technology that captures 3D vehicle photos.

Carvana hit its stride during the COVID-19 pandemic, when car buyers shifted to online shopping. They rolled out touchless delivery and pickup, and their vehicle sales surged 25% in the second quarter of 2020, helping them rake in $1.12 billion in gross revenue.

In 2020, Carvana sold a whopping 244,111 vehicles, which brought them to second place as the largest online used-car retailer in the U.S. While CarMax has a combination of physical stores and an online presence, Carvana’s primarily online approach allows customers to buy a car without leaving their homes, an advantage in a world moving more towards digital transactions.

Auto Trader

Auto Trader is the UK’s top spot for buying and selling cars online. If you’ve ever dreamed of a specific car, you can find it on Auto Trader. Just like CarMax, Auto Trader is in the business of helping people buy and sell used (and new) cars. But unlike CarMax, they’re more of a middleman, linking buyers and sellers.

Auto Trader began its journey in 1977 as a magazine. But as the internet wave took over, they made the smart move to go digital in 1996. Since then, they’ve grown to become the UK’s largest digital automotive marketplace.

While CarMax has a mix of physical stores and an online platform, Auto Trader is primarily online-focused and has a wide range of vehicles listed on their platform, from budget-friendly to luxury ones.

Auto Trader makes money by charging sellers to advertise their vehicles on the platform. So, if you’re selling your car, you’d pay a fee to list it, reaching a massive audience of potential buyers.

While CarMax is huge in the U.S., AutoTrader is a big deal in the UK. Both platforms aim to simplify the car-buying and selling process but go about it differently. CarMax is more hands-on with physical inspections and owning and selling the inventory. Auto Trader, on the other hand, lets individual sellers and dealers list their cars, acting as a bridge between buyers and sellers.

Let’s keep it real, though: the automotive world is vast. Both CarMax and AutoTrader have their strengths and challenges. While Auto Trader doesn’t have physical stores like CarMax, their strong online presence and long history make them a force to reckon with in the UK car market.

Cars.com

Cars.com is an online automotive-classified platform firmly planted in the United States. Having launched in June 1998, this Chicago-based company is now considered the second-largest automotive classified site in the nation.

The business model of Cars.com intersects with CarMax in the sense that both facilitate car transactions. However, their approaches differ. CarMax operates physical stores and offers a curated car buying and selling experience, while Cars.com primarily acts as a digital bridge, connecting potential buyers with sellers.

In 2003, it received commendable feedback from a Library Journal survey, particularly for its comprehensive staff-written car reviews. It later partnered with Kelley Blue Book in 2004 and began national advertising, enhancing its brand visibility. By October 2007, the platform was poised for its most extensive marketing campaign and had announced a partnership with Yahoo! Autos.

Initially, Cars.com was owned by Classified Ventures, a consortium of large media enterprises, including Gannett, The McClatchy Company, Tribune, Graham Holdings, and A.H. Belo. However, in 2014, Gannett moved to acquire the stakes it did not already own in Classified Ventures for $2.5 billion.

The evolution of Cars.com did not stop there. It strategically acquired DealerRater, a dealer and service shop rating site, in July 2016. This decision added a new dimension to the platform by integrating user-generated reviews. In February 2018, Cars.com expanded its reach by acquiring Dealer Inspire, a digital marketing agency focused on automotive dealerships.

Cars.com’s vast online presence and strategic partnerships significantly influence the digital car shopping space. Its diverse offerings, encompassing listings, reviews, and dealer services, make it a formidable competitor for CarMax, particularly online.

Enterprise Car Sales

Enterprise Car Sales is a segment of the well-known Enterprise Holdings, primarily recognized for its car rental services through Enterprise Rent-A-Car. Both CarMax and Enterprise Car Sales sell used cars to consumers.

The cars that Enterprise Car Sales offers are typically sourced from their rental fleet. This gives them a distinct advantage, as the history of these vehicles is usually well documented since they’ve been under Enterprise’s care from the start.

One of Enterprise Car Sales’ significant offerings is its no-haggle pricing, ensuring a straightforward purchasing experience. Additionally, they provide a 7-day buyback policy, offering buyers peace of mind and confidence in their purchase.

While Enterprise Holdings has several other services, including Alamo Rent A Car and National Car Rental, the Enterprise Car Sales division directly competes with CarMax in the used car market.

Vroom

Vroom is an e-commerce company headquartered in New York City that specializes in selling, purchasing, and financing used cars online. Established in August 2013 by Kevin Westfall and Marshall Chesrown, the company began its journey as AutoAmerica. However, it underwent a significant transformation in 2014 when Elie Wurtman and Allon Bloch joined the team, rebranding the business as Vroom.

The company’s trajectory has seen notable highlights. In 2015, Vroom was recognized by Forbes as one of the hottest e-commerce startups. Further, solidifying its market presence, Vroom acquired Texas Direct Auto in the same year. This acquisition was pivotal in boosting Vroom’s revenue, which reached $900 million by the end of 2015.

Tom Shortt, Vroom’s current CEO, took over the leadership role from Paul Hennessy, a former CEO of Priceline.com. Under their combined leadership, the company has continued its upward trajectory despite facing challenges. In 2018, they scaled back some operations but subsequently secured a significant Series G financing round of $146 million, spearheaded by AutoNation.

One of Vroom’s standout features is its no-haggle pricing policy. The company offers a comprehensive e-commerce service covering all aspects of the transaction. Once a purchase is made, customers benefit from a 7-day money-back guarantee and a 90-day warranty.

Regarding financial backing, Vroom has successfully raised $440 million in funding. This includes investments from renowned firms and individuals such as AutoNation, General Catalyst Partners, and Cascade Investments (associated with Bill Gates).

While CarMax and Vroom operate within the used car sales sector, their business models differ. CarMax has a blend of physical and online presence, while Vroom is primarily an online platform, streamlining the digital age’s car buying and selling process.

Conclusion

CarMax stands tall in the used car industry, but it is not alone. Many competitors are vying for the same market share, each bringing their own flavor. As someone might prefer a cappuccino over a latte, consumers can choose where to buy or sell their cars.

Companies like AutoNation or Enterprise Car Sales offer various vehicles, often with attractive deals. Then there’s Vroom, which has made a name for itself by making the entire car buying and selling process online-friendly. And let’s not forget about local dealerships; they offer that personal touch, sometimes making customers feel more at home.

In the car game, it’s all about what suits you best. Whether price, service, or convenience, so if you ever think of looking beyond CarMax, there’s a whole world of options, from big-name players to the cozy dealer down the road.