The BlackRock business model is based on providing clients with a range of investment products and services, including mutual funds, exchange-traded funds (ETFs), and customized investment solutions. As a global investment management firm, BlackRock has become one of the most successful financial institutions in the world. With over $9 trillion in assets under management, the company has revolutionized the way investment management is conducted, and its business model has been a driving force behind its success.

The company’s unique approach to investment management has made it a household name in the financial world. Its success has led many to wonder how the company operates and what makes it so successful. Various key activities, including investment analysis and research, marketing, sales, and customer service, support BlackRock’s business model. These activities are all geared towards meeting the needs of its customers and ensuring that they receive the highest level of support and service.

Contents

A brief history of BlackRock

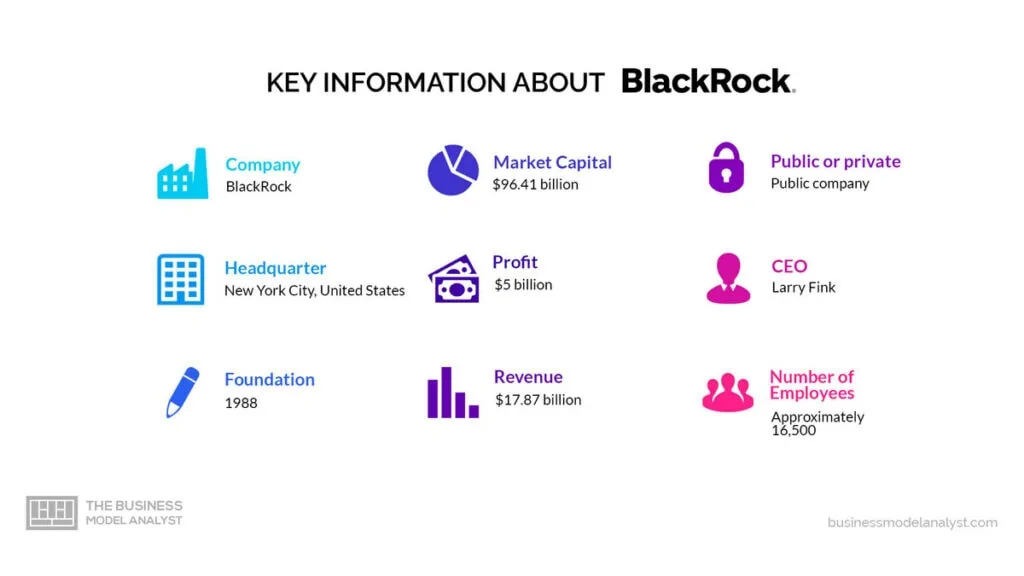

BlackRock was founded in 1988 by eight entrepreneurs, including Larry Fink, Susan Wagner, and Robert Kapito, with a vision of creating a firm that would use technology to revolutionize the investment management industry. Initially, the company focused on providing risk management and fixed-income investment solutions to institutional clients. Still, it quickly expanded its offerings to include equity strategies and investment products for retail investors.

Over the years, BlackRock continued to grow and evolve, making strategic acquisitions and expanding its global footprint. In 1995, the company merged with State Street Research & Management, which helped it access new markets and clients. In 1999, BlackRock went public, and the company’s shares began trading on the New York Stock Exchange. This move gave BlackRock the capital to continue its growth and expansion.

Who Owns BlackRock

As a publicly traded company, BlackRock is owned by its shareholders. The largest shareholders of BlackRock are institutional investors, such as mutual funds and pension funds. The company’s largest shareholder is The Vanguard Group, which owns approximately 6% of BlackRock’s outstanding shares. Other significant shareholders include BlackRock’s own investment products,

BlackRock Mission Statement

BlackRock’s mission statement is “to create a better financial future for our client.”

How BlackRock works

BlackRock is a global investment management company that provides a wide range of financial products and services to individuals, institutions, and governments worldwide. The company works by leveraging its expertise in the following areas:

Investment Management

BlackRock manages a variety of investment strategies across a wide range of asset classes, including equities, fixed income, multi-asset, and alternative investments. They offer these strategies to institutional and retail clients through various investment vehicles such as mutual funds, exchange-traded funds (ETFs), and separately managed accounts.

Risk Management

BlackRock uses sophisticated risk management tools and techniques to help clients manage their investment risks. The company has developed proprietary risk management models and software that enable it to monitor and analyze portfolio risk at a granular level.

Technology

BlackRock is a leader in developing and using financial technology (FinTech). The company uses technology to manage investments, analyze risk, and provide insights to clients. BlackRock also offers a range of FinTech solutions to other financial institutions, including Aladdin, its flagship investment management platform.

Sustainability

BlackRock is committed to integrating environmental, social, and governance (ESG) factors into its investment decisions. The company believes that companies with strong ESG profiles are more likely to generate sustainable long-term returns.

How BlackRock makes money

BlackRock makes money through several channels, including:

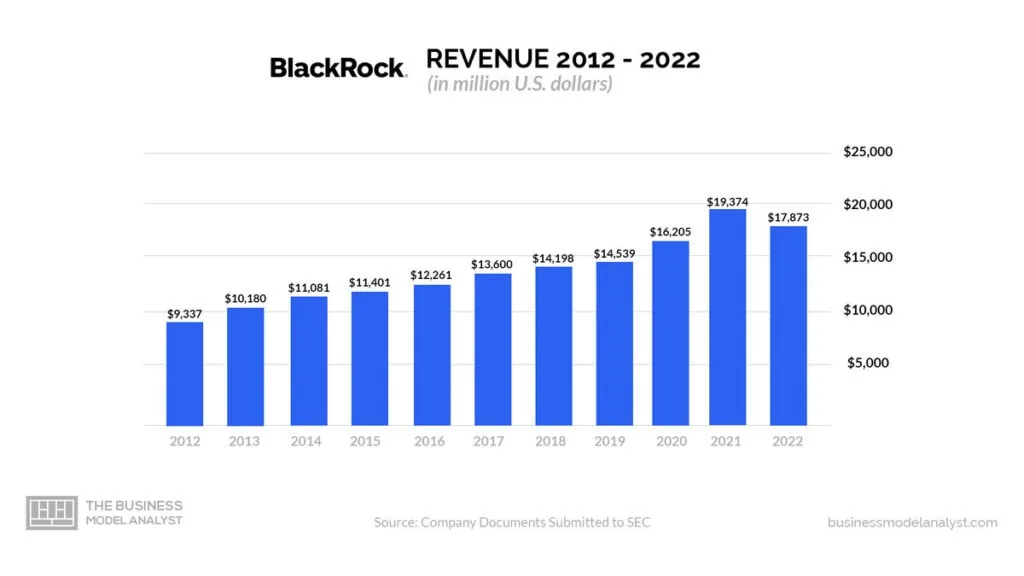

Investment Management Fees

BlackRock earns fees for managing client assets, which are charged as a percentage of assets under management (AUM). These fees can vary depending on the investment strategy type, the investment size, and the investment period’s length.

Performance Fees

BlackRock may also earn performance fees when specific investment strategies outperform their benchmark indexes. These fees are typically charged as a percentage of the outperformance or alpha generated by the strategy.

Services

BlackRock offers technology solutions to financial institutions, like the Aladdin investment management platform. BlackRock charges licensing fees for these services. BlackRock also earns advisory fees for investment advice to institutional clients, such as pension and sovereign wealth funds.

Commissions

BlackRock may earn commissions on trades executed on behalf of its clients, such as through its iShares exchange-traded fund (ETF) business.

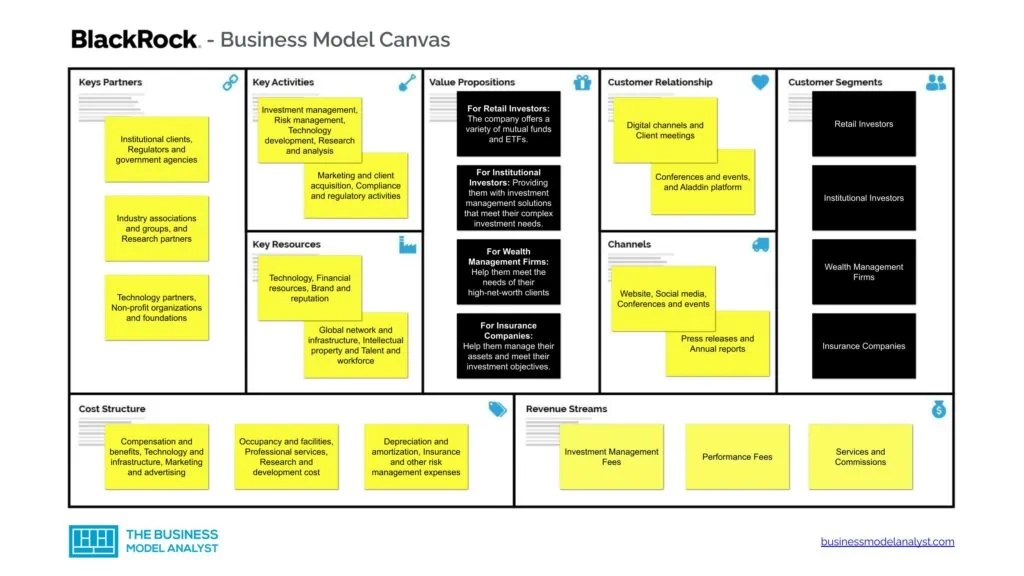

BlackRock Business Model Canvas

Let’s take a look at the BlackRock Business Model Canvas below:

BlackRock Customer Segments

BlackRock’s customer segments consist of:

- Retail Investors: These are individual investors who invest their personal savings in various financial instruments, such as stocks, bonds, and mutual funds. BlackRock offers a range of investment products, such as mutual funds and exchange-traded funds (ETFs), that are designed to meet the needs of retail investors;

- Institutional Investors: These are large organizations, such as pension funds, endowments, and foundations, that invest large amounts of money on behalf of their stakeholders. BlackRock provides institutional investors with a range of investment management solutions, including portfolio management, risk management, and advisory services;

- Wealth Management Firms: These are financial advisory firms that provide investment advice and financial planning services to high-net-worth individuals and families. BlackRock partners with wealth management firms to offer investment products and solutions that meet the needs of their clients;

- Insurance Companies: These are firms that provide insurance products, such as life insurance and annuities, to individuals and businesses. BlackRock partners with insurance companies to offer investment products and solutions that help them manage their assets and meet their investment objectives;

- Government Entities: These are entities at the federal, state, or local level that invest in various financial instruments to manage their assets and meet their financial obligations. BlackRock provides investment management solutions to government entities, including portfolio management and risk management services;

- Corporations: These are businesses that invest their corporate assets in various financial instruments to manage their assets and generate returns. BlackRock offers investment management solutions to corporations, including cash management, corporate bond investing, and risk management services.

BlackRock Value Propositions

BlackRock’s value propositions consist of:

- For Retail Investors: BlackRock’s value proposition to retail investors is centered around providing them with a range of investment products and solutions that meet their financial needs and help them achieve their investment goals. The company offers a variety of mutual funds and ETFs that are designed to provide investors with exposure to different asset classes, sectors, and regions, while also offering diversification and risk management features;

- For Institutional Investors: BlackRock’s value proposition to institutional investors is centered around providing them with investment management solutions that meet their complex investment needs and help them achieve their objectives. The company offers a range of investment management services, including portfolio management, risk management, and advisory services, that are designed to help institutional investors manage their assets, generate returns, and mitigate risk;

- For Wealth Management Firms: BlackRock’s value proposition to wealth management firms is centered around providing them with investment products and solutions that help them meet the needs of their high-net-worth clients. The company partners with wealth management firms to offer a range of investment solutions, including mutual funds, ETFs, and separately managed accounts, that are designed to meet the unique needs of high-net-worth individuals and families;

- For Insurance Companies: BlackRock’s value proposition to insurance companies is centered around providing them with investment management solutions that help them manage their assets and meet their investment objectives. The company offers a range of investment solutions, including fixed income, equities, and alternative investments, that are designed to help insurance companies generate returns, manage risk, and meet regulatory requirements;

- For Government Entities: BlackRock’s value proposition to government entities is centered around providing them with investment management solutions that help them manage their assets and meet their financial obligations. The company offers a range of investment solutions, including fixed income, equities, and alternative investments, that are designed to help government entities generate returns, manage risk, and meet their investment objectives;

- For Corporations: BlackRock’s value proposition to corporations is centered around providing them with investment management solutions that help them manage their cash, invest their corporate assets, and meet their investment objectives. The company offers a range of investment solutions, including cash management, corporate bond investing, and risk management services, that are designed to help corporations generate returns, manage risk, and meet their financial goals.

BlackRock Channels

BlackRock’s channels consist of:

- Website

- Social media

- Conferences and events

- Press releases

- Annual reports

BlackRock Customer Relationships

BlackRock’s customer relationships consist of:

- Digital channels

- Client meetings

- Conferences and events

- Aladdin platform

BlackRock Revenue Streams

BlackRock’s revenue streams consist of:

- Investment Management Fees

- Performance Fees

- Services

- Commissions

BlackRock Key Resources

BlackRock’s key resources consist of:

- Technology

- Financial resources

- Brand and reputation

- Global network and infrastructure

- Intellectual property

- Talent and workforce

BlackRock Key Activities

BlackRock’s key activities consist of:

- Investment management

- Risk management

- Technology development

- Research and analysis

- Marketing and client acquisition

- Compliance and regulatory activities

- Financial reporting and analysis

- Corporate strategy and development

- Partnership and collaboration management

BlackRock Key Partners

BlackRock’s key partners consist of:

- Institutional clients

- Regulators and government agencies

- Industry associations and groups

- Research partners

- Technology partners

- Non-profit organizations and foundations

BlackRock Cost Structure

BlackRock’s cost structure consists of:

- Compensation and benefits

- Technology and infrastructure

- Marketing and advertising

- Occupancy and facilities

- Professional services

- Research and development cost

- Depreciation and amortization

- Insurance and other risk management expenses

BlackRock Competitors

- Vanguard: Vanguard was founded in 1975 by John C. Bogle and is headquartered in Malvern, Pennsylvania. The company is known for its low-cost index funds and ETFs that track various market indexes. Vanguard is currently one of the largest investment management companies in the world, with over $7.2 trillion in assets under management. Vanguard competes with BlackRock by offering similar passive investment products at a low cost;

- State Street Global Advisors: State Street Global Advisors (SSGA) was founded in 1978 and is headquartered in Boston, Massachusetts. The company is known for its ETFs, which include the SPDR S&P 500 ETF (SPY), the first ETF ever introduced in the market. SSGA competes with BlackRock in the ETF space, offering similar products and services;

- Fidelity: Fidelity is a large investment management and financial services company founded in 1946 and headquartered in Boston, Massachusetts. The company offers a range of investment products and services, including mutual funds, ETFs, and advisory services. Fidelity competes with BlackRock by offering both active and passive investment products;

- JPMorgan Chase: JPMorgan Chase is a large financial services company offering various products and services, including investment management. JPMorgan Asset Management competes with BlackRock by providing a range of investment products, including ETFs and mutual funds;

- Goldman Sachs: Goldman Sachs is a global investment banking and financial services company founded in 1869 and headquartered in New York City. The company offers a range of investment products and services, including asset management. Goldman Sachs Asset Management competes with BlackRock by offering a range of investment products, including mutual funds, ETFs, and alternative investments.

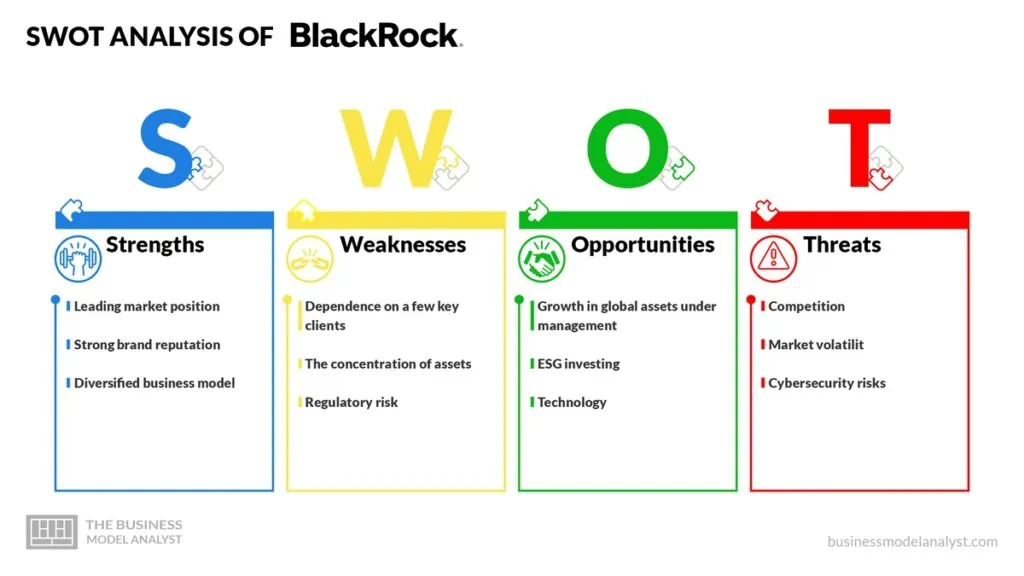

BlackRock SWOT Analysis

Below, there is a detailed SWOT analysis of BlackRock:

BlackRock Strengths

- Leading market position: BlackRock is the world’s largest asset management firm, with over $9.5 trillion in assets under management. This scale gives the company significant advantages, including economies of scale, a broad range of investment products, and a global reach. BlackRock can offer its clients access to a diverse range of investment opportunities across asset classes and geographies;

- Strong brand reputation: BlackRock has built a strong reputation for innovation, risk management, and client service. Its iShares exchange-traded funds (ETFs) have been very successful, and the company has won many awards for its investment products and services. This reputation helps the company attract and retain top talent, as well as build long-term relationships with institutional and retail clients;

- Diversified business model: BlackRock offers a broad range of investment products and services, including active and passive strategies, alternative investments, and advisory services. This diversified business model helps the company weather market volatility and enables it to serve a wide range of client needs. Additionally, the company has made significant investments in technology to better serve clients and improve efficiency.

BlackRock Weaknesses

- Dependence on a few key clients: Despite having a large and diverse client base, BlackRock heavily depends on a few key clients for a significant portion of its revenue. Losing one or more of these clients could have a significant impact on the company’s financial results;

- The concentration of assets: While BlackRock’s large scale is a strength, it also creates concentration risks. The company has a significant portion of its assets under management in its largest funds, which could lead to outflows if performance suffers or investors decide to move their money elsewhere;

- Regulatory risk: BlackRock is subject to increased regulatory scrutiny as a large and influential player in the financial markets. Regulation changes could impact the company’s operations, profitability, and reputation.

BlackRock Opportunities

- Growth in global assets under management: BlackRock is well-positioned to benefit from the trend of increasing global wealth and the growing demand for investment products. The company has a strong presence in emerging markets and has the potential to expand further in these regions;

- ESG investing: BlackRock has been a leader in promoting environmental, social, and governance (ESG) investing. This trend is likely to continue, and the company could benefit from the growing demand for sustainable investment products;

- Technology: BlackRock has made significant investments in technology, which could enable the company to improve its investment processes, enhance client service, and create new business opportunities

BlackRock Threats

- Competition: BlackRock faces significant competition from other asset managers, including Vanguard, State Street, and Fidelity. This competition could lead to fee compression, outflows, and reduced profitability;

- Market volatility: BlackRock’s business is heavily dependent on market performance. Market volatility could lead to outflows, reduced revenue, and lower profitability;

- Cybersecurity risks: As a large financial services firm, BlackRock is vulnerable to cybersecurity risks. A breach could result in significant financial losses, regulatory fines, and reputational damage.

Conclusion

BlackRock’s business model has proven to be incredibly successful in the world of investment management. By leveraging technology, data analytics, and a focus on passive index investing, BlackRock has become one of the world’s largest and most powerful financial firms.

BlackRock’s business model has transformed the investment management industry, and its influence will likely continue for years. As the company continues to innovate and adapt to changing market conditions, it will be interesting to see what new developments and challenges lie ahead for this industry leader.