Affirm is a financial technology company that provides consumers with a simple, flexible, and transparent way to finance purchases. The company is one of the leading Buy Now, Pay Later (BNPL) solutions in the United States of America. As a BNPL service, Affirm allows shoppers to split their purchases into smaller, fixed payments over a set period, typically from a few weeks to several months.

Affirm operates as a point-of-sale (POS) lender, allowing consumers to split their purchases into smaller, fixed installments. Using Affirm is fast and straightforward. When making a purchase online or in-store, customers can choose Affirm as their payment option during checkout.

They then provide some basic information and the company assesses the customer’s creditworthiness in real-time and provides a decision on the loan, often within seconds. Once approved, consumers can select the payment plan that best suits their needs, and the total purchase amount is divided into equal installments.

Affirm charges no hidden fees or late penalties, making it a convenient and transparent way to pay for larger expenses without incurring excessive debt. Also, unlike traditional credit cards, the company does not rely on complex fee structures or compounding interest. Customers are presented with a clear breakdown of the total cost of their purchase, including interest (if applicable), before committing to the loan.

Since Affirm does not operate like traditional credit cards, how does it make money? The company generates revenue primarily through interest and fees charged to customers. The interest rates are based on the credit risk of the customer and the repayment term chosen. While Affirm partners with various merchants to offer its services, it also earns a portion of the transaction fees charged to these retailers for providing alternative payment options to their customers.

Affirm offers several benefits to consumers, making it an appealing choice for a wide range of shoppers. The company provides transparent and fair financing that allows consumers to fully understand the cost of their purchases before committing to a payment plan. It also makes budgeting easy for its customers by breaking down larger expenses into manageable installments. These methods all promote responsible spending and help consumers make informed financial decisions.

Affirm was founded in 2012 by the cofounder of PayPal, Max Levechin, Nathan Gettings, Jeffrey Kaditz, and Alex Rampell. The company was started as a part of the initial portfolio of HVF, a startup studio.

Ukrainian-American software engineer and businessman Max Levechin co-founded Affirm out of his desire to create a more transparent and responsible alternative to traditional credit options. His vast background in the financial technology sector helped Affirm recognize and correct the shortcomings of conventional credit cards and loans.

Affirm quickly gained traction, and its vision appealed to investors and partners alike. In its early days, the company secured significant funding from venture capital firms, including Founders Fund, Khosla Ventures, and Lightspeed Venture Partners. This financial backing allowed Affirm to accelerate its growth and expand its operations.

In 2017, Affirm launched its consumer app that allowed loans for purchases at any retailer. The app has since been downloaded over 10 million times, and Affirm has processed over $10 billion in loans. To make its services widely accessible, Affirm focused on forming partnerships with various online retailers and e-commerce platforms such as Walmart, Shopify, BigCommerce, etc.

By integrating its platform with these e-commerce stores, Affirm enabled customers to choose its financing option during checkout. This strategic approach not only expanded Affirm’s customer base but also provided merchants with a competitive edge by offering a transparent and consumer-friendly financing solution.

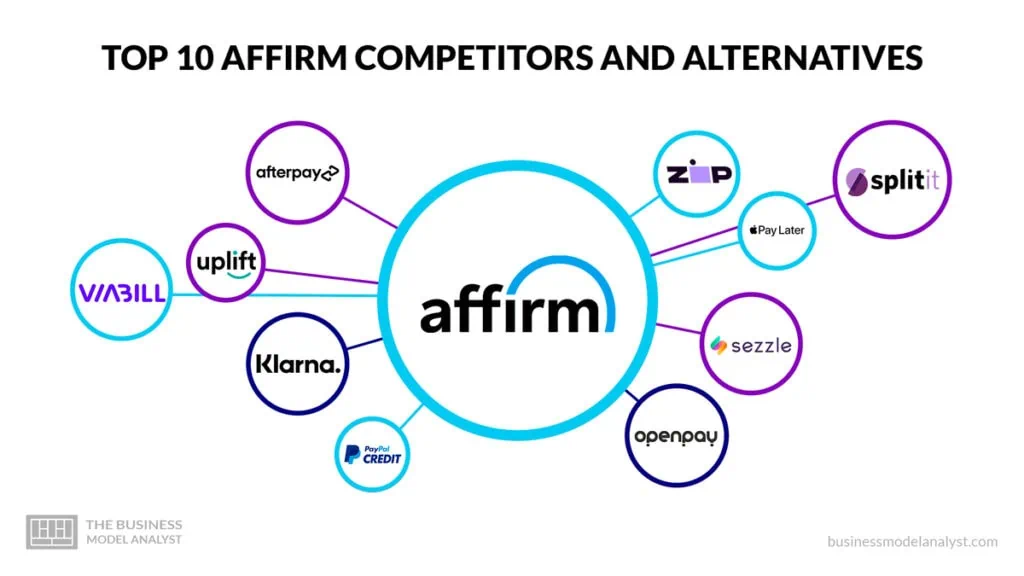

Throughout its history, Affirm has faced competition from various fintech companies such as Afterpay, Klarna, PayPal credit, QuadPay, etc., offering similar point-of-sale financing solutions. Some of these competitors may even offer better services and incentives compared to Affirm. Therefore, we will be examining the best alternatives and competitors to Affirm in the financial technology industry.

Contents

Afterpay

Afterpay is one of the leading buy now, pay later (BNPL) providers in the world and a solid competitor of Affirm. Like Affirm, the company offers installment loans that allow consumers to purchase goods and services now and pay for them over time. Afterpay is a capable alternative that may meet the needs of people looking to use a BNPL service other than Affirm.

Afterpay was founded in 2014 by Australian entrepreneur, Nick Molnar and his then-neighbor, Anthony Eisen. The company quickly became one of the most popular BNPL providers in the world. Afterpay’s business model centers on providing consumers with an interest-free alternative to credit cards.

When purchasing through Afterpay, customers can split their total cost into four equal installments, paid over six weeks. These installments are automatically deducted from the customer’s linked debit or credit card.

The two companies have unique selling points, attracting different customer segments. Afterpay’s strength lies in its simplicity and ease of use, while Affirm’s emphasis on transparency appeals to those seeking more detailed information about their financing options.

Afterpay with a larger market share does not charge interest, unlike Affirm. However, the company charges late fees for late payments, which Affirm does not. Affirm provides more flexible product options, as customers can repay their loans for up to 36 months, compared to Afterpay’s policy of 4 equal payments over 6 weeks.

Afterpay and Affirm both operate in the fiercely competitive BNPL sector. While Afterpay originated in Australia and quickly expanded globally, Affirm initially gained prominence in the United States and extended its reach to international markets.

Klarna

Klarna is another top competitor that provides a similar service to Affirm. Klarna was founded in Sweden in 2005, and it quickly became one of the most popular BNPL providers in the world. The company started as an online payment service but has since evolved into a comprehensive fintech platform.

At its core, Klarna offers a BNPL service, allowing consumers to make purchases and split payments into four interest-free installments over six weeks. Klarna also provides longer-term financing options with interest for larger purchases, giving customers greater flexibility in their payment choices. Klarna does not charge interest on its loans, and it only charges a late fee if a payment is not made on time.

The key features and benefits of Klarna include multiple Payment Options, simplified checkout, personalized shopping, retailer partnerships, Klarna credit card, etc. Klarna issues a co-branded credit card that customers can use for BNPL transactions, as well as traditional credit purchases. Its versatile platform allows users to choose from multiple payment methods, including one-time payments, interest-free installments, or credit-based financing.

The service collaborates with a vast network of online retailers worldwide, making its BNPL service widely available to consumers. In addition, Klarna’s app offers personalized product recommendations and exclusive deals based on users’ shopping behavior, enhancing the customer experience.

As two of the leading players in the BNPL sector, Klarna and Affirm compete for market share, each boasting unique features that appeal to different customer segments. Klarna’s extensive international presence, especially in Europe, has given it an edge in global reach. Affirm, on the other hand, has made significant strides in the U.S. market, forging partnerships with major retailers and expanding its user base.

PayPal Credit

PayPal Credit is a buy now, pay later (BNPL) product offered by the well-known payment giant PayPal. It is a digital credit line that allows customers to make purchases online and in-store and pay them off over time. PayPal Credit is one of the most popular BNPL products in the world, with over 20 million active users.

The service functions like a traditional credit card but is integrated directly into the PayPal platform. When using PayPal Credit, customers enjoy a period of interest-free financing if they pay off the entire balance within a specified time frame, typically six months or more.

PayPal Credit was formerly known as Bill Me Later, and it was purchased by PayPal in 2008. It was later rebranded to PayPal Credit in 2013. PayPal Credit offers a variety of BNPL plans, including 2-month financing, 6-month financing, and 12-month financing. The company also offers a line of credit that can be used for any purchase. PayPal Credit does not charge interest on its loans, but it does charge a late fee if a payment is not made on time.

PayPal Credit is a competitive BNPL product for Affirm. It offers a variety of plans to fit different needs, and it does not charge interest on its loans. Its key features include seamless integration, promotional financing, online and offline use, payment flexibility, enhanced security, etc. PayPal’s extensive user base and widespread acceptance among merchants give PayPal Credit a competitive edge, especially for online purchases.

PayPal Credit is a more established BNPL provider than Affirm. The service has been around for over 10 years, and it has over 20 million active users. It is also a more conservative BNPL provider than Affirm. The service does not charge interest on its loans; it only charges a late fee if a payment is not made on time. Affirm, on the other hand, may charge interest on its loans, and it may also charge late fees. Therefore, PayPal is a formidable competitor and a considerable alternative to Affirm.

Zip Co

Zip Co is one of the key players in the buy now, pay later (BNPL) industry. Founded in Australia in 2013, the service has swiftly become a leading BNPL provider. Zip Co offers a simple and convenient BNPL plan, and it partners with a wide range of merchants. It allows consumers to split their purchases into four equal payments over six weeks. There are no interest charges, and there is only a $6 late fee if you miss a payment.

Zip Co offers a range of financing options to consumers, including Zip Pay, Zip Money, and Zip Business. Zip Pay allows customers to make interest-free purchases and split payments into manageable installments. Zip Money, on the other hand, offers interest-free periods for larger purchases, and Zip Business targets small and medium-sized enterprises, providing them with flexible payment solutions.

As the BNPL sector experiences rapid growth, Zip Co and Affirm compete for market share, each with its unique approach to consumer financing. Zip Co’s diverse financing offerings and strong presence in Australia have given it an advantage in the local market. Affirm, on the other hand, has made significant strides in the United States, forging partnerships with major retailers and expanding its user base.

Regarding the competition between the two BPNL giants, Zip Co is a more straightforward BNPL provider than Affirm. While Zip Co does not offer as many features as Affirm, it is easier to use. Affirm, on the other hand, offers more features, such as longer BNPL terms and the ability to build your credit history.

Sezzle

Sezzle is a rapidly growing BNPL platform that allows consumers to split their purchases into interest-free installments. The company’s model centers around offering a “Shop Now, Pay Later” experience, giving users more control over their finances. When purchasing through Sezzle, customers can spread their total cost into four equal installments, paid over six weeks.

Sezzle was founded in 2016 by Charlie Youakim and Paul Paradis. Sezzle is a relatively new BNPL provider compared to Affirm, but it has quickly grown to become one of the most popular in the United States. The company partners with over 30,000 merchants, including major retailers such as Target, Walmart, and Nike.

The service’s plan is simple and easy to use. When you checkout with Sezzle, you can choose to split your purchase into four equal payments. There are no interest charges, and there is only a $7 late fee if you miss a payment.

Sezzle’s most significant appeal lies in its interest-free installment plan, making it an attractive alternative to traditional credit cards. It operates a real-time credit check process that does not affect users’ credit scores.

This makes it a popular option for individuals cautious about their credit history. Sezzle integrates with various online retailers, allowing for a smooth and efficient checkout experience. Once a purchase is made, Sezzle automatically deducts the installments from the user’s linked debit or credit card, simplifying the repayment process.

Splitit

As a buy now, pay later (BNPL) service gain, Splitit offers flexible payment options. The service differentiates itself from traditional BNPL services by leveraging the power of existing credit cards. When using Splitit, consumers can split their purchases into interest-free installments over time, without the need for additional credit checks or financing applications. Unlike other BNPL providers, Splitit does not lend money. Instead, it facilitates the installment process through the user’s existing credit card.

Splitit was founded in 2012 and is headquartered in London, UK. Its BNPL plan is unique in that it allows consumers to split their purchases into up to 24 equal payments. This is in contrast to other BNPL providers, which typically only offer 4 or 6 equal payments. Splitit’s longer payment terms give consumers more flexibility and make it easier to afford large purchases.

Splitit also offers a unique feature called “Installment Builder.” This feature allows consumers to customize their BNPL plan by choosing the number of payments, the amount of each payment, and the due date for each payment. This gives consumers even more control over their BNPL payments. Other features include interest-free financing, wide credit card acceptance, budget flexibility, etc.

Splitit’s unique approach of leveraging existing credit cards sets it apart, appealing to consumers who want to avoid new credit applications. The service positions itself as a better alternative and a more flexible BNPL provider for consumers who need to afford large purchases.

OpenPay

OpenPay is a rapidly growing BNPL platform that focuses on providing users with flexible payment solutions. It was founded in 2013 by Yaniv Meydan and Richard Broome and is headquartered in Melbourne, Australia. The company allows customers to make purchases and spread the total cost into interest-free installments over time. OpenPay supplies online and in-store purchases, offering users a seamless and straightforward payment experience.

The key features and benefits of OpenPay include its interest-free installments, vast merchant network, customizable repayment schedules, etc. Users have the freedom to choose their preferred payment schedule with OpenPay. This grants them greater control over their budgets. OpenPay is inclusive, supplying to a broad range of customers, including those without credit history or with suboptimal credit scores.

OpenPay and Affirm find themselves in competition, each targeting different market segments. OpenPay’s emphasis on in-store purchases and accessibility appeals to a diverse customer base. On the other hand, Affirm’s transparent financing and extensive retailer network have helped it establish a significant presence in the United States and beyond.

OpenPay is a more focused BNPL provider. It primarily targets small businesses, while Affirm targets both small businesses and consumers. This means that OpenPay has a deeper understanding of the needs of small businesses, and it can offer them more tailored BNPL solutions.

On the other hand, Affirm is a more established BNPL provider. It has been in operation for longer than OpenPay and has a larger customer base. This means that Affirm has more data on its customers, and it can offer them more personalized BNPL solutions.

ViaBill

ViaBill is a rapidly growing fintech company that specializes in providing consumers with flexible payment options. The company was founded in 2010 and is headquartered in Aarhus, Midtjylland, Denmark. ViaBill’s platform allows users to split purchases into interest-free installments, making it an attractive buy now, pay later (BNPL) option. The service provides online shoppers, offering seamless integration with various e-commerce platforms.

ViaBill’s BNPL plan is simple and easy to use. When a customer makes a purchase, they are given the option to pay in installments. The customer enters their credit or debit card information, and ViaBill immediately charges them the first installment. The remaining installments are then charged at regular intervals, typically every two weeks. ViaBill partners with a wide range of merchants, including major retailers such as Amazon, Zalando, and Nike.

While ViaBill competes with Affirm for market share, the service has its own unique selling points (USP). Viabill’s appeal lies in its interest-free installment plans and no credit checks, making it accessible to a diverse customer base. On the other hand, Affirm attracts consumers seeking transparent financing and comprehensive information before making a financial commitment.

Apple Pay Later

Apple Pay Later is Apple’s foray into the buy now, pay later (BNPL) sector. The service is available to Apple Pay users in the United States who are approved. It allows Apple Pay users to split their purchases into interest-free monthly installments.

Apple Pay Later features two distinct plans: “Apple Pay in 4” for smaller transactions, and “Apple Pay Monthly Installments” for more significant purchases. The latter offers extended repayment periods with a fixed interest rate.

To use Apple Pay Later, approved users simply have to select Apple Pay as their payment method at checkout. Then, they choose to pay later and enter their Apple ID password. They will be able to see their payment schedule and make payments through the Wallet app. Apple Pay Later is a fee-free service, and there are no extra fees if payments are made on time. However, if a payment is missed, users will be charged a late fee of $7.50.

Apple Pay Later leverages the power of the Apple ecosystem to attract its vast user base, offering interest-free installments and extended financing options. While the service offers similar services to other BNPL providers, it has different features and terms that may make it a suitable alternative for many people.

Uplift

Uplift is a buy now, pay later (BNPL) provider that offers fixed-rate loans for travel purchases. Founded in 2014, the company offers a simple and convenient BNPL plan, and it partners with a wide range of travel merchants, including major airlines, hotels, and car rental companies.

Uplift focuses on providing travel financing solutions, allowing customers to book flights, hotels, and other travel experiences with flexible payment plans. The service partners with various travel agencies and travel providers to integrate its financing platform directly into their booking processes. This allows travelers to select Uplift as a payment option during checkout and spread their travel expenses into affordable monthly installments.

Uplift’s BNPL plan is simple and easy to use. When a customer purchases an airline ticket, they are given the option to finance their purchase with Uplift. The customer then enters their credit or debit card information, and Uplift will approve them for a loan based on their creditworthiness. The customer will then have up to 24 months to repay the loan.

Uplift is in direct competition with Affirm within the travel financing space. However, Uplift’s focus on supplying exclusively to the travel industry positions it as a specialized solution for wanderlust-driven consumers seeking seamless travel financing options. On the other hand, Affirm’s broad retailer network extends its reach into the travel sector, offering travelers more choices when financing their journeys.

Conclusion

In conclusion, the fintech landscape has witnessed a significant rise in competition, giving rise to numerous Affirm competitors and alternatives. Some of these competitors have unique value propositions and innovative features that reshape how consumers approach payments and financing.

From flexible buy now, pay later options to specialized financing solutions for various industries, these companies provide diverse needs and preferences. Some of them also empower seamless travel bookings, support businesses with simplified B2B payments, and offer transparent financing for online shopping. All of these make some Affirm competitors suitable alternatives that provide consumers with greater control over their finances.