The Visa Business Model is based on the connection with businesses, banks, financial institutions, and consumers with fast and reliable Electronic services. It is a fact that Visa is generally associated with credit cards, debit cards, and prepaid cards, but what most people do not know is that the company’s business model does not issue debit or credit cards, extend credit, or set rates and fees for consumers.

Credit debit and prepaid cards are then issued by financial institutions working with Visa, as Visa acts as an intermediary that connects consumers with financial institutions and more. In addition, according to Statista, Visa ranks 7th with a brand value of US$191.03 billion.

Contents

A brief history of Visa

A lot of people know Visa and probably have 2-3 Visa credit cards, but they don’t know the history or how Visa actually started. For starters, Visa is a global digital payment technology company that provides services to individuals, financial institutions, government entities, and merchants. Visa started in 1958 as “Bankamericard” after being launched by “The Bank of America” as the first Multi purpose Consumer Credit Card. It was initially based in the United States for middle-class consumers and small, mid-sized merchants. Still, It did not take too long for the company to expand internationally in 1974, and in 1975 debit cards were introduced, and visa became an independent entity.

In 1976, Bank Americard was renamed to Visa by the company’s founder, it was also said that the term “Visa” was used because of the ease of pronunciation in different languages, which then signifies universal acceptance.

Later, in 1979, Visa introduced the use of an electronic transaction authorization system whenever a transaction is made with a Visa card.

In 1986, Visa joined the PLUS ATM network, providing its cardholders with convenient access to cash. Visa also sponsored its first Olympics in Seoul, South Korea, and Calgary, Alberta, in 1988.

After that, in 1994, Visa obtained an interlink, providing the ability to offer online banking services globally also in 1995, Visa announced it would merge some of its business and become a public company, Visa Inc.

Visa released the Visa mobile platform in 2008 in an effort to accelerate the adoption of mobile payments and value-added services and provide ease in their services.

Who Owns Visa

Dee Ward Hock was the founder and CEO of Visa, and then he retired in 1984 and was succeeded by Charles T. Russell.

Alfred F. Kelly Jr. is the present CEO of visa after he was elected by the board of directors.

Their top shareholders include Rajat Taneja, Alfred F. Kelly, Vasant M. Prabhu, Vanguard Group Inc., BlackRock Inc., and T. Rowe Price Associates Inc.

Visa Mission Statement

Visa’s mission statement is, “To connect the world through the most innovative, reliable, and secure payments network, enabling individuals, businesses, and economies to thrive.”

How Visa works

Through its electronic payment services, Visa connects consumers, merchants, and financial institutions. In other words, when a consumer makes a purchase using a Visa card, the transaction is sent to the merchant’s bank for authorization. The acquiring bank then transmits the transaction to Visa for processing. After the transaction has been approved, the money is then transferred from the consumer’s bank account (the “issuing bank”) to the merchant’s bank account (the “acquiring bank”)

Is Visa Safe?

Visa employs a variety of fraud-detection and risk-management tools to make sure your transactions are safe, thus, the answer is yes.

Visa also provides other payment options, such as contactless, mobile, and online transactions. These alternatives enable users to make purchases using their Visa card, mobile device, or virtual Visa card number for online transactions.

How Visa makes money

Visa makes money through several different income streams, and these include:

Interchange Fees

When a transaction is completed using a Visa card, the merchant is required to pay a fee known as an interchange fee to the bank that issued the card. These fees are normally calculated as a percentage of the total transaction value, and they are used to cover the costs of processing and maintaining the cardholder’s account.

Service Fees

Visa charges financial institutions and merchants service fees for access to its electronic payment network. These fees cover the cost of network maintenance and upgrades, as well as the provision of services such as data analytics and fraud detection.

Data Processing Fees

For the processing and settlement of transactions on its network, Visa levies data processing fees. These fees pay for the maintenance of the data centers, as well as the hardware and software required for transaction processing.

International Transaction Fees

Visa imposes international transaction fees on cross-border transactions. These fees cover the expenses related to converting currencies and adhering to international laws.

Other Fees

Visa charges other fees, such as annual fees, for various account types and services. Additionally, Visa generates revenue through investments and business partnerships.

Visa makes money through the fees it charges financial institutions and merchants for accessing its network, as well as the fees it charges consumers who use Visa-branded cards. Additionally, the corporation generates income through interest, foreign exchange, and other sources.

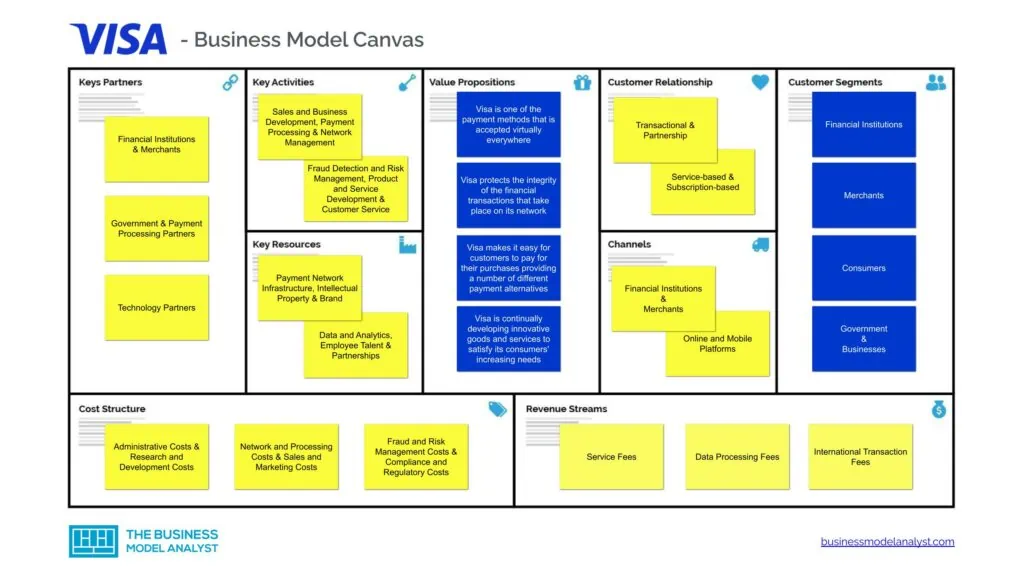

Visa Business Model Canvas

Here’s an analysis of Visa’s business model canvas.

Visa Customer Segments

Visa’s customer segments consist of:

- Financial Institutions: Visa’s principal clients are financial institutions like banks, credit unions, and other lenders. These institutions issue Visa-branded credit and debit cards to their customers and pay Visa to access its electronic payment network;

- Merchants: Visa is a widely accepted means of payment at Merchants and retailers of all sizes, including supermarkets, department shops, and internet merchants. In addition to costs for network access and other services, these merchants pay Visa a fee for each transaction done with a Visa card;

- Consumers: The primary users of the Visa payment network are consumers. They make purchases at millions of merchants throughout the world using Visa-branded credit and debit cards;

- Government: Social welfare payments, tax refunds, and other government-to-person transfers are also disbursed using Visa’s payment network;

- Businesses: Visa assists businesses of all kinds, from small firms to multinational corporations, by offering a variety of commercial payment solutions. These options include commercial credit cards, virtual account numbers, and other goods and services that assist businesses in managing and controlling their costs.

Visa Value Propositions

Visa’s value propositions consist of:

- Global Reach: Visa is one of the payment methods that is accepted virtually everywhere, due to the fact that the Visa payment network is recognized by millions of businesses throughout the world. This enables customers to use their Visa cards to make transactions everywhere Visa is accepted, regardless of whether they are shopping at home or while traveling abroad;

- Security: Visa protects the integrity of the financial transactions that take place on its network using a wide range of fraud detection and risk management tools. This includes more advanced analytics, tokenization, encryption, and any other security measures that are necessary to safeguard against fraud and transactions that are not permitted;

- Convenience: Visa makes it easy for customers to pay for their purchases with their Visa cards or mobile devices by providing a number of different payment alternatives. These include contactless payments, mobile payments, and internet payments;

- Innovation: Visa is continually developing innovative goods and services to satisfy its consumers’ increasing needs. It also collaborates with other businesses to incorporate innovative technologies and services, such as biometric verification and real-time payment processing, into its payment network;

- Customer Support: Visa offers customer service to its financial institution and merchant partners, assisting them in navigating the complex world of payments and supplying them with the tools and resources necessary to run and expand their companies.

Visa Channels

Visa’s channels consist of:

- Financial Institutions

- Merchants

- Online and Mobile Platforms

Visa Customer Relationships

Visa’s customer relationships consist of:

- Transactional

- Partnership

- Service-based

- Subscription-based

Visa Revenue Streams

Visa’s revenue streams consist of:

- Service Fees

- Data Processing Fees

- International Transaction Fees

Visa Key Resources

Visa’s key resources consist of:

- Payment Network Infrastructure

- Intellectual Property

- Brand

- Data and Analytics

- Employee Talent

- Partnerships

Visa Key Activities

Visa’s key activities consist of:

- Sales and Business Development

- Payment Processing

- Network Management

- Fraud Detection and Risk Management

- Product and Service Development

- Customer Service

Visa Key Partners

Visa’s key partners consist of:

- Financial Institutions

- Merchants

- Government

- Payment Processing Partners

- Technology Partners

Visa Cost Structure

Visa’s cost structure consists of:

- Administrative Costs

- Research and Development Costs

- Network and Processing Costs

- Sales and Marketing Costs

- Fraud and Risk Management Costs

- Compliance and Regulatory Costs

Visa Competitors

Visa’s competitors are a combination of payment networks and digital platforms that offer similar services to consumers, financial institutions, and merchants. They include:

- China UnionPay: China UnionPay is a state-owned enterprise in China that manages a payment network and offers debit and credit cards. In the Chinese market, it competes with Visa and Mastercard, and it is also expanding internationally;

- Mastercard: Mastercard is one of the primary competitors to Visa. Mastercard, like Visa, maintains a global payment network and provides consumers, financial institutions, and merchants with credit and debit card services;

- American Express: American Express is another significant rival to Visa. The company maintains its own payment network and provides consumers and companies with credit and debit card services;

- Alipay and WeChat Pay: Alipay and WeChat Pay are digital wallet systems provided by the Chinese firms, Ant Financial and Tencent, respectively. They are extensively utilized in China and offer digital payment solutions that compete with Visa and Mastercard in the Chinese market;

- PayPal: PayPal is a digital payment network that enables consumers and organizations to electronically send and receive payments. It competes with Visa and Mastercard in the electronic payment industry, particularly in e-commerce and peer-to-peer transactions.

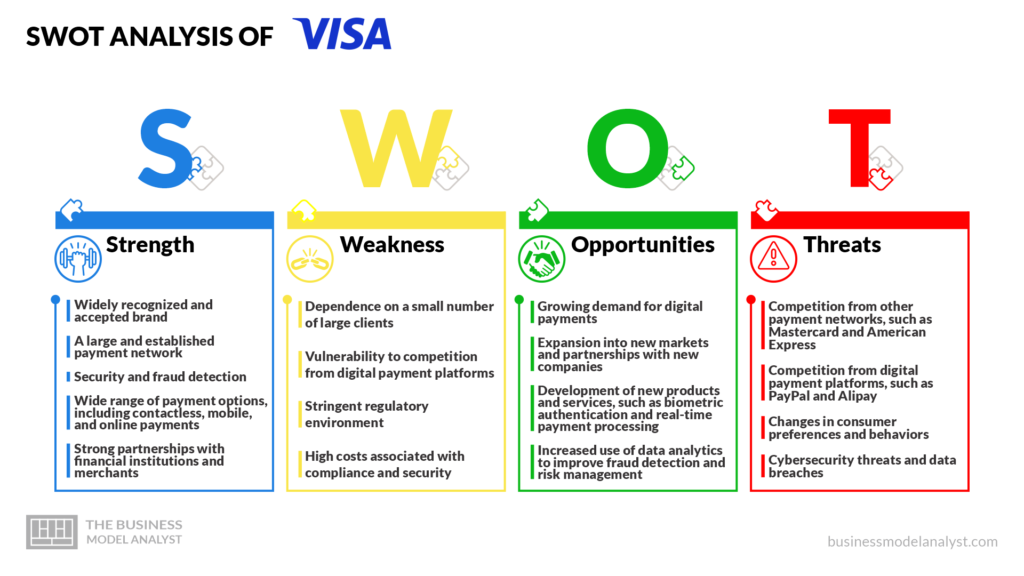

Visa SWOT Analysis

Here’s a breakdown of Visa’s SWOT analysis:

Visa Strengths

- Widely recognized and accepted brand: Visa boasts a powerful brand that is globally known and accepted. This makes it simple for customers to trust and use Visa’s payment network, giving the corporation an industrial advantage;

- A large and established payment network: Visa offers a global payment network that is broad and well-established. This enables the organization to conduct a high volume of transactions, which is advantageous for both consumers and merchants;

- Security and fraud detection: Visa places a significant emphasis on security and the detection of fraud. This aids in protecting the financial information of customers and preventing fraudulent transactions. This is especially relevant in an industry where data breaches are becoming increasingly common;

- Wide range of payment options: The vast range of payment options includes contactless, mobile, and online payments;

- Solid partnerships: Financial institutions and merchants have strong ties with Visa

Visa Weaknesses

- Dependence on a small number of large clients: Visa depends a lot on a small number of big customers, like banks and merchants. This makes it possible for the company to lose these clients, which can have a big effect on its income;

- Vulnerability to competition from digital payment platforms: Digital payment platforms like PayPal and Alipay could be a threat to Visa. The traditional payment industry has been shaken up by these platforms, and people are using them more and more;

- Stringent regulatory environment: Visa works in an industry with a lot of rules, and it has to follow strict rules about data security and privacy. These rules can be expensive to follow, and they can also make it harder for a company to come up with new products and services;

- High costs associated with compliance and security.

Visa Opportunities

- Growing demand for digital payments: Digital payments are becoming more popular quickly, which gives Visa a chance to grow its business and get a bigger share of the market. Visa has a big chance to make money off of the fact that more and more people are moving away from cash and checks;

- Expansion into new markets and partnerships with new companies;

- Development of new products and services: Biometric authentication and real-time payment processing, to mention a few

- Data Intelligence: Increased use of data analytics to improve fraud detection and risk management.

Visa Threats

- Payment Networks Competition: Other payment networks, such as Mastercard and American Express, are definitely the biggest rivals to Visa;

- Payment Platforms Competition: Digital payment platforms, such as PayPal and Alipay, are constant threats to Visa;

- Changes in consumer preferences and behaviors: Visa is vulnerable to changes in consumer preferences and behaviors. Visa may need to modify its products and services in order to remain competitive as technology, and the change of consumer preferences;

- Cybersecurity: Cybersecurity threats and data breaches.

Conclusion

Visa is a global leader in the electronic payments business, with a widely acknowledged and recognized payment network, a strong emphasis on security and fraud detection, a broad selection of payment alternatives, and strong partnerships with financial institutions and merchants. Despite experiencing challenges and competition, it has growth opportunities and continues to innovate and adapt to market changes and consumer demands, placing it well for continued industry success.