Venmo is a digital wallet and online payment service that allows users to transfer money to others using a mobile phone app. The Venmo business model is based on providing a convenient and secure platform for users to send and receive money, and it makes money by charging a small fee for certain transactions. Venmo’s popularity has grown rapidly in recent years, particularly among younger users who appreciate the simplicity and social features of the app.

Contents

A brief history of Venmo

Venmo is a mobile payment app that allows users to easily send and receive money from others. The company was founded in 2009 by two friends, Iqram Magdon-Ismail and Andrew Kortina, who were inspired to create a more seamless and social way to pay each other back for shared expenses.

Before Venmo, the process of sending money to friends and family often involved awkward exchanges of cash or checks, which could be inconvenient and time-consuming. Magdon-Ismail and Kortina saw an opportunity to create a digital platform that would make it easy for people to transfer money to each other using their smartphones.

They launched Venmo in 2009 as a way for users to quickly and easily send money to each other using their phone numbers. The app was initially only available on iOS, but it soon expanded to Android and other platforms. In 2012, Venmo was acquired by Braintree, a payment processing company that was later acquired by PayPal.

Despite the changes in ownership, Venmo has remained a popular app among users, particularly younger generations who appreciate the app’s social features. In addition to its core money transfer functionality, Venmo allows users to see their friends’ transactions, comment on them, and even “like” them. This social aspect of the app has helped to drive its popularity and make it a household name.

Today, Venmo is used by millions of people around the world to easily and securely send and receive money. The company’s founders, Magdon-Ismail and Kortina, continue to be involved in the development of the app, and their vision of a more convenient and social way to pay has been realized through the success of Venmo.

Who Owns Venmo

Venmo is owned by PayPal, a global online payment company. Following PayPal’s acquisition of Braintree, the parent company of Venmo, in 2013, Venmo has been incorporated into the company’s suite of financial services. The app continues to operate as a standalone product, offering users a convenient and social way to send and receive money using their smartphones.

Venmo’s Mission Statement:

Venmo’s mission statement is “to change people’s relationships with money and each other.”

How does Venmo Work

Venmo is a mobile payment platform that allows users to easily transfer money to each other using their smartphones. To use Venmo, users must first create an account and link it to a bank account or debit card. Once the account is set up, users can send and receive payments from other Venmo users by entering the recipient’s name or phone number. Venmo also offers the option to split bills or payments with friends, making it a convenient option for group outings or shared expenses. The platform also offers the ability to add notes or emojis to transactions, creating a social aspect of the payment experience. Overall, Venmo offers a simple and convenient way for users to manage their peer-to-peer payments.

How Venmo makes money

Venmo generates revenue through its “Pay with Venmo” feature, which allows users to pay for online purchases using their Venmo balance or linked bank account. The company earns a fee for each instant transfer, interchange, and withdrawal, as well as interest on users’ cash balances. Venmo also charges fees for cashing checks and for its cashback program, which rewards users for making purchases at participating retailers. In this way, Venmo leverages its popular app and user base to monetize its services and continue to grow its business.

Pay with Venmo

Pay with Venmo is a feature that allows Venmo users to pay for purchases at participating online retailers using their Venmo balance or linked bank account. This feature is similar to PayPal’s “Pay with PayPal” option, and it provides users with a convenient way to pay for their online purchases without having to enter their payment information each time.

Venmo makes money from Pay with Venmo in several ways. Firstly, the company charges a small fee for certain transactions made using the feature. This includes a 3% fee for using a credit card to pay.

Additionally, Venmo may earn interest on the balances of users who have money in their Venmo account and opt to use that balance to make a purchase through Pay with Venmo. The company may also generate revenue through partnerships and collaborations with retailers who offer the Pay with Venmo option on their websites.

Overall, Pay with Venmo is a valuable source of revenue for Venmo, providing the company with a convenient and secure way to monetize its popular payment app.

Instant transfers

Instant transfer is a feature on Venmo that allows users to quickly and easily transfer money from their Venmo account to a linked bank account. This feature is useful for users who want to access their funds as soon as possible, without having to wait for the standard two-day processing period.

Venmo makes money from instant transfers by charging a fee for each transfer. This fee is typically 1% of the transferred amount, with a minimum fee of $0.25 and a maximum fee of $10. For example, if a user transfers $100 from their Venmo account to their bank account using the instant transfer feature, they will be charged a fee of $1.

Interchange and withdrawal fees

Interchange and withdrawal fees are charges that Venmo may apply when users use certain payment methods or bank accounts to send and receive money. These fees are typically a percentage of the transaction amount, and they are paid to the financial institutions that facilitate the transactions.

For example, if a user sends money to another Venmo user using a credit card, Venmo may charge a 3% interchange fee. This fee is paid to the credit card company, and it covers the cost of processing the transaction.

ATM withdrawal fees are charges that users pay when they withdraw cash from an ATM using their Venmo debit card. Venmo makes money from ATM withdrawal fees by charging a fee for each withdrawal. This fee is, typically, $2.50, although it may vary depending on the ATM operator. When a user makes a withdrawal at a bank teller, they will be charged a $3.00 fee in addition to any fees that the bank may charge for the withdrawal. This fee is typically deducted from the user’s Venmo account balance, and it is non-refundable.

Cash a Check

Venmo’s “Cash a Check” feature allows users to deposit a physical check into their Venmo account using the app on their smartphone. This feature is useful for users who want to quickly and easily deposit a check without having to visit a bank or ATM.

Venmo makes money from the “Cash a Check” feature by charging a fee for each check that is deposited. This fee is typically around 1% of the check amount, with a minimum fee of $0.25 and a minimum check amount of $5. For example, if a user deposits a check for $100 using the “Cash a Check” feature, they will be charged a fee of $1.

Cashback program

Venmo’s Cashback program is a rewards program that allows users to earn cashback on their purchases at participating retailers. When a user makes a purchase using their Venmo account, they may be eligible to receive a percentage of the purchase amount back in the form of cashback.

Venmo makes money from the Cashback program through partnerships and collaborations with retailers. The company may earn a commission on each purchase made using the program, as well as a share of the cashback rewards that are distributed to users.

In addition to generating revenue from partnerships, the Cashback program may also help to increase user engagement and loyalty, as users may be more likely to use Venmo for their purchases in order to earn cashback rewards.

The Cashback program is a valuable source of revenue for Venmo, providing the company with a way to monetize its app and reward users for their loyalty and engagement.

Cash interest

Venmo makes money from cash interest by earning interest on the funds in users’ accounts. When a user has money in their Venmo account, the company may earn interest on that balance.

Venmo may also earn interest on the funds in users’ accounts when they use the app to make purchases or transfer money to others. In this case, the company may hold the funds temporarily in a holding account, where they can earn interest until the transaction is completed.

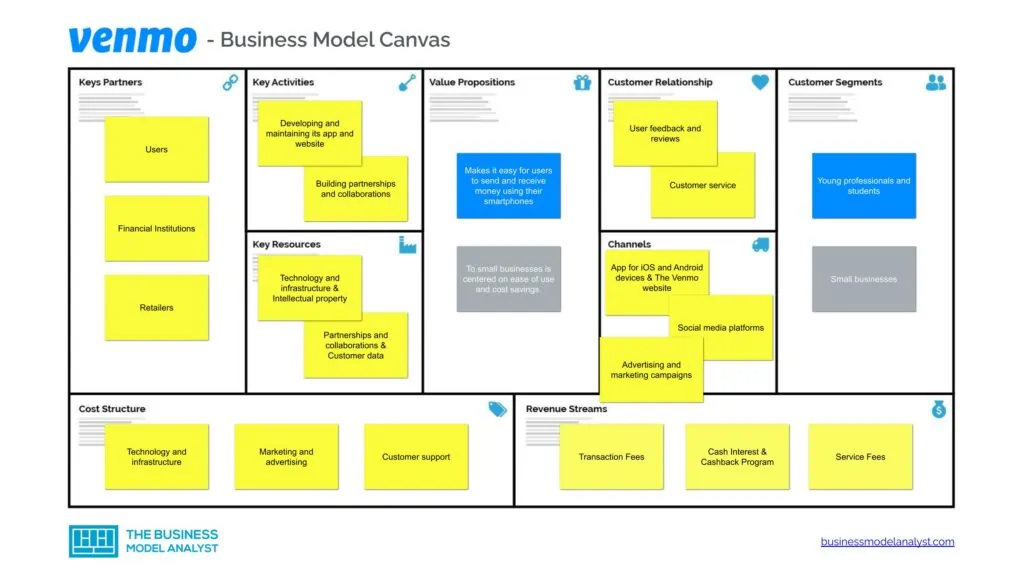

Venmo’s Business Model Canvas

The Venmo Business Model can be explained in the following business model canvas:

Venmo’s Customer Segments

Venmo customer segments consist of:

- Young professionals and students: These individuals often have a need for a simple and convenient way to send money to friends and family, and Venmo’s app offers an easy-to-use solution. The app’s social features, such as the ability to add comments and emojis to transactions, also appeal to this segment, as they allow them to share their payments with friends and family in a fun and engaging way;

- Small businesses: The app’s ability to accept payments from customers and transfer funds to employees makes it a useful tool for businesses that need a simple and convenient way to manage their finances. The app’s user-friendly design and social features also make it appealing to small businesses that want to create a positive and engaging experience for their customers.

Venmo’s Value Propositions

Venmo value propositions consist of:

- Young professionals and students: Venmo’s value proposition for young professionals and students is centered on convenience and social connection. The app makes it easy for users to send and receive money using their smartphones, eliminating the need for awkward exchanges of cash or checks. This convenience is particularly appealing to younger generations, who are used to conducting many aspects of their lives digitally.

In addition to its core payment functionality, Venmo also offers a range of social features that make it more fun and engaging to use. Users can see their friends’ transactions, comment on them, and even “like” them. This social aspect of the app allows users to connect with each other and share their experiences, making it more than just a payment app.

For young professionals and students, Venmo also offers a range of practical benefits. The app allows users to easily split expenses with friends and track their spending, making it a useful tool for managing their finances. Venmo also offers a debit card and a cashback program, which provide users with additional ways to access and use their funds. - Small businesses: Venmo’s value proposition to small businesses is centered on ease of use and cost savings. The app allows small businesses to easily accept payments from their customers using their smartphones, without the need for specialized equipment or expensive point-of-sale systems. This makes it a convenient and affordable option for small businesses, especially those that operate on a “cash-only” basis or do not have a traditional storefront.

In addition to its core payment functionality, Venmo also offers a range of features that are useful for small businesses. For example, the app allows businesses to track their sales, making it a useful tool for managing their operations. Venmo also offers a debit card for businesses, which allows them to easily access and use their funds, and it has partnerships with a number of major retailers who can attract users to the platform, providing small businesses with additional opportunities to reach new customers.

Venmo’s Channels

Venmo channels consist of:

- The Venmo app for iOS and Android devices

- The Venmo website

- Social media platforms, such as Facebook, Twitter, and Instagram

- Advertising and marketing campaigns

- Word-of-mouth and referrals from existing users

- Public relations and media coverage

- Events and partnerships with organizations

Venmo’s Customer Relationships

Venmo customer relationships consist of:

- The Venmo app

- Social media platforms

- Email and in-app notifications

- Customer service

- User feedback and reviews, which allow Venmo to gather and analyze customer opinions and use that information to improve the app and its features

- Promotions and rewards, such as cashback offers and referral programs

Venmo’s Revenue Streams

Venmo revenue streams consist of:

- Transaction Fees

- Cash Interest

- Cashback Program

- Service Fees

Venmo’s Key Resources

Venmo key resources consist of:

- Technology and infrastructure

- Intellectual property.

- Partnerships and collaborations

- Customer data

- Human resources

- Financial resources

- Physical resources

Venmo’s Key Activities

Venmo key activities consist of:

- Developing and maintaining its app and website

- Building partnerships and collaborations

- Marketing and advertising

- Providing customer support

- Processing and safeguarding transactions

- Collecting and analyzing data

- Managing its financial resources

- Ensuring compliance with regulations

- Day-to-day business operations

Venmo’s Key Partners

Venmo key partners consist of:

- Users

- Financial Institutions

- Retailers

- IT platform providers

Venmo’s Cost Structure

Venmo cost structure consists of:

- Technology and infrastructure

- Marketing and advertising

- Customer support

- Transaction processing

- Employee salaries and benefits

- Rent and office expenses

- Legal and regulatory compliance

Venmo’s Competitors

- PayPal: PayPal is a global online payment company and one of Venmo’s main competitors. Like Venmo, PayPal allows users to send and receive money using their smartphones, and it offers a range of payment services for consumers and businesses;

- Zelle: Zelle is a digital payment network that allows users to easily send and receive money from others using their bank accounts. It is available through a number of major banks and credit unions in the United States;

- Cash App: Cash App is a mobile payment app developed by Square, Inc. It allows users to send and receive money, pay bills, and buy and sell cryptocurrency. Cash App has become increasingly popular in recent years;

- Google Pay: Google Pay is a digital wallet and online payment service developed by Google. It allows users to pay for purchases online and in-store using their Android device, and it offers a range of features and services similar to those of Venmo;

- Apple Pay: Apple Pay is a digital wallet and mobile payment service developed by Apple Inc. It allows users to pay for purchases using their iPhone, iPad, or Apple Watch.

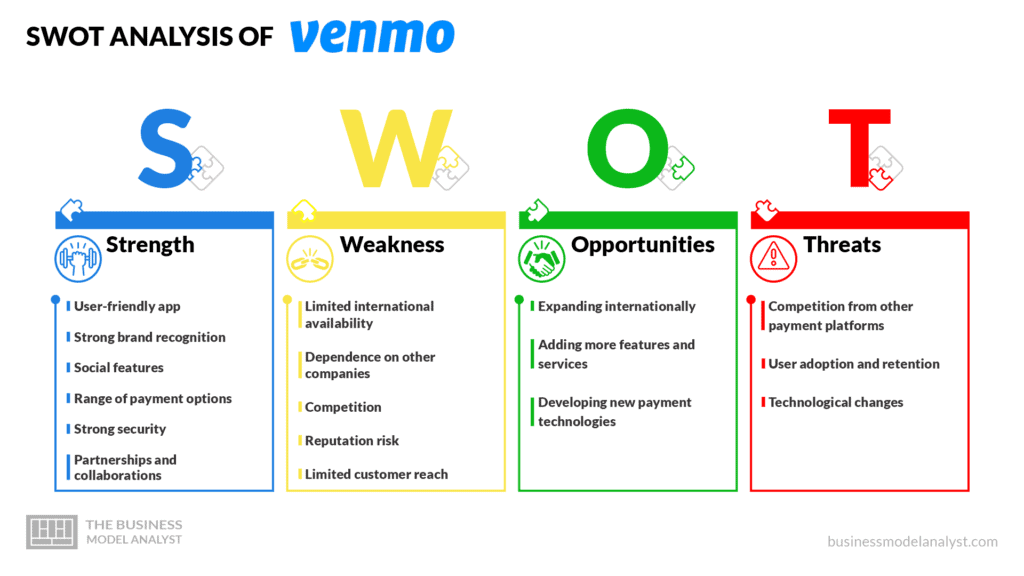

Venmo’s SWOT Analysis

Below, there is a detailed swot analysis of Venmo:

Venmo’s Strengths

- User-friendly app: Venmo’s app is easy to use and intuitive, making it accessible and convenient for users to send and receive money;

- Strong brand recognition: Venmo has built a strong brand and is well-known among consumers, particularly younger generations;

- Social features: Venmo’s app includes social features, such as the ability to comment on and “like” transactions, which make it more engaging and fun to use;

- Range of payment options: Venmo offers a variety of payment options, including instant transfers, credit and debit cards, and bank accounts, making it a versatile and flexible payment app;

- Strong security: Venmo uses advanced security measures to protect users’ personal and financial information, providing a safe and secure way to send and receive money;

- Partnerships and collaborations: Venmo has partnerships and collaborations with banks, retailers, and other companies, which provide the company with access to new customers and opportunities.

Venmo Weaknesses

- Limited international availability: Venmo is currently only available in the United States, limiting its global reach and appeal;

- Dependence on other companies: Venmo relies on partnerships and collaborations with banks, retailers, and other companies, which can be unpredictable and subject to change;

- Competition: Venmo faces competition from other digital payment apps, such as PayPal and Cash App, which may offer similar or superior features and services;

- Reputation risk: Venmo’s reputation is closely tied to its users’ experiences, and negative experiences or incidents could damage the company’s reputation and trust with its customers;

- Limited customer reach: Venmo has a relatively small customer base compared to other payment apps, limiting its potential for revenue.

Venmo’s Opportunities

- Expanding internationally: Venmo has already made strides in expanding its services outside the United States, with users in Canada and the United Kingdom. However, there is still potential for growth in other markets, particularly in Europe and Asia where mobile payment systems are becoming increasingly popular;

- Adding more features and services: Venmo currently offers a simple platform for peer-to-peer payments, but there is potential for the company to add more features and services to its platform;

- Developing new payment technologies: As mobile payment technologies continue to evolve, Venmo has the opportunity to develop and offer new payment options to its users. This could include integrating with emerging technologies like blockchain, etc.

Venmo’s Threats

- Competition from other payment platforms: Venmo faces competition from a variety of other payment platforms, including traditional players like PayPal and newer entrants like Square and Zelle. These competitors may offer similar or superior services, which could lead to users switching to these other platforms;

- User adoption and retention: Despite its popularity, Venmo still faces challenges in terms of user adoption and retention. The platform may not be as widely used as competitors, and users may not find it as convenient or necessary as other payment options;

- Technological changes: The world of mobile payments is constantly evolving, and Venmo must stay ahead of the curve in terms of technology and innovation. If the company fails to keep up with new developments, it may be left behind by competitors who are able to offer more advanced services.

Conclusion

Venmo has built a successful business model by offering a simple and convenient platform for peer-to-peer payments. The company has leveraged its large and growing user base to expand its services and explore new revenue streams. However, Venmo also faces challenges from competitors, security concerns, and regulatory issues. As the mobile payment industry continues to evolve, Venmo will need to stay ahead of the curve in terms of technology and innovation in order to maintain its position as a leader in the space.