Known as the “PayPal for the mobile era”, operating in 130 countries, with customers like Google, Amazon, Microsoft, and National Geographic, the Stripe Business Model and history calls the attention of business scholars. Stripe Business Model offers a fast, simple, and secure online payment solution for businesses. It can be incorporated into any website or mobile application, in order to avoid fraud and facilitate online purchases with credit or debit cards. Besides, as customers’ information is only accessible to Stripe, the fintech takes the whole responsibility for the payments. If you want to understand more about Stripe’s business model, keep following up.

Contents

A brief history of Stripe

Stripe is a young company, founded in 2010 by two also young prodigies: the Irish brothers Patrick and John Collison. Patrick, at only 16, was awarded the Young Scientist of the Year (for his work on Lisp programming language). He also had to leave high school earlier, in order to attend his Computer Science classes at MIT. On his side, John has the record of the highest score in the Irish Leaving Certificate (the last examination to qualify for university) and entered Harvard University for Computer Science too, another Ivy League institution.

At the beginning of his freshman year (2007), Patrick and John founded Auctomatic, an auction management system for marketplaces like Amazon and eBay. Auctomatic joined the winter batch of Y Combinator, a seed money startup accelerator. Some months later, the company would be acquired by Live Current Media for $5 mi — and Patrick became its Head of Product Engineering — at 19 years old. At that time, John was entering Harvard. The next year, John dropped out of Harvard and the two brothers started Stripe. Stripe’s first funding could not come from any other place than Y Combinator — actually by its founder, Paul Graham, who previously knew Patrick.

A little long later, the brothers met Peter Thiel and Elon Musk, founders of PayPal. The result was an investment of $2 million and great insights and orientation, according to Patrick. Stripe was finally launched in September 2011 and, five months later, raised another round of funding — $18 mi from Sequoia Capital, with participation from Affirm and PayPal.

In the following years, Stripe would expand its operation and product line, and its first clients included names like Lyft and Wish. In 2020, the coronavirus pandemic forced traditional companies to adapt to online sales, boosting Stripe’s path, which increased its valuation from $20 bi in 2019 to $95 bi the next year. Currently, Stripe works with more than one million businesses all over the world and employs over 4,000 people.

Who Owns Stripe

Stripe is still owned by its founders, the brothers Patrick and John Collison, with Patrick holding the position of the company’s CEO and John as the President.

Stripe’s Mission Statement

Stripe’s mission statement is “Our mission is to increase the GDP of the internet”.

How Stripe makes money

As a payment processing fintech, Stripe makes money by taking a percentage and a fixed fee (depending on the package selected) on every payment it processes. This multisided business model depends on two related clients:

- Customers: People who buy over the internet;

- Vendors: Businesses and organizations that receive web and mobile payments from customers.

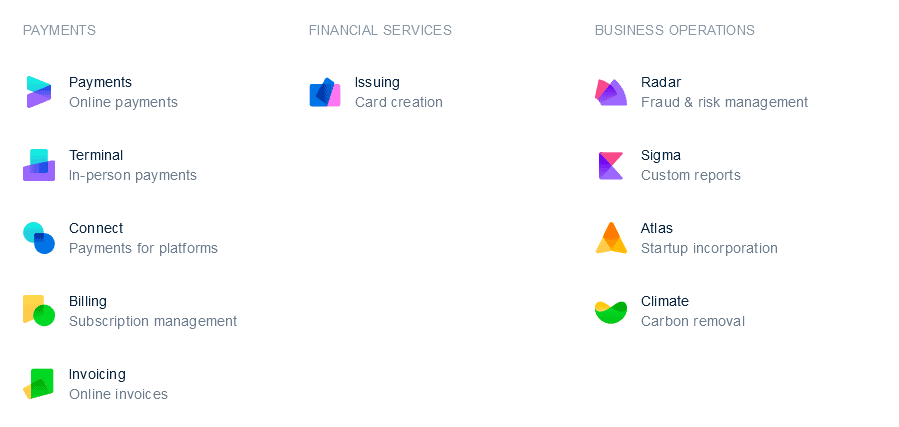

Nowadays, the Stripe revenue model is based on 7 sources:

1. Payment Processing Fees

This is the greatest share of Stripe’s revenue, handling payment transactions through the internet. This involves five payment processing products:

- Payments: The most popular type, used by clients such as Amazon. It charges 2.9% over each successful payment, plus a fixed fee of $0.30 (plus 1% for international cards and 1% more when requiring currency conversion). For instant payouts, it charges 1% of payout volume;

- Billing: For subscriptions and invoicing for businesses with recurring revenues, such as SaaS companies, like Slack. There are two plans. Starter, with 0.5% of recurring charges, and Scale, with advanced integrations, starting at 0.8% of recurring charges;

- Connect: For platforms and marketplaces that need infrastructure to pay the third-party sellers, such as Shopify. The Standard plan is free of charge. Custom or Express plan charges $2 per monthly active account, plus 0.25% and $0.25 per payout sent;

- Terminal: For an in-person point of sale payments, with hardware, for clients like ShowClix. For in-person card processing, it cuts 2.7% plus $0.05 per charge. For international cards, 1% plus 1% if currency conversion is required;

- Invoicing: A global invoicing platform that creates and sends a Stripe-hosted invoice in minutes. Or uses the Invoicing API to automate payment reconciliations. The Starter plan offers 25 free invoices per month and charges 0.4% per paid invoice after that. The Plus plan, with advanced features, charges 0.5% per paid invoice.

2. Atlas

It is a service for customers to set up and incorporate a startup business within minutes. Stripe incorporates the business in Delaware, integrates the business with their payment infrastructures, and gives credits and discounts from businesses like Amazon Web Services (AWS), plus legal and accounting firms. A one-time setup fee of $500 has to be paid. Also, the ongoing costs encompass a Delaware registered agent ($100 per year), corporate tax prep (starts at $250 per year), Delaware tax filing (starts at $225), and a business bank account.

3. Radar

It is a machine learning application that helps businesses detect and identify fraudulent transactions, used by clients, such as Kickstarter and OpenTable. Its algorithms mark suspicious payments and stop processing the transaction. Stripe charges $0.05 per screened transaction.

4. Sigma

It is Stripe’s warehousing tool used for businesses to analyze their operations and finances to help teams get insights into the ventures. It charges a monthly fixed fee according to the infrastructure needed, plus a variable fee per credit card charge, which starts at $0.02 per charge.

5. Issuing

It is a corporate service to create cards for businesses and their employees. Stripe charges $0.10 per virtual card and $3 per physical one. The first $500K in card transactions are free, after that, the cost is 0.2% plus $0.20 for each transaction. Again, for international payments, 1% plus $0.30 and additional 1% for currency conversion.

6. Treasury

It is an invite-only service that allows businesses to embed financial services in their marketplaces or platforms, for their customers to hold funds, pay bills, earn interest, and manage cash flow. The fee is customized.

7. Premium Support

Stripe customers all have access to standard free support. However, Premium Support, with 24/7 operational and technical support across the globe has a cost of over $1,800 per month, depending on the company’s size.

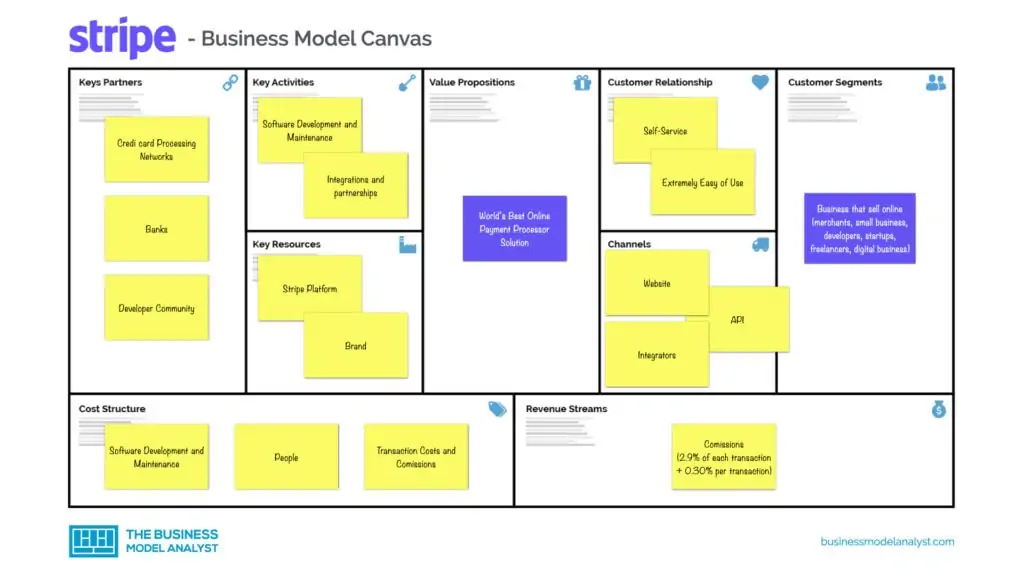

Stripe’s Business Model Canvas

Let’s take a look at the Stripe Business Model Canvas below:

Stripe’s Customer Segments

Stripe’s customer segments consist of:

- Businesses that sell online

- Digital businesses

- Small businesses

- Startups

- Developers

- Merchants

Stripe’s Value Propositions

Stripe’s value propositions consist of:

- A fast, simple, and secure online processing payment solution and infrastructure is required to operate online transactions;

- A simple and clear pricing model;

- A solution that fulfills the needs of developers and complements existing payment systems;

- The best software platform for running an internet business.

Stripe’s Channels

Stripe’s channels consist of:

- Website

- API

- Integrators

- Word-of-mouth

Stripe’s Customer relationships

Stripe’s customer relationships consist of:

It is an automated self-service, with limited interactions with employees. There is a Help section and customer support through e-mail.

Stripe’s Revenue Streams

Stripe’s revenue streams consist of:

Commissions and fixed fees, monthly or per transaction.

Stripe’s Key Resources

Stripe’s main resources are its proprietary software platform and its strong brand.

Stripe’s Key Activities

Stripe’s key activities consist of:

- Maintaining the platform

- Building innovative products

- Integrating technology and partnering

- Marketing

- Expanding internationally

Stripe’s Key Partners

Stripe’s key partners consist of:

Companies that enable customers to manage payments using Stripe’s service, such as banks, accounting, and analytics firms, CRM, eCommerce, electronic signature systems, fundraising & marketplaces, certificating firms, shipping companies, as well as integrators, and developers.

Stripe’s Cost Structure

- Transaction expenses

- Customer support

- Operation and administration

- Sales and marketing

- R&D

- Software development

- Infrastructure and maintenance

- Staff

- Legal and taxes

Stripe’s Competitors

- Square: It offers an online payment solution, e-commerce store builder, billing, payroll, etc.;

- PayPal: It accepts online payments, known for their simplicity of use;

- Payment Cloud: It’s best for high-risk businesses that are rejected by third-party processors like Stripe;

- Adyen: It provides a customizable online payment solution, focused on omnichannel sales, and fraud prevention, best for larger, low-risk, high-volume businesses;

- 2Checkout: It emphasizes global payments, digital goods, and related e-commerce tools;

- WePay: It allows merchants to create their own payments platform;

- Payline Data: It accommodates brick-and-mortar as well as online-based businesses;

- PayJunction: It offers a solution for in-person and online payments;

- Fattmerchant: It’s best for domestic, high-volume businesses that want a tidy, centralized platform, with a unique subscription-based pricing model and direct cost of interchange transaction fees;

- Amazon Pay: Best for low-volume businesses that use Amazon’s infrastructure.

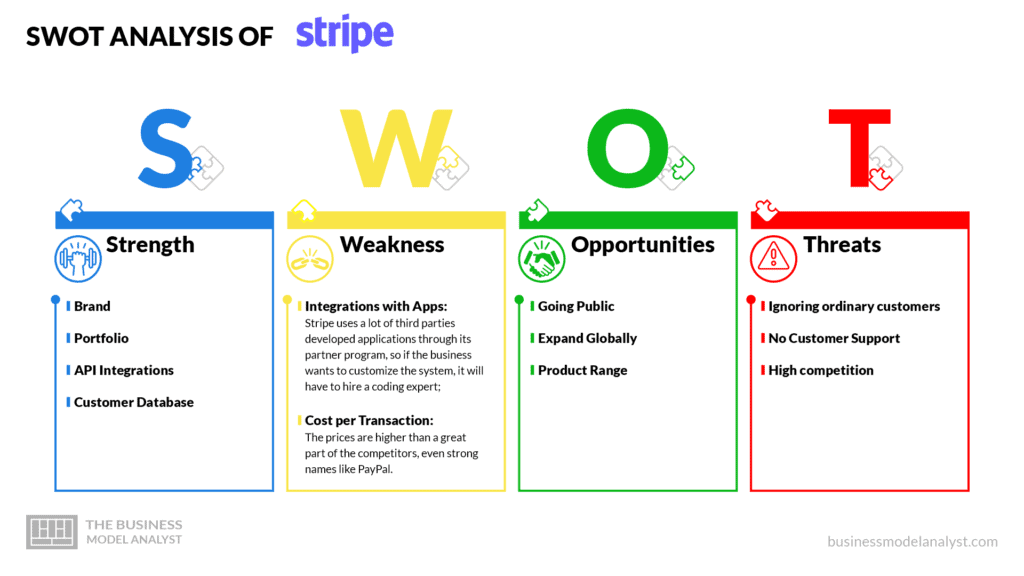

Stripe’s SWOT Analysis

Below, there is a detailed swot analysis of Stripe:

Stripe’s Strengths

- Brand: It is a globally recognized brand, used by millions of businesses, in over 130 countries;

- Portfolio: There are many solutions, and cloud-based data processing services, and they never stop developing new ones;

- API Integrations: A flexible service with the help of API integration and many other applications. Businesses can easily integrate those applications on their website;

- Customer Database: The world’s leading companies are its clients, such as Google, Spotify, Shopify, Microsoft, HubSpot, Uber, Amazon, Slack, Xero, Zoom, Wix, etc.

Stripe’s Weaknesses

- Integrations with Apps: Stripe uses a lot of third parties developed applications through its partner program, so if the business wants to customize the system, it will have to hire a coding expert;

- Cost per Transaction: The prices are higher than a great part of the competitors, even strong names like PayPal.

Stripe’s Opportunities

- Going Public: Stripe has not announced the initial public offering (IPO) yet, but if the company wants to expand into the international market, then going public through IPO may happen;

- Expand Globally: Stripe keeps on its expansion program, reaching more and more countries on a regular basis;

- Product Range: There are still plenty of opportunities in the financial service sector and for individual customers.

Stripe’s Threats

- No Customer Support: Customer support is only paid or through e-mail, and negative feedback can jeopardize the credibility of the brand;

- High competition: Competitors as the one mentioned above are a great challenge for Stripe, and cryptocurrency can also bring risk to financial providers;

- Ignoring ordinary customers: Stripe totally avoids the retail customer market.

Also, check Cred Business Model, an Indian startup fintech.

Conclusion

To sum up, although Stripe has conquered a great market share, it still has plenty of prospects to go even bigger, such as the mentioned initial public offering (IPO) — which may not happen anytime in the near future though, according to the founders —, and other possibilities in the financial market itself.