Is Twitter Profitable? No, Twitter is currently not profitable. The company last reported a profit in 2019, when it generated about $1.4 billion in net income; it had generated $1.2 billion the year prior but has since returned to non-profitability (a trend it had maintained from 2010 to 2017, according to Statista).

For more than a decade and a half, Twitter has exerted a powerful influence on the worldwide social media scene and digital communication. With over 360 million active users every month, it remains one of the most popular destinations for connecting with services and websites. As it transitions into being a privately traded company, questions about its profitability abound: how does it make money, and is it profitable? While answers to these queries may not always be apparent, Twitter continues to devise creative solutions to capitalize on its platform’s audiences and expansion.

Contents

Timeline of Twitter’s financial growth and funding

2006–2007: Twitter was founded in 2006 when it became available to the public, and by 2007, the platform had about 50,000 active users per week. The microblogging site went public in November 2013 and saw an initial public offering on the New York Stock Exchange at a price of $26 per share. On October 27, 2022, Twitter’s stock price was trading around $53 per share (the day Elon Musk concluded his acquisition).

2010: In 2010, Twitter raised $200 million in venture capital. They had over 50 million users at this time and a pre-money valuation of $3.5 billion.

2011: In 2011, Twitter raised $800 million in two separate funding rounds that would bring the company’s valuation to $8 billion. This money was used for product development and expansion into international markets, as well as cashing out current investors at the time. That same year, Twitter also acquired TweetDeck, a popular 3rd-party Twitter client, for $40 million.

2013: In 2013, Twitter raised $1.8 billion in its IPO from various investors. This would bring their total investments and series funding significantly above $3 billion. However, the company still showed no profits in 2013 despite having more than 230 million users at this time.

2015: In 2015, Twitter experienced yet another loss totaling $521 million, almost half of what would become their net loss in 2020 (-$1.14 billion). This year’s loss can be attributed to ongoing struggles with user growth, stagnating effects of its ad business model, and associated expenses such as stock compensation-related costs.

In the same year, they entered several strategic partnerships with other media outlets while introducing new features like “Moments,” which made it easier for people to discover content from all over their network.

2018–2019: Following the successful launch of the live video streaming feature two years prior, combined with the introduction of advertising services specific to mobile gadgets used increasingly amongst the population, the company’s efforts finally paid off, resulting in both 2018 and 2019 being consecutively profitable years against a highly competitive industry landscape, alongside improved service and monetization strategies applied within these years.

2020: Despite an initially strong start in 2020 from their record profit in 2019, setting Twitter up to reach potentially record-breaking heights, the events leading up to the Covid-19 pandemic shifted priorities and caused a quick reversal of fortunes. This resulted in their financial performance suffering more than expected, which likely affected their long-term outlook, potentially stifling future ambitions and projects planned for 2021 onwards. The company reported its highest net loss to date at a staggering $1,135.626 million.

2022: After several months of negotiations and going back and forth, Elon Musk acquires Twitter and begins making strategic changes aimed at improving its profitability.

Has Twitter Ever Been Profitable?

Despite its widespread popularity and influence, Twitter has only recently become profitable, and soon afterward, it went back to reporting losses. In fact, Twitter only became profitable for the first time in 2018 when it reported its first-ever net income of $1.2 billion for that year. This was followed by a second consecutive year of profitability in 2019, with total revenue of $3.4 billion and a net income of $1.4 billion, which was higher than expected by many analysts.

Prior to these two years of profitability, Twitter had had mostly negative financial results as it struggled to monetize its large user base into revenue gains while also dealing with expenses related primarily to stock-based compensation and data center operations costs, among other factors. Between 2013 and 2017, there were no periods where Twitter had annual profits, while they posted losses totaling more than $2 billion during this period combined.

In addition to these losses and their recent recorded losses from 2020 to 2021, financial services company Moody’s recently downgraded its credit rating on Twitter’s debt amid concerns over slow user growth resulting from competition from newer social networks such as TikTok, etc., and their recent buyout, which could further impact their ability to generate revenues going forward.

Financial Performance of Twitter

Twitter’s total revenue in 2022 was $4.4 billion, a 12% decrease from 2021. Advertising drove the majority of this figure with $4 billion, followed by data licensing and other revenue, which added up to $0.4 billion. In the second quarter of 2022, costs and expenses rose 31% year-over-year to $1.52 billion, resulting in an operating loss of $344 million (an operating margin of -29%). In 2021, Twitter’s net loss amounted to just under a quarter of a billion dollars ($221.41 million).

Overview of revenues, expenses, and profits

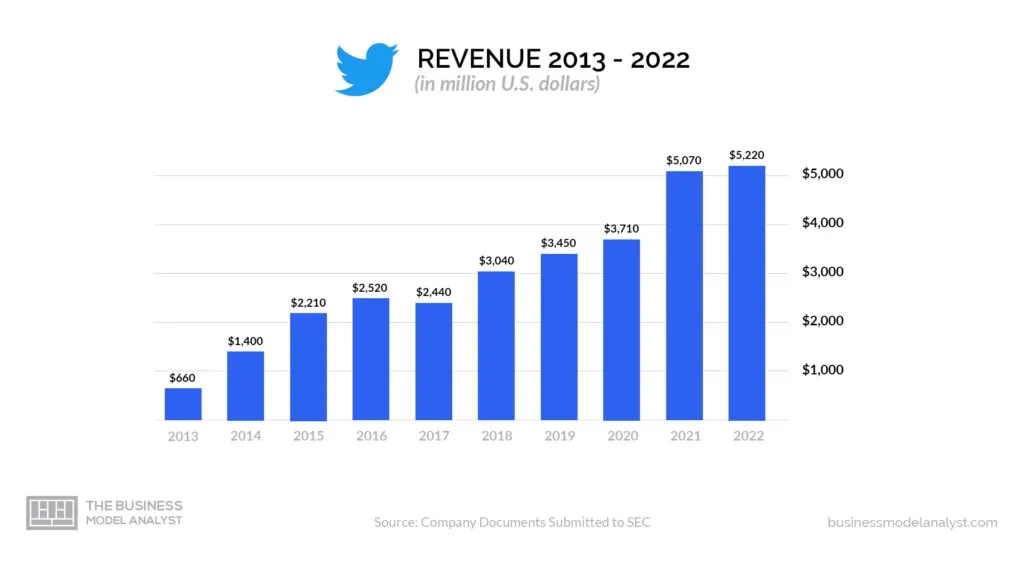

Twitter’s Revenue

In 2022, Twitter generated a total of $4.4 billion in revenue, with advertising accounting for the lion’s share (90.9%) of that figure. While advertising revenues decreased 11% year-on-year to $4 billion compared to 2021 ($4.5 billion), revenues from other sources, such as data licensing fees and other activities, fell 20% from the previous year to $0.4 billion. Nevertheless, despite the decrease in overall revenues, Twitter is still on track to achieve profitability in 2023, thanks to its change in management and potentially strategic decisions.

With Twitter’s reported total revenue of $5 billion in 2021, the US accounted for over $2.8 billion, and the rest of the world generated about $2.2 billion in revenue; this demonstrates that even though only 17% of Twitter users come from the U.S., it still constitutes a majority (>52%) of their overall revenues. This trend continued into 2022, with the US leading even though there was a decline in revenue; while other countries contributed about $2 billion to Twitter’s coffers, the U.S. generated approximately $2.4 billion in revenue alone.

Twitter’s Expenses

On the expense side, personnel costs continued to be one of Twitter’s most significant contributors to overhead, with salaries being paid to around 7,500 employees before aggressive personnel cuts were enforced in 2022. In Q2 2021, the cost of revenue, sales and marketing, R&D, and G&A expenses accounted for 35.9% ($416.932 million), 25.8% ($301.902 million), 26% ($299.859 million), and 12.1% ($141.482 million), respectively, of the company’s overall revenue.

Twitter’s Profits

Despite solid financial performance overall, it has remained a widely unprofitable company. This has prompted Elon Musk, its new owner, to let go of a significant number of its employees, as well as look for other ways to cut costs in order to generate profit.

Conclusion

Despite Twitter only having been profitable in 2018 and 2019, the company could be able to make a significant turnaround after its acquisition by Elon Musk. While the company wasn’t performing well on its own, with Musk at the helm, there is great potential for success. Analysts believe that this platform could once again become a big moneymaker with some restructuring, reorganization of resources, and strategic interventions deemed necessary by the new owner.

Musk has not yet addressed the addition of experienced executives or top-level software experts, but this kind of expertise may be needed to turn around long-term operational losses. Changes toward diversifying income streams away from advertising-based models must also start to take shape if Twitter is to recapture its previous successes.

All things considered, though, it’s reasonable to assume that given Elon Musk’s leadership and history of success in other ventures — such as Tesla Inc., SpaceX, and The Boring Company — there is potential for a return to profitability in the future.