Binance is the world’s largest online cryptocurrency exchange platform by volume. The Binance business model combines digital technology and finance, which enable users to trade cryptocurrencies and other digital assets on the Binance platform. It has a strong focus on altcoin trading, offering crypto-to-crypto trading on more than 600 cryptocurrencies and swotvirtual tokens. It has its own blockchain-based cryptocurrency called Binance Coin (BNB). Binance offers other services like helping its users to make investment decisions, electronic fund transfers, and eligibility to earn interest.

Contents

A brief history of Binance

Binance was founded by two co-founders — Changpeng Zhao and Yi He, back in 2017 in China. The company later moved its headquarters out of China following the Chinese government’s increasing regulation of cryptocurrencies. Binance is currently headquartered in Cayman Island and has 40 office locations across 38 countries and doing business in 180 countries.

Both of them were employees occupying executive positions in OKCoin. During their stay at Okcoin, they gained deep knowledge of the crypto niche, which served as a good foundation for Binance. An Initial Coin Offering (ICO) was organized to finance their new project. They were able to raise over USD 15 million through an offering of 100 million Binance coins (BNB) to investors.

The funds raised were split appropriately to develop the new project: 35% of the fund was used to build and upgrade the platform, 50% was used for branding and marketing, while the remaining 15% was reserved as an emergency fund. In 2021, Binance facilitated trades worth over $9.5 trillion, over two-thirds of all trading volume handled by centralized crypto exchanges.

Who Owns Binance

Binance is currently privately held. It is funded by 12 investors.

Binance’s Mission Statement

Binance’s mission is “To be the infrastructure services provider for the blockchain ecosystem.”

How Binance makes money

Being the largest cryptocurrency exchange in the world with its own cryptocurrency, Binance has multiple streams of income that fetches its profit.

Trading Fees

Binance charges users a fee for trading cryptocurrency on their platform. Users can buy or sell cryptocurrency on the Binance platform. Binance charges 0.1% for each trade a user initiates. Users also pay withdrawal fees whenever they want to withdraw their profit.

Mining Services

In 2020, Binance launched two mining pools for mining Bitcoin and Ethereum. The mining pool charges Bitcoin users 2.5% and Ethereum users 0.5% pool fees.

Cloud

Binance provides software-as-a-service (SaaS) through its cloud capabilities for users to launch their own digital asset exchanges. Binance charges an annual fee for its cloud products.

Spread

Spread is the difference between the buying and selling price of a product, like a token. Although no fee is charged for the buying and selling of tokens, Binance earns through the spread of each transaction.

Interchange Fees

Through its partnership with Visa, Binance launched a visa debit card in July 2020. To use the card, users need to transfer funds from their cryptocurrency wallet to a spot wallet. An interchange fee is charged when the card is used to make a purchase. Users also pay fees for ATM withdrawals and payments.

Investing

Binance has investments in other cryptocurrencies, and distributed technology projects. The company earns dividends from its shares or when it sells the shares.

Interest on Loans

Binance allows its users to borrow cryptocurrency loans with an interest on them. Users can use their crypto holdings as collateral while the loan period is for a period of 7 to 180 days. Binance earns money through the interest paid on the loans. The interest rate is determined by loan amount, collateral pledged, repayment period, and type of currency.

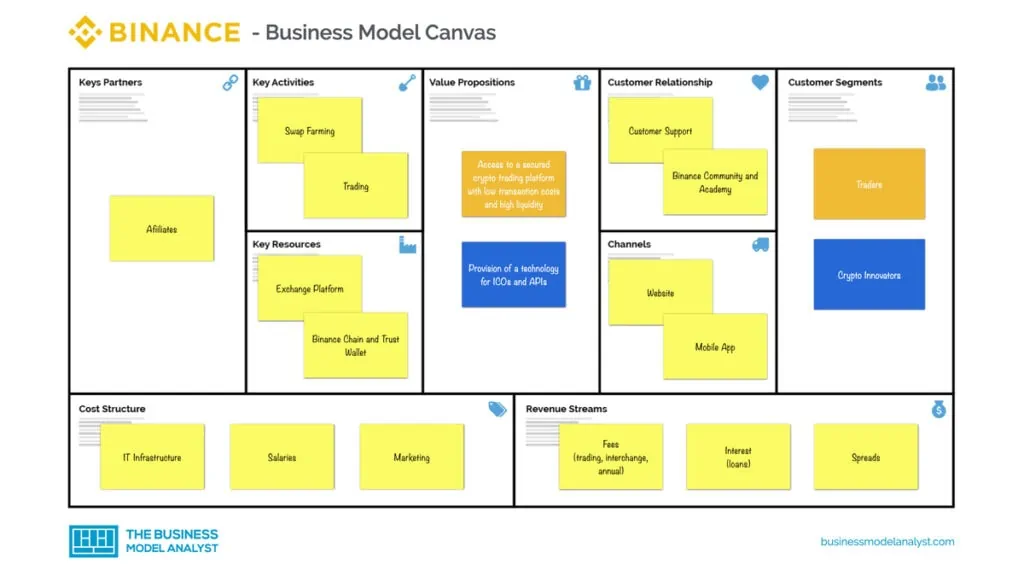

Binance’s Business Model Canvas

The Binance Business Model can be explained in the following business model canvas:

Binance’s Customer Segments

Binance’s customer segments consist of:

- Traders: Users who want to conveniently trade cryptocurrencies on a secured platform;

- Crypto Innovators; People in need of a reputable platform to launch their crypto ideas into the market.

Binance’s Value Propositions

Binance’s value propositions consist of:

- Traders: Access to a secured crypto trading platform with low transaction costs and high liquidity;

- Crypto Innovators: Provision of a technology incubator called Binance Labs, and a LaunchPad to nurture promising pre-ICO projects and host new projects and API interfaces, respectively.

Binance’s Channels

Binance’s channels consist of:

- Websites

- Through mobile apps on Android and iOS platforms

Binance’s Customer Relationships

Binance’s customer relationships consist of:

- Social media

- Users’ channels

- Telephones

- Binance Community

- Binance Academy

Binance’s Revenue Streams

Binance’s revenue streams consist of:

- Trading Fee

- Spreads

- Interchange Fees

- Annual Fees

- Interests on Loans

Binance’s Key Resources

Binance’s key resources consist of:

- Exchange Platform

- Binance Chain

- Trust Wallet

- Research

- LaunchPad

- Binance Labs

- Binance Info

- Binance Academy

Binance’s Key Activities

Binance’s key activities consist of:

- Trading

- Software-as-a-Service (SaaS)

- Swap Farming

Binance’s Key Partners

Binance’s key partners consist of:

- Affiliates

- Platform Users

Binance’s Cost Structure

Binance’s cost structure consists of:

- Salaries

- IT Operations

- Website/Platform maintenance

- Marketing

- Intellectual Property

Binance’s Competitors

- Coinbase: A most popular alternative to Binance. It offers a user-friendly interface, which makes it easy for beginners in the crypto space. Its learning platform rewards users with cryptocurrency when they learn about crypto. Coinbase has strong user reviews and security ratings;

- Kraken: It appeals to advanced users due to its sophisticated features and high cybersecurity ratings;

- KuCoin: It provides access to a wide library of altcoins at low fees and offers automated and margin-based trading;

- Crypto.com: It offers unique perks like crypto rewards debit cards. Users with high balances in its proprietary stable coin Cronos (CRO) are offered discounts on trading fees and enhanced benefits;

- Bitstamp: Though an early entrant into the crypto space, it offers advanced charting capabilities.

Binance’s SWOT Analysis

Below, there is a detailed swot analysis of Binance:

Binance’s Strengths

- Wide range of cryptocurrencies: Users can buy, trade, and hold over 600 cryptocurrencies on Binance;

- Market leader: Binance is clearly the market leader in the crypto space in terms of ratings and trade volume. This further gives it brand recognition;

- Strong Security: Binance offers strong cybersecurity to users against hackers;

- Binance Academy: This offers tutorials to newbies in the crypto space. Hence, it is an attraction to new users.

Binance’s Weaknesses

- Regulation: Binance has regulatory troubles in many countries;

- Complex Platform: The wide range of features and options on the platform could be intimidating and overwhelming for traders.

Binance’s Opportunities

- Rising adoption rate: As more countries adopt crypto as alternate legal tender, it presents immense opportunities for Binance to grow its market reach;

- Rising confidence: More people are becoming confident that cryptocurrency is not a scam. This implies that more people will be willing to invest in the crypto space.

Binance’s Threats

- Security threats: There is always the constant fear of crypto exchange platforms being hacked. This could lead to the loss of crypto assets by users and the company.

- Non-transparent corporate structure: There is so much opacity around the corporate culture of Binance. This could wither public trust in the company.

Conclusion

Since it was founded in 2017, Binance has carved a niche for itself in the crypto space. Within that short time, it has accomplished so much beyond the imagination of most companies. It combined an aggressive expansion policy and smart business practices to blaze the trail of crypto exchange and related businesses. Its rapid growth also quickly caught the attention of authorities worldwide, making it run into regulatory challenges. As the crypto space continues to evolve and more countries adopt cryptocurrencies, Binance is set to become even bigger.